Speak directly to the analyst to clarify any post sales queries you may have.

The halitosis agent market is experiencing notable changes as technological progress, evolving oral health practices, and increased regulatory focus transform both opportunities and challenges for senior industry leaders. Strong shifts in consumer preferences, product innovation, and supply chain dynamics create new pathways for growth and strategic differentiation.

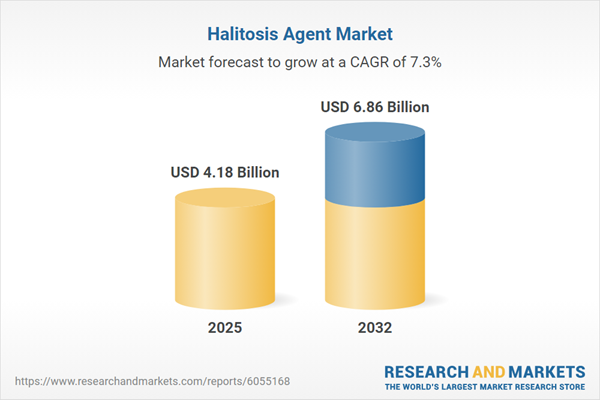

Market Snapshot: Halitosis Agent Market Size and Growth Trajectory

Heightened global awareness of oral health is fueling steady expansion in the halitosis agent market. In 2024, the market reached a valuation of USD 3.91 billion, with a projected increase to USD 4.18 billion by 2025. This growth represents a consistent compound annual growth rate (CAGR) of 7.25%. Looking ahead, ongoing momentum is expected to drive total sector value to USD 6.86 billion by 2032. Underlying factors include increasing demand for advanced oral care options, the rising popularity of natural and functional product formulations, and a stronger recognition of links between oral hygiene and broader well-being. Industry leaders are actively refining operational strategies and resource allocation to keep pace with regional and global market dynamics.

Scope & Segmentation: In-Depth Halitosis Agent Market Analysis

This report offers a comprehensive analysis of the halitosis agent market, assessing the main commercial drivers, evolving technologies, and supply and demand shifts influencing competitive positioning. Detailed segmentation enables decision-makers to identify critical product opportunities and tailor approaches for greater market relevance.

- Component Types: Coverage includes chemical agents—such as cetylpyridinium chloride, chlorhexidine, triclosan, and zinc salts—as well as natural alternatives like essential oils and plant extracts, both balancing clinical effectiveness and meeting increasing demand for clean-label, sustainable solutions.

- Product Formats: Assesses delivery options including mouthwashes, chewing gums, breath sprays, toothpastes, lozenges, and tablets, each catering to diverse consumption habits and preferences in both professional and personal care contexts.

- Disease Applications: Examines the use of solutions for managing true halitosis, pseudo-halitosis, and halitophobia, supporting both targeted professional treatment protocols and at-home care routines for end-users.

- Distribution Channels: Explores sales presence in pharmacies, traditional retail, department stores, as well as digital brand platforms and e-commerce models, reflecting the shift to flexible purchasing and robust supply chain approaches.

- Geographic Coverage: Delivers insights into trends and growth across the Americas, Europe, Middle East & Africa, and Asia-Pacific, highlighting local innovations, shifting consumer needs, and emerging regional demands.

- Key Companies: Profiles major industry participants such as Chattem, Church & Dwight, Colgate-Palmolive, Dabur India, Dentaid, Dental Herb Company, Dr. Harold Katz, GlaxoSmithKline, Hello Products, Johnson & Johnson, Kao Corporation, Kerr Corporation, Koninklijke Philips, Lion Corporation, OraLabs, Patanjali Ayurved, PerioSciences, Procter & Gamble, Rowpar Pharmaceuticals, Sunstar Suisse, Tom's of Maine, Unilever, Viatris, Zendium, and Zila. Each competitor contributes to a dynamic and innovation-driven competitive environment.

Key Takeaways: Strategic Trends Shaping the Halitosis Agent Market

- Organizations are integrating more natural and plant-derived actives into formulations, meeting growing sustainability goals and transparency expectations among end-users and regulatory bodies.

- New diagnostic platforms, including AI-powered applications, support greater personalization in product selection and outcomes measurement, improving both consumer engagement and clinical efficacy.

- Expanded regulatory scrutiny on safety and labeling is raising industry standards in product validation, driving manufacturers toward more rigorous compliance and clearer communication of product claims.

- Digital health initiatives are facilitating convergence between offline expertise and online accessibility, enabling providers to extend reach and deliver guidance through telehealth and e-commerce solutions.

- Localization of product development is gaining ground, with tailored ingredient choices and escalating interest in premium options informing how brands adapt to preferences within different regions.

Tariff Impact: Adapting to Cost and Supply Chain Changes

- Recent U.S. tariffs affecting specialty chemical imports are prompting additional supply chain complexity and cost management challenges for chemical-based product segments.

- Companies are responding by increasing reliance on local and regional sourcing practices, reducing vulnerability to global disruptions and promoting supply chain resilience.

- Strategic collaborations with regional suppliers and vertical integration efforts are seen as essential for protecting access to core raw materials and maintaining operational stability.

Methodology & Data Sources

The research is based on primary interviews with market experts, supply chain leaders, and formulation specialists, combined with secondary evaluation of clinical publications, regulatory data, and official industry disclosures. Stringent validation steps ensure accuracy and relevance to current market demands.

Why This Report Matters: Insight for Senior Decision-Makers

- Provides actionable recommendations for managing product portfolios, leveraging trends in formulation, compliance, and regional strategies.

- Supports risk management planning through a robust evaluation of supply chain approaches and emerging international trade considerations.

- Guides executives in optimizing go-to-market strategies using detailed segmentation and analysis of evolving consumer and channel dynamics.

Conclusion

Decision-makers gain clear, detailed intelligence for overcoming immediate challenges, directing strategy, and advancing sustainable growth across the global halitosis agent market.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Halitosis Agent market report include:- Chattem, Inc.

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Dabur India Limited

- Dentaid S.L.

- Dental Herb Company

- Dr. Harold Katz, LLC

- GlaxoSmithKline PLC

- Hello Products LLC

- Johnson & Johnson

- Kao Corporation

- Kerr Corporation

- Koninklijke Philips N.V.

- Lion Corporation

- OraLabs, Inc.

- Patanjali Ayurved Ltd.

- PerioSciences

- Procter & Gamble Co.

- Rowpar Pharmaceuticals, Inc

- Sunstar Suisse S.A.

- Tom's of Maine, Inc.

- Unilever PLC

- Viatris Inc.

- Zendium

- Zila, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 4.18 Billion |

| Forecasted Market Value ( USD | $ 6.86 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |