Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the industry confronts a significant hurdle regarding the establishment of uniform safety regulations and liability frameworks. The presence of conflicting legal guidelines across various regions introduces complex compliance requirements that retard product introductions and obstruct the broad commercial rollout of autonomous technologies. Such regulatory inconsistencies create barriers that prevent manufacturers from scaling effectively, underscoring the urgent need for harmonized standards to support the market's continued expansion.

Market Drivers

The rapid incorporation of Artificial Intelligence and Machine Learning algorithms is fundamentally upgrading the functionality of autonomous systems by substituting static rule-based programming with dynamic decision-making capabilities. These advanced algorithms enable navigation units to interpret immense volumes of data from sensor arrays instantaneously, allowing vehicles to anticipate environmental shifts and perform intricate maneuvers autonomously. This technological shift is generating substantial financial gains for component providers delivering the requisite computational power; for instance, NVIDIA reported in its 'Q3 Fiscal 2025 Financial Results' in November 2024 that Automotive revenue hit a record $449 million, a 72% increase year-over-year, driven primarily by the adoption of AI cockpit solutions and self-driving platforms.Concurrently, the rising implementation of Advanced Driver Assistance Systems (ADAS) within the automotive industry serves as a vital accelerator for the wider navigation market. As manufacturers normalize features like adaptive cruise control and automated parking, the supply chain for critical hardware such as high-definition cameras and radar units is becoming more resilient and cost-efficient, smoothing the path from partial to full automation. Highlighting this trend, the China Association of Automobile Manufacturers noted in July 2024 that the penetration rate of Level 2 combined driving assistance in passenger cars hit 55.7% in the first half of the year. To support this trajectory, massive investments are flowing into next-generation software, exemplified by Wayve securing $1.05 billion in 2024 to advance embodied AI technologies for automated driving.

Market Challenges

The lack of cohesive safety regulations and defined liability frameworks results in a fractured legal landscape that substantially hinders the scalability of autonomous navigation innovations. Manufacturers are compelled to manage a complex array of conflicting state and regional mandates, which adds significant layers of difficulty to both testing and deployment stages. This regulatory inconsistency demands substantial resources to guarantee compliance across diverse jurisdictions, thereby prolonging development schedules and escalating operational expenditures. Furthermore, the absence of a unified set of standards fosters uncertainty regarding legal accountability in accident scenarios, which dampens investment enthusiasm and stalls the progression from pilot projects to broad commercial accessibility.Underscoring the severity of this issue, the 'Autonomous Vehicle Industry Association' reported in '2025' that over 93% of its member CEOs view the creation of a federal policy framework as the most essential step for the industry's advancement, highlighting how regulatory vagueness directly blocks market growth. This deficit of centralized direction compels organizations to proceed with extreme caution, effectively restricting the pace at which autonomous systems can be assimilated into global supply chains and transportation infrastructures.

Market Trends

A critical emerging trend is the enhancement of navigation capabilities within GPS-denied environments, aiming to mitigate the susceptibility of conventional satellite-based systems to signal jamming, spoofing, and physical obstruction. Operators in industrial and defense sectors are increasingly adopting robust positioning, navigation, and timing (PNT) solutions that leverage visual odometry, inertial sensors, and magnetic anomaly detection to sustain high-precision activities in underground or contested zones. This transition guarantees operational reliability where standard GNSS is ineffective, greatly expanding the potential applications of autonomous systems in mining, warehousing, and military fields; for example, Defense Advancement reported in December 2024 that Trillium Engineering successfully demonstrated its GD-Loc capability to the U.S. Army, attaining a target location accuracy within six meters in signal-compromised conditions.In parallel, the integration of V2X communication for collaborative navigation is reshaping the market by permitting vehicles to share real-time data with one another and surrounding infrastructure. Unlike onboard sensors restricted by line-of-sight, V2X technology enables cooperative perception, empowering autonomous fleets to detect hazards around blind corners and coordinate maneuvers to enhance traffic efficiency and safety. This connectivity is evolving into a significant revenue source for semiconductor producers embedding advanced telematics into their central computing hubs, as evidenced by Computer Weekly in November 2024, which noted that Qualcomm's automotive revenue jumped 68% year-over-year to $899 million, fueled by the broad adoption of its Snapdragon Digital Chassis for advanced connectivity and vehicle-to-everything applications.

Key Players Profiled in the Autonomous Navigation Market

- Aurora Innovation, Inc.

- Cruise LLC

- General Dynamics Corporation

- Honeywell International, Inc.

- L3Harris Technologies Inc.

- Nothrop Grumman Corporation

- RTX Corporation

- Safran Group

- Tesla

- Waymo LLC

Report Scope

In this report, the Global Autonomous Navigation Market has been segmented into the following categories:Autonomous Navigation Market, by Platform:

- Ground

- Airborne

- Marine

- Space

- Weapons

Autonomous Navigation Market, by Solution:

- Hardware

- Software

Autonomous Navigation Market, by End Use:

- Commercial

- Military & Government

Autonomous Navigation Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Autonomous Navigation Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Autonomous Navigation market report include:- Aurora Innovation, Inc.

- Cruise LLC

- General Dynamics Corporation

- Honeywell International, Inc.

- L3Harris Technologies Inc.

- Nothrop Grumman Corporation

- RTX Corporation

- Safran Group

- Tesla

- Waymo LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

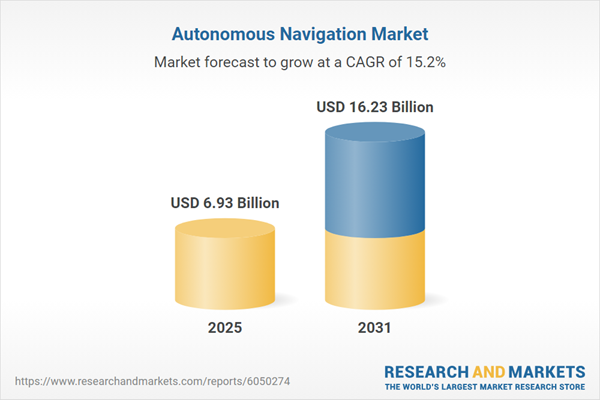

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.93 Billion |

| Forecasted Market Value ( USD | $ 16.23 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |