Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the industry confronts substantial hurdles stemming from macroeconomic instability, which can suppress construction activity and postpone capital-intensive initiatives. Elevated interest rates and inflationary pressures frequently limit project funding and curtail the immediate purchase of finishing materials. This contraction in demand is evident in recent performance metrics; according to the Tile Council of North America, U.S. ceramic tile consumption fell to 2.70 billion square feet in 2024. These fluctuations highlight the market's vulnerability to broader economic headwinds, which can hinder expansion despite the underlying long-term necessity for construction resources.

Market Drivers

The escalation of renovation and remodeling activities within mature markets acts as a primary catalyst for the global construction flooring sector. As residential and commercial properties age, especially in Europe and North America, owners are prioritizing refurbishment to increase asset value and modernize interiors, thereby sustaining demand for materials such as hardwood and luxury vinyl tile. This consumption driven by retrofitting provides a steady revenue stream that is less volatile than new construction cycles, as businesses and homeowners invest in upgrading durable surfaces. The vitality of this sector is reflected in industry sentiment; according to the National Association of Home Builders, the 'Remodeling Market Index' reading for the fourth quarter of 2024 increased to 68 in January 2025, marking a five-point rise from the prior quarter and signaling strong confidence in home improvement.Concurrently, the modernization of workspaces and growth in commercial real estate are significantly supporting market expansion. Educational institutions and corporate entities are redesigning interiors to support hybrid work models and enhanced safety standards, promoting the adoption of high-performance solutions like resilient surfaces and modular carpet.

This resurgence in the commercial segment is generating tangible financial benefits for leading manufacturers; according to Interface Inc., the company's net sales rose 11% year-over-year to $344.3 million in its Q3 2024 earnings release, driven by robust demand in the education and Americas sectors. This growth aligns with broader infrastructure trends, as the U.S. Census Bureau reported in 2025 that the total value of construction put in place during 2024 reached $2.15 trillion, a 6.5% increase over the previous year.

Market Challenges

Macroeconomic instability represents a major obstacle to the continued development of the global construction flooring market. High interest rates and inflationary pressures directly elevate borrowing costs, thereby limiting financing options for residential buyers and commercial developers alike. As capital becomes more expensive, new construction starts often stall, and planned infrastructure projects encounter indefinite delays. Furthermore, this economic volatility reduces consumer purchasing power, causing homeowners to delay discretionary remodeling projects that typically generate a significant share of flooring sales, resulting in a noticeable contraction in volume as project pipelines empty and immediate demand softens.Recent industry data confirms the negative impact of these economic conditions through a decline in material uptake. According to the European Parquet Federation, overall consumption in the European parquet market fell by just under 5% in 2024 compared to the prior year. This downturn demonstrates how economic uncertainty and monetary tightening directly result in diminished market activity. When financing becomes prohibitively costly, the critical connection between construction needs and actual material procurement is disrupted, preventing the market from achieving its full growth potential.

Market Trends

The industry is observing a rapid uptake of recycled and bio-based materials as manufacturers shift toward circular economic models to lower environmental impact. Leading companies are reformulating their product lines to integrate post-consumer content, such as polyethylene terephthalate fibers and reclaimed vinyl, thereby decreasing dependence on virgin resources. This strategic transition is evidenced by significant operational changes; according to Tarkett’s '2024 Sustainability Statement' released in April 2025, the company used 157,000 tons of recycled materials in production during 2024, accounting for 19% of its total raw material intake. Such efforts affirm that sustainability has become a fundamental manufacturing standard guiding material procurement strategies.At the same time, the market is undergoing a sustained expansion of waterproof rigid core solutions, specifically Stone Plastic Composite (SPC), which continues to gain market share from traditional ceramic tiles and hardwood. This segment is driven by consumer preference for moisture-resistant, durable surfaces that offer aesthetic versatility and ease of installation in both commercial and residential environments. The financial strength of this category is clear in recent performance metrics; according to Floor Covering News in July 2025, SPC dollar sales hit $3.6 billion in 2024, representing nearly 15% of total flooring industry sales. This strong performance highlights how functional properties are redefining the hard surface landscape.

Key Players Profiled in the Construction Flooring Market

- Mohawk Industries, Inc.

- Tarkett, S.A.

- Burke Flooring Products, Inc.

- Shaw Industries, Inc.

- Interface, Inc.

- Mannington Mills, Inc.

- Crossville Inc.

- Atlas Concorde S.P.A.

- Porcelanosa Group

- Kajaria Ceramics Limited

Report Scope

In this report, the Global Construction Flooring Market has been segmented into the following categories:Construction Flooring Market, by End User:

- Residential

- Non-Residential

Construction Flooring Market, by Printing Technology:

- Digital

- Traditional

Construction Flooring Market, by Material:

- Wood

- Stone

- Ceramic

- Laminate

- Others

Construction Flooring Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Construction Flooring Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Construction Flooring market report include:- Mohawk Industries, Inc.

- Tarkett, S.A.

- Burke Flooring Products, Inc.

- Shaw Industries, Inc.

- Interface, Inc

- Mannington Mills, Inc.

- Crossville Inc.

- Atlas Concorde S.P.A.

- Porcelanosa Group

- Kajaria Ceramics Limited

Table Information

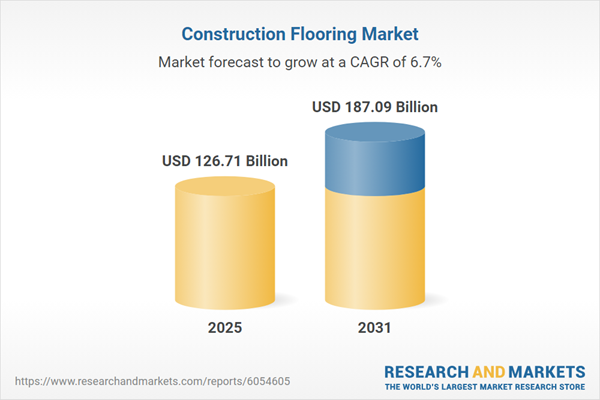

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 126.71 Billion |

| Forecasted Market Value ( USD | $ 187.09 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |