Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry confronts a major obstacle regarding its dependence on the fiscal health of the broader construction sector. Elevated interest rates and inflationary conditions frequently lead to the stalling of new infrastructure initiatives, consequently diminishing installation numbers. For instance, the Construction Products Association noted that total construction output was expected to decrease by 2.9 percent in 2024. This contraction in a pivotal sector underscores how vulnerable roller shutter market growth is to wider economic instability and decreased capital expenditure.

Market Drivers

The rising need for sophisticated physical security measures serves as a key market accelerator, especially within retail and commercial environments where protecting assets is paramount. Business proprietors are installing reinforced roller shutters to lower financial liabilities linked to burglary and vandalism, a move prompted by a tangible increase in organized crime and violent occurrences that require stronger barriers than standard glass. According to the British Retail Consortium's 'Annual Crime Survey' from January 2025, retail crime losses in the United Kingdom hit £2.2 billion during the 2023-2024 timeframe, emphasizing the urgent necessity for fortified shopfronts. These security concerns also pervade the residential sector, pushing product development toward durable materials that provide resistance to intrusion while maintaining visual appeal.Concurrently, the industry is being transformed by the increasing uptake of automated and smart shutter solutions, moving from manual operation to integrated smart home devices. Both consumers and facility managers are favoring electromechanical systems that sync with building management protocols to improve convenience and energy conservation. This trend is highlighted by substantial revenue growth in connected access segments; Assa Abloy’s 'Annual Report 2024', released in February 2025, indicated that sales of electromechanical solutions saw a currency-adjusted rise of 8 percent in 2024. This modernization frequently occurs during general property upgrades, with existing buildings being retrofitted with smart entry systems. As reported by Houzz in 2025, 54 percent of U.S. homeowners engaged in renovation projects during 2024, offering a consistent channel for installing these advanced shutter technologies.

Market Challenges

A significant barrier facing the Global Roller Shutter Market is its intense vulnerability to the financial condition of the broader construction sector. When developers face higher capital costs due to inflationary environments and elevated interest rates, planned infrastructure projects are often postponed or suspended indefinitely. Since roller shutters are finishing elements installed at the end of the building process to secure the envelope, they are uniquely exposed to these upstream interruptions; if foundational construction halts, the immediate need for security installations disappears, stopping manufacturers from capturing potential revenue.Recent industry statistics confirm this reduction in building activity. The 'European Construction Industry Federation (FIEC)' reported that investment in the residential housing sector within the European Union was expected to drop by 7.7 percent in '2024'. This steep decline in housing development demonstrates a clear link between macroeconomic constraints and lower installation volumes. As capital investment for new structures retreats, the roller shutter market faces difficulties in sustaining momentum, effectively limiting growth despite the continuing essential need for energy efficiency and security.

Market Trends

The shift toward solar-powered and energy-autonomous systems is emerging as a prevalent trend, especially in the residential renovation market. Unlike conventional hardwired units that demand intrusive electrical modifications, these wireless alternatives use built-in photovoltaic panels to charge internal batteries, ensuring functionality even when the grid fails. This feature notably lowers installation expenses, making them well-suited for retrofit applications where maintaining interior design is essential. The commercial success of this trend is highlighted by major companies focusing on off-grid solutions; for example, Somfy reported in its '2024 Annual Results' in March 2025 that it secured a 4.8 percent revenue rise, attributing this growth largely to accelerating sales in its solar product categories.At the same time, manufacturers are actively expanding their use of recycled and environmentally friendly materials to adhere to circular economy principles. Because producing primary aluminum is energy-intensive, the sector is moving toward secondary aluminum billets for slat manufacturing to reduce the embodied carbon of building envelopes. This change is increasingly requested by developers focused on sustainability who aim to satisfy rigorous environmental standards. The effectiveness of this shift is measurable through recent supply chain advancements; according to StellaGroup’s '2024 Sustainability Report' from July 2025, the carbon intensity of aluminum purchased for its La Toulousaine brand fell by 38 percent in 2024, a result achieved largely through sourcing recycled metals.

Key Players Profiled in the Roller Shutter Market

- AM Group Holdings Limited

- Alulux GmbH

- ASSA ABLOY group

- Bunka Shutter Co., Ltd.

- Ferco Seating Systems Ltd.

- heroal - Johann Henkenjohann GmbH & Co. KG

- HORMANN Group

- Novoferm GmbH

- Sanwa Group

- SKB Shutters

Report Scope

In this report, the Global Roller Shutter Market has been segmented into the following categories:Roller Shutter Market, by Product Type:

- Built on roller shutter

- Built in roller shutter

- Integrated roller shutter

- Roller shutter with tilted laths

Roller Shutter Market, by Fixation Type:

- Door

- Window

Roller Shutter Market, by Material:

- Wood

- Synthetic

- Metal

- Glass

Roller Shutter Market, by Operating System:

- Manual

- Automated

Roller Shutter Market, by Application:

- Residential

- Commercial

- Others

Roller Shutter Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Roller Shutter Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Roller Shutter market report include:- AM Group Holdings Limited

- Alulux GmbH

- ASSA ABLOY group

- Bunka Shutter Co., Ltd.

- Ferco Seating Systems Ltd

- heroal - Johann Henkenjohann GmbH & Co. KG

- HORMANN Group

- Novoferm GmbH

- Sanwa Group

- SKB Shutters

Table Information

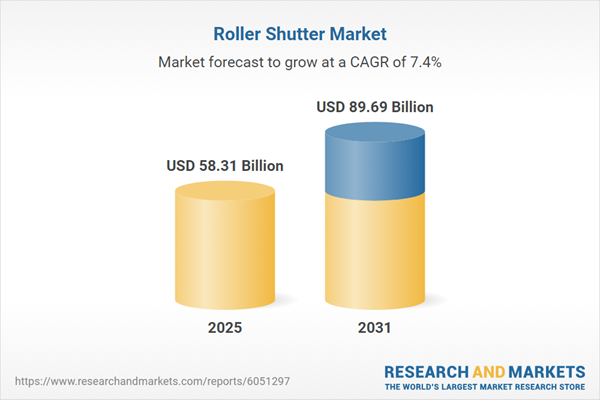

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 58.31 Billion |

| Forecasted Market Value ( USD | $ 89.69 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |