Speak directly to the analyst to clarify any post sales queries you may have.

Laying the Foundation for Transformative Advancements in Orthopedic Joint Surgery through Automated Robotics and Integrated Software Platforms Driving Operational Excellence

The evolution of joint surgical procedures has reached a pivotal moment as automated robotics and integrated software platforms redefine orthopedic interventions. Fueled by advances in artificial intelligence, real-time imaging, and precision engineering, these systems are enhancing surgical accuracy, reducing patient recovery times, and transforming clinical workflows. This introduction provides a clear lens through which stakeholders can appreciate the strategic importance of understanding the joint surgical automated system market at this transformative juncture.Drawing on a thorough review of technological innovations and stakeholder interviews, this analysis explores the convergence of hardware components-such as robotic arms, vision modules, and milling mechanisms-with sophisticated software architectures that enable data-driven planning and execution. It examines how these integrated solutions are reshaping surgeon-device interactions and driving new standards of care.

Ultimately, this section sets the stage for a comprehensive exploration of emerging trends, regulatory developments, and competitive dynamics. It invites decision-makers to engage with nuanced insights that lay the groundwork for informed investment, partnership, and product development strategies in the joint surgical automation field.

Identifying the Pivotal Technological Shifts Reshaping the Landscape of Joint Arthroplasty and Robotic Assisted Orthopedic Surgeries Worldwide over the Past Decade

Over the past decade, the joint surgical automation arena has undergone seismic shifts propelled by breakthroughs in robotics, machine learning, and augmented reality. These technological inflection points have elevated surgical precision and intraoperative visualization, enabling surgeons to perform increasingly complex procedures with minimal invasiveness and improved patient outcomes.Moreover, the integration of AI-driven planning tools and intraoperative analytics has unlocked new levels of procedural customization. Surgeons can now simulate bone resections, predict soft tissue balance, and optimize implant placement before making the first incision. In tandem, advancements in sensor technology and haptic feedback have fostered a more intuitive interface between surgeon and machine, reducing the learning curve and enabling broader adoption across diverse clinical settings.

Consequently, healthcare systems are witnessing a shift from traditional manual techniques toward data-centric, robotics-assisted workflows. This transition is underpinned by collaborative partnerships between device manufacturers, software developers, and clinical research institutions, collectively driving the landscape toward higher standards of safety, efficiency, and clinical excellence.

Assessing the Widespread Implications of the 2025 United States Tariff Adjustments on Global Joint Surgical Automated System Supply Chains

The introduction of revised United States tariffs in 2025 has reverberated throughout the joint surgical automated system supply chain, compelling manufacturers and distributors to reassess sourcing strategies and cost structures. With a heightened duty burden on components such as precision cutting instruments and high-definition imaging modules, several key players have initiated near-shoring efforts to mitigate import dependency and stabilize pricing dynamics.Furthermore, these tariff adjustments have intensified negotiations between device makers and their suppliers, prompting a wave of contract renegotiations aimed at preserving margin integrity. In parallel, distributors have responded by recalibrating their value propositions, increasingly bundling maintenance contracts and training services to offset raw material cost escalations.

As a result, end users are experiencing localized shifts in procurement cycles, with some healthcare systems accelerating capital expenditures ahead of anticipated price adjustments, while others explore leasing models to manage budgetary impacts. Ultimately, this section elucidates how the 2025 tariff revisions are reshaping competitive landscapes and driving strategic realignments across the joint surgical automation sector.

Unveiling Critical Market Dynamics Through Comprehensive Segmentation of System Types, Procedures, Sales Channels, and End Users

A detailed market segmentation reveals the multifaceted nature of the joint surgical automated system industry. Based on system type, the landscape divides into sophisticated hardware platforms and complementary software solutions. Within hardware, advanced milling systems deliver bone resection precision, navigation modules provide real-time spatial guidance, robotic arms translate surgeon intent into controlled movements, and high-definition vision systems enable high-fidelity intraoperative imaging. These components interface seamlessly with software suites that offer preoperative planning modules, intraoperative analytics, and AI-driven decision support.Beyond system architecture, procedural segmentation encompasses a breadth of joint interventions. Ankle, elbow, shoulder, and wrist surgeries are gaining traction alongside major hip and knee replacements. Notably, hip procedures bifurcate into partial and total arthroplasties, while knee replacements are performed as either partial or total interventions. Shoulder applications include both primary and revision arthroplasty scenarios, each demanding tailored robotic assistance.

The dichotomy between minimally invasive and open surgeries further underscores the need for versatile platforms. Open approaches, both conventional and robotic-assisted, co-exist with less invasive techniques that prioritize smaller incisions, reduced soft tissue disruption, and accelerated rehabilitation.

Finally, sales channels and end-user demographics shape market reach. Offline distribution persists through direct sales and distributor networks, while online portals gradually expand their foothold. Ambulatory surgical centers, hospitals and clinics, and specialty orthopedic facilities each present distinct adoption drivers, reflecting variable workflow requirements, investment capabilities, and clinical priorities.

Evaluating Regional Market Nuances Across the Americas, Europe Middle East Africa, and Asia-Pacific for Joint Surgical Automation Adoption

When evaluating global adoption patterns, the Americas emerge as a mature market characterized by early incorporation of robotic platforms in leading healthcare institutions and a robust regulatory framework that supports innovation. High reimbursement rates and well-established training programs have facilitated widespread clinical acceptance and accelerated replacement cycles.In contrast, the Europe, Middle East, and Africa region presents a heterogeneous landscape. Western Europe has embraced robotic solutions with an emphasis on patient safety standards and cross-border technology transfer, while emerging economies in the Middle East and Africa are demonstrating rapid uptake driven by infrastructure investments and public-private partnerships aimed at enhancing surgical capacity.

Asia-Pacific offers a dynamic growth narrative, with select markets such as Japan, South Korea, and Australia pioneering local manufacturing and innovation clusters. Simultaneously, large patient populations in China and India are creating enormous demand for scalable automation models, prompting joint ventures and licensing agreements between multinational device manufacturers and regional players.

These regional insights underscore the importance of localized strategies that align with reimbursement environments, clinical training ecosystems, and infrastructure readiness, thereby unlocking the full potential of joint surgical automation across diverse geographies.

Analyzing Strategic Positioning and Competitive Footprints of Leading Innovators Shaping the Joint Surgical Automation Market Evolution

Market leadership in joint surgical automation is defined by a blend of R&D prowess, strategic partnerships, and clinical trial validation. Established orthopedic instrument manufacturers have leveraged their surgical expertise to integrate robotics into legacy portfolios, while pure-play robotics companies focus on iterative enhancements and system interoperability.Collaborations between device makers and technology providers have yielded next-generation platforms that combine high-precision optics, adaptive control algorithms, and cloud-based analytics. In parallel, alliances with academic medical centers have enabled rigorous in vivo studies, bolstering clinical evidence of improved alignment accuracy and patient satisfaction metrics.

Additionally, key players are expanding their footprints through targeted acquisitions and geographic licensing deals, securing distribution channels in emerging markets and bolstering service networks. This strategic focus on enhancing post-sales support and training infrastructures has become a cornerstone of competitive differentiation, as surgical teams increasingly demand turnkey solutions that encompass hardware, software, and ongoing service commitments.

Consequently, an organization’s ability to orchestrate end-to-end value delivery-from device innovation and regulatory clearance to comprehensive training and remote monitoring-defines its competitive position in this rapidly evolving market.

Outlining Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities in Robotic Joint Surgery

To capitalize on the accelerated shift toward automated joint surgery, industry leaders should prioritize cross-disciplinary partnerships that integrate robotics providers with data analytics firms and digital health platforms. This collaborative approach will enable the creation of holistic ecosystems that span preoperative planning, intraoperative execution, and postoperative outcome monitoring.Moreover, stakeholders must invest in scalable training programs that blend virtual simulation with hands-on clinical mentorship to ensure rapid proficiency among surgical teams. By fostering a community of practice, organizations can drive broader acceptance and reduce barriers to adoption.

In addition, diversifying sales channels to include digital distribution models and value-based contracting structures will equip manufacturers to meet evolving procurement preferences and budget constraints. Such innovative commercial frameworks can mitigate the impact of geopolitical factors, including tariff fluctuations, while enhancing revenue predictability.

Finally, a relentless focus on real-world evidence generation-through post-market surveillance initiatives, patient-reported outcome registries, and longitudinal studies-will solidify the clinical and economic value proposition of robotic platforms, ultimately driving sustainable growth and market leadership.

Detailing the Rigorous Multi Tiered Research Methodology Underpinning the Joint Surgical Automation Market Analysis

This research initiative employed a meticulous, multi-method approach to deliver nuanced insights into the joint surgical automation market. Secondary research began with an exhaustive review of peer-reviewed journals, patent filings, regulatory documentation, and publicly disclosed financial statements. These sources provided foundational clarity on technological capabilities, clinical outcomes, and investment trends.Primary data collection entailed in-depth interviews with surgeons, hospital administrators, device engineers, and procurement specialists across key regions. These qualitative dialogues enriched the analysis with frontline perspectives on workflow integration, training requirements, and value metrics. Concurrently, quantitative surveys targeted medical device distributors and healthcare payers to capture pricing dynamics, reimbursement scenarios, and procurement cycles.

Data triangulation ensured the integration of diverse inputs, while rigorous validation workshops with external experts verified key findings and reconciled discrepancies. Finally, scenario analysis and sensitivity testing were applied to assess the potential impact of emerging regulations, tariff changes, and technological breakthroughs on market trajectories.

Concluding Insights Emphasizing the Critical Role of Automated Systems in Advancing Patient Outcomes and Operational Efficiency

The advent of advanced robotics and software integration is driving a paradigm shift in joint surgical care, yielding improvements in procedural accuracy, patient recovery, and overall healthcare efficiency. As tariff realignments prompt supply chain realignments, manufacturers and healthcare providers must adopt agile strategies to navigate cost pressures while sustaining innovation momentum.Comprehensive segmentation underscores the importance of tailoring solutions to distinct system types, procedural applications, surgery methods, and end-user environments. Simultaneously, regional dynamics demand localized approaches that reflect reimbursement landscapes, infrastructure capabilities, and clinical training readiness.

Competitive success hinges on an ability to orchestrate end-to-end value, from product design and regulatory clearance through to service excellence and real-world evidence generation. By embracing collaborative partnerships, flexible commercial models, and continuous learning frameworks, stakeholders will be well-positioned to lead the transition toward a more automated, patient-centered future in joint surgical interventions.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- System Type

- Hardware

- Milling System

- Navigation System

- Robotic Arms

- Vision System

- Software

- Hardware

- Surgical Procedure

- Ankle

- Elbow

- Hip Surgery

- Partial Hip Arthroplasty

- Total Hip Arthroplasty

- Knee Surgery

- Partial Knee Arthroplasty

- Total Knee Arthroplasty

- Shoulder

- Primary Shoulder Arthroplasty

- Revision Shoulder Arthroplasty

- Wrist

- Surgery Type

- Minimally Invasive

- Open

- Conventional

- Robotic Assisted

- Sales Channel

- Offline

- Direct Sales

- Distributor Network

- Online

- Offline

- End User

- Ambulatory Surgical Centers

- Hospitals & Clinics

- Specialty Clinics

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Johnson & Johnson Services, Inc.

- Conformis, Inc.

- Corin Group

- CUREXO, INC

- Exactech, Inc.

- Intuitive Surgical Operations, Inc.

- Medtronic plc

- NuVasive, Inc.

- OMNIlife science, Inc.

- Siemens Healthineers AG

- Smith & Nephew PLC

- Stryker Corporation

- THINK Surgical, Inc.

- Zimmer Biomet Holdings, Inc.

- CMR Surgical Limited

- Meril Group

- Guangzhou Aimooe Technology Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Joint Surgical Automated System market report include:- Johnson & Johnson Services, Inc.

- Conformis, Inc.

- Corin Group

- CUREXO, INC

- Exactech, Inc.

- Intuitive Surgical Operations, Inc.

- Medtronic plc

- NuVasive, Inc.

- OMNIlife science, Inc.

- Siemens Healthineers AG

- Smith & Nephew PLC

- Stryker Corporation

- THINK Surgical, Inc.

- Zimmer Biomet Holdings, Inc.

- CMR Surgical Limited

- Meril Group

- Guangzhou Aimooe Technology Co., Ltd.

Table Information

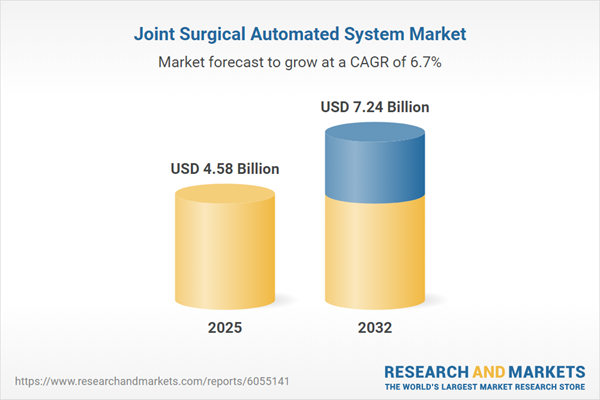

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 4.58 Billion |

| Forecasted Market Value ( USD | $ 7.24 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |