Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the market encounters a major obstacle in the form of substantial initial capital expenditure needed to build generation plants and distribution grids. This significant entry barrier can postpone project implementation in regions facing financial constraints. Despite these economic challenges, the industry continues to expand globally as cities place a premium on efficient infrastructure. According to the International District Energy Association, the total building area dedicated to district energy systems exceeded 3 billion square feet in 2024, signaling a strong trend toward the deployment of centralized cooling solutions.

Market Drivers

Rapid urbanization and the development of smart city infrastructure serve as the main engines for the district cooling sector's progress. As metropolitan zones become denser, municipal planners are increasingly adopting centralized cooling networks to handle thermal loads more efficiently than scattered, individual units can. This transition is highlighted by the aggressive growth strategies of major utility providers expanding to support burgeoning commercial and residential districts in high-growth areas. For instance, according to the National Central Cooling Company (Tabreed), in its 'Consolidated Financial Results for the Year 2024' released in February 2025, the firm added 23,756 Refrigeration Tons (RT) of new connected capacity across the UAE, Saudi Arabia, Oman, Egypt, and India during the fiscal year, underscoring the dependence of developing urban centers on scalable utility frameworks for sustainable infrastructure growth.Simultaneously, the growing need for energy-efficient cooling solutions is fueling market adoption as stakeholders aim to reduce the high electricity consumption linked to traditional air conditioning. District cooling systems utilize economies of scale and advanced industrial chillers to provide superior thermal energy performance, directly meeting corporate and regulatory decarbonization goals. According to SP Group, in the 'Largest Industrial District Cooling System Begins Operations in Ang Mo Kio' press release from October 2025, the new network at STMicroelectronics in Singapore is engineered to cut cooling-related electricity usage by 20% annually. This efficiency yields significant economic benefits and lower carbon footprints, reinforcing the technology's standing in the market, while the sector's financial strength is evidenced by Emirates Central Cooling Systems Corporation (Empower), which reported a record annual revenue of AED 3.3 billion for the 2024 fiscal year in 2025.

Market Challenges

The Global District Cooling Market encounters a significant hurdle due to the immense initial capital expenditure needed to establish centralized infrastructure. In contrast to decentralized cooling alternatives that permit incremental investment, district cooling requires substantial upfront funding to build generation plants and lay extensive underground piping networks before any service revenue can be generated. This heavy financial requirement poses a formidable entry barrier, especially for private developers who must navigate long payback periods and increased financial risk during construction. Consequently, obtaining the necessary capital is often a complicated and protracted process that frequently postpones the financial close and subsequent launch of utility-scale projects.This financial limitation directly hampers market growth, particularly in rapidly emerging economies where the cost of capital is frequently prohibitive. While the operational efficiencies of centralized cooling are proven, the challenge of mobilizing large-scale initial funding creates a marked gap between market potential and actual implementation. For example, according to the Asia-Pacific Urban Energy Association, India had only eight operational district cooling projects in 2024. This scarce number of active systems, despite the nation's massive cooling requirements and fast-paced urbanization, underscores how high capital costs effectively limit the widespread rollout of this infrastructure in financially constrained regions.

Market Trends

The move toward high-density data center cooling solutions is becoming a key growth driver for the global district cooling market. As artificial intelligence pushes thermal loads past the capabilities of standard air cooling, centralized water-based systems are increasingly being utilized to ensure efficient heat rejection for hyperscale facilities. This trend enables utilities to support the expanding digital economy while broadening their client base beyond the commercial real estate sector. Highlighting the scale of this infrastructure need, TechRepublic stated in the 'How AI is Revolutionizing Data Center Power and Cooling' article from April 2025 that annual global capital expenditure for data centers is projected to hit $1 trillion by 2030, a surge largely fueled by the necessity for robust physical infrastructure, including advanced cooling frameworks.Concurrently, the integration of Thermal Energy Storage (TES) systems is becoming a standard approach for optimizing network performance and managing peak loads. By generating chilled water during off-peak hours and storing it for use during high-demand times, operators can alleviate grid strain and lower operational expenses. This operational flexibility supports sustainability goals by maximizing the utilization of efficient generation capacity when ambient conditions are cooler. For instance, according to the 'Empower to build new 47,000 RT district cooling plant at Dubai Science Park' press release by Emirates Central Cooling Systems Corporation (Empower) in August 2025, the newly announced facility will incorporate advanced thermal energy storage systems to bolster its total production capacity of 47,000 Refrigeration Tonnes (RT).

Key Players Profiled in the District Cooling Market

- Fortum Corporation

- National Central Cooling Company PJSC

- Veolia Group

- AtkinsRealis

- Keppel Corporation Limited

- Siemens AG

- ADC Energy Systems

- Danfoss A/S

- Shinryo Corporation

- ENGIE Group

Report Scope

In this report, the Global District Cooling Market has been segmented into the following categories:District Cooling Market, by Type:

- Free Cooling

- Absorption Cooling

- Others

District Cooling Market, by End Use Sector:

- Commercial

- Industrial

- Others

District Cooling Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global District Cooling Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this District Cooling market report include:- Fortum Corporation

- National Central Cooling Company PJSC

- Veolia Group

- AtkinsRealis

- Keppel Corporation Limited

- Siemens AG

- ADC Energy Systems

- Danfoss A/S

- Shinryo Corporation

- ENGIE Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

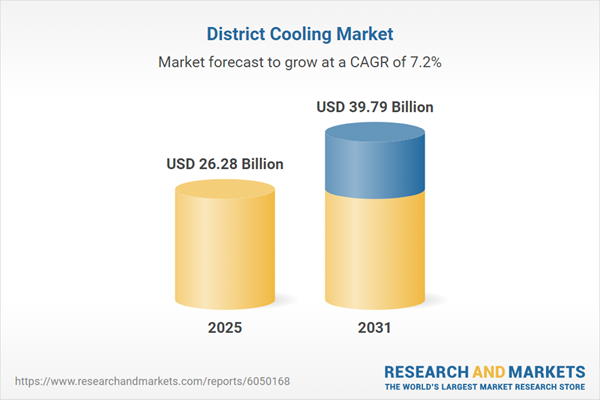

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 26.28 Billion |

| Forecasted Market Value ( USD | $ 39.79 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |