Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive demand indicators, the industry confronts substantial difficulties related to the sustainable handling of bauxite residue produced during refining operations. The hazardous nature of this byproduct necessitates complex environmental remediation and strict disposal protocols, resulting in elevated operational expenses and regulatory barriers. These challenges impose significant constraints on production capabilities and threaten to hinder the broader expansion of the market due to the high costs associated with managing environmental liabilities.

Market Drivers

A primary growth catalyst is the rising demand for non-halogenated flame retardants, spurred by the enforcement of strict fire safety codes within the electronics and construction sectors. As industries abandon toxic halogenated additives, aluminium hydroxide is increasingly preferred for its capacity to release endothermic water vapor, which suppresses smoke and inhibits combustion without causing environmental toxicity. This transition is reflected in the financial results of major specialty producers; for instance, Nabaltec AG’s 'Interim Report January to June 2024', released in August 2024, noted that revenue in its Functional Fillers segment - which includes these flame retardants - rose by 5.4% to EUR 78.2 million during the first half of the year, highlighting the material's essential role in modern cable insulation and composite cladding compliance.Simultaneously, advancements in lithium-ion battery technology are generating high-value opportunities for aluminium hydroxide as a feedstock for high-purity alumina (HPA) utilized in cathode materials and separator coatings. The rapid growth of the electric vehicle industry demands battery components with exceptional chemical stability and thermal resistance, driving investments in refining infrastructure. Illustrating this trend, Alpha HPA announced the commencement of 'Stage Two Construction' in August 2024 for a facility targeting an annual output of 10,000 tonnes of high-purity products for the LED and battery sectors. To support these downstream applications, Rio Tinto reported in October 2024 that its quarterly bauxite production increased by 8% year-on-year to 15.1 million tonnes, ensuring the necessary raw material stability.

Market Challenges

A major obstacle hindering the Global Aluminium Hydroxide Market is the sustainable management of bauxite residue, a hazardous waste product resulting from the Bayer refining process. Stringent environmental laws governing the containment and storage of this high-pH sludge require significant capital expenditure on long-term remediation strategies and specialized disposal infrastructure. These compulsory compliance costs drive up operational expenses, eroding profit margins that manufacturers might otherwise allocate toward capacity upgrades or facility expansions. As a result, the sector encounters a financial bottleneck where the rising costs of managing environmental liabilities effectively limit production capabilities and the ability to scale alongside increasing demand.The magnitude of this operational constraint is emphasized by the sheer volume of material processed within the industry, as residue generation is directly proportional to refining output. According to data from the International Aluminium Institute, global alumina production totaled 96.878 million tonnes in the first eight months of 2024. This extensive volume of processed material underscores the colossal amount of associated waste that producers are legally obligated to manage safely, demonstrating how waste disposal logistics and associated costs function as a primary governor on the market's rate of expansion.

Market Trends

The Global Aluminium Hydroxide Market is being reshaped by a transition toward low-carbon and sustainable production methods as producers work to decarbonize energy-intensive refining operations in accordance with global net-zero goals. To reduce the carbon footprint of aluminium hydroxide and its derivatives, manufacturers are increasingly substituting coal-fired calcination systems with cleaner energy sources such as hydrogen or natural gas. This shift is evident in recent major capital upgrades in Europe aimed at lowering emissions while sustaining output; for example, Huber Advanced Materials announced in December 2024, under 'Huber Achieves Major Sustainability Milestone', the activation of a new natural gas-fired power plant at its Martinswerk site, which is expected to cut the facility's carbon dioxide emissions by approximately 40%.Concurrently, the market is expanding its reach into high-performance applications through the growing adoption of nanoscale and ultrafine grades, which offer rheological and dispersion properties superior to standard micron-sized particles. Nanoscale variants like boehmite are gaining traction for their compatibility with advanced polymer matrices and exceptional thermal stability, serving as critical functional fillers rather than mere bulk additives. The commercial importance of these specialized grades is clear in financial data; Nabaltec AG reported in its 'Annual Report 2023', released in May 2024, that its boehmite product line generated EUR 17.3 million in revenue for the fiscal year, confirming the value of products catering to these high-tech specifications.

Key Players Profiled in the Aluminium Hydroxide Market

- Almatis

- Alteo

- ALUMINA - CHEMICALS & CASTABLES

- Aluminum Corporation of China Ltd.

- MAL - Magyar Aluminum Ltd.

- Sumitomo Chemical Co. Ltd.

- Huber Materials.

- Sibelco NV

- LKAB Minerals AB

- Donau Carbon GmbH

- TOR Minerals International, Inc.

- Aditya Birla Management Corporation Pvt. Ltd.

Report Scope

In this report, the Global Aluminium Hydroxide Market has been segmented into the following categories:Aluminium Hydroxide Market, by Grade:

- Industrial Grade

- Pharma Grade

Aluminium Hydroxide Market, by End User:

- Construction

- Pharmaceuticals

- Automotive

- Electronics

Aluminium Hydroxide Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aluminium Hydroxide Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aluminium Hydroxide market report include:- Almatis

- Alteo

- ALUMINA - CHEMICALS & CASTABLES

- Aluminum Corporation of China Ltd

- MAL - Magyar Aluminum Ltd.

- Sumitomo Chemical Co. Ltd.

- Huber Materials.

- Sibelco NV

- LKAB Minerals AB

- Donau Carbon GmbH

- TOR Minerals International, Inc.

- Aditya Birla Management Corporation Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

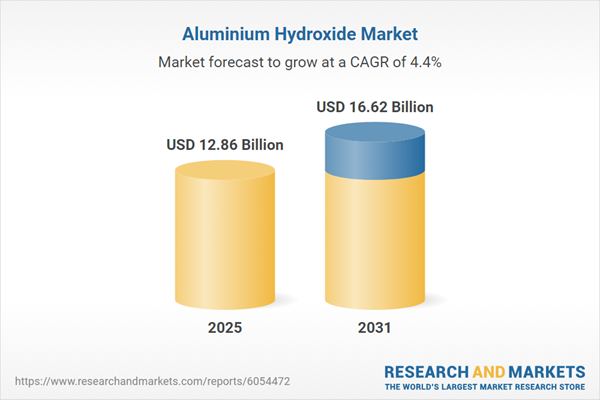

| Estimated Market Value ( USD | $ 12.86 Billion |

| Forecasted Market Value ( USD | $ 16.62 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |