Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One significant obstacle hindering market progression is signal attenuation, where atmospheric moisture absorbs electromagnetic energy and limits detection ranges during heavy rainfall. This physical constraint often necessitates the installation of supplementary units to ensure consistent coverage. Highlighting the scale of the meteorological infrastructure sector, the World Meteorological Organization reported in 2024 that the global database of operational weather radars included 1,118 registered systems. This statistic emphasizes the growing importance of X-Band units in bridging coverage gaps and guaranteeing precise localized storm tracking.

Market Drivers

Rising global defense budgets and military modernization initiatives are the main forces fueling the adoption of X-Band radar systems, especially for fire control and precision targeting tasks. As countries upgrade from legacy equipment to advanced active electronically scanned array (AESA) architectures, there is increased procurement of radars designed to track low-observable threats like cruise missiles and unmanned aerial systems. This trend is reflected in financial data; according to the Stockholm International Peace Research Institute's 'Trends in World Military Expenditure, 2023' Fact Sheet from April 2024, global military spending rose by 6.8 percent in real terms to $2.44 trillion in 2023. This investment enables the purchase of specialized X-band units such as the Giraffe 1X, evidenced by Saab receiving a roughly SEK 700 million order for the system in 2024.Simultaneously, the civil market is being transformed by the growing need for high-resolution meteorological monitoring and disaster management. Although traditional S-band and C-band radars offer wide regional coverage, they frequently lack the precision required to detect localized severe weather phenomena, such as flash floods and microbursts in urban settings. The increasing occurrence of extreme weather is prompting governments to augment their sensor networks with X-band "gap-filler" radars to safeguard infrastructure and communities. The economic necessity of this is illustrated by the National Oceanic and Atmospheric Administration's January 2024 report on '2023 U.S. billion-dollar weather and climate disasters,' which noted 28 separate events causing losses over $1 billion each, driving meteorological agencies to invest in mobile and fixed X-band solutions to improve storm tracking and reduce financial losses.

Market Challenges

Signal attenuation serves as a major physical impediment to the Global X-Band Radar Market, resulting primarily from atmospheric moisture absorbing electromagnetic energy. Although X-band frequencies excel at high-resolution imaging, they are susceptible to "rain fade," a condition where heavy precipitation significantly weakens signal strength and reduces effective detection ranges. This limitation restricts market expansion by requiring a denser network of radar installations to prevent coverage gaps, which consequently increases both capital expenditures and operational complexity for end-users.As a result, potential buyers in cost-conscious sectors may be reluctant to implement these systems, as establishing reliable situational awareness demands a complex mesh of overlapping units instead of fewer, longer-range alternatives. The necessity for extensive infrastructure density is demonstrated in regions utilizing multi-frequency networks; according to the Network of European Meteorological Services (EUMETNET), the operational OPERA database listed 217 radar systems in 2025 as necessary to sustain comprehensive composite coverage across member states. This substantial hardware requirement highlights the logistical and financial burdens associated with range-limited technologies, posing a direct challenge to the scalability of X-band solutions in competitive markets.

Market Trends

The market is being reshaped by the expansion of Space-Based X-Band Synthetic Aperture Radar (SAR), which establishes persistent global monitoring capabilities that overcome terrestrial limitations. This trend focuses on deploying agile satellite constellations that deliver high-resolution imagery regardless of atmospheric conditions, effectively closing intelligence gaps for environmental and defense applications. Governments are swiftly acquiring these commercial services for strategic advantages, a shift illustrated by the German Ministry of Defence awarding a contract valued at approximately €1.7 billion to ICEYE and Rheinmetall in December 2025 for the creation of a dedicated SAR satellite constellation.Concurrently, the integration of Gallium Nitride (GaN) technology to improve power efficiency is revolutionizing radar architecture by providing superior energy density over legacy semiconductors. This material advancement facilitates the manufacturing of compact, high-performance systems that sustain extended detection ranges without the spatial and thermal constraints of earlier generations. Defense agencies are prioritizing this technology to address sophisticated airborne threats with higher precision, a demand underscored by RTX's report in September 2025 that Raytheon secured a $1.7 billion contract to supply the Lower Tier Air and Missile Defense Sensor (LTAMDS), which leverages this advanced semiconductor technology to improve signal sensitivity and reliability.

Key Players Profiled in the X-Band Radar Market

- Thales S.A.

- RTX Corporation

- Brunswick Corporation

- Israel Aerospace Industries Ltd.

- Vaisala Oyj

- Furuno Electric Co., Ltd.

- Japan Radio Co., Ltd.

- Saab AB

- Terma Group

- EWR Radar Systems, Inc.

Report Scope

In this report, the Global X-Band Radar Market has been segmented into the following categories:X-Band Radar Market, by Type:

- Mobile X-Band Radar

- Sea-Based X-BRadar

X-Band Radar Market, by End User:

- Aviation Industry

- Defense Industry

- Others

X-Band Radar Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global X-Band Radar Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this X-Band Radar market report include:- Thales S.A.

- RTX Corporation

- Brunswick Corporation

- Israel Aerospace Industries Ltd

- Vaisala Oyj

- Furuno Electric Co., Ltd

- Japan Radio Co., Ltd

- Saab AB

- Terma Group

- EWR Radar Systems, Inc.

Table Information

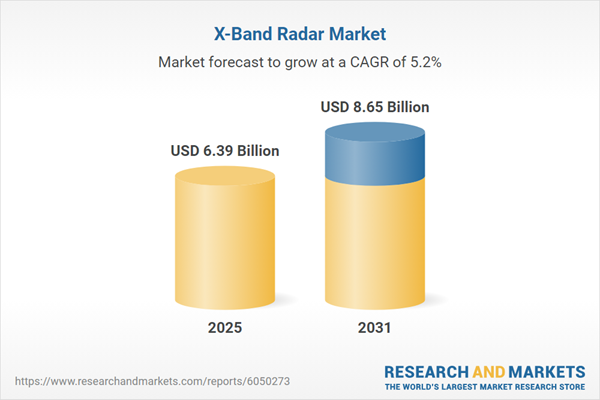

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.39 Billion |

| Forecasted Market Value ( USD | $ 8.65 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |