Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Evolution of Automatic Coil Winding Systems in Modern Manufacturing Environments and Their Strategic Importance to Industrial Efficiency

In an era defined by accelerating technological innovation and stringent efficiency mandates, automatic coil winding systems have emerged as cornerstone assets in manufacturing operations. These systems ensure unparalleled precision in creating inductive components, thereby supporting applications spanning from consumer electronics to utility-scale power solutions. As global demand for complex electromagnetic devices escalates, manufacturers increasingly prioritize streamlined processes that reduce waste, enhance reproducibility, and shorten time to market.Against this backdrop, the market for coil winding automation reflects a convergence of advanced control architectures, sensor integration, and modular hardware design. This synthesis drives operational excellence by enabling dynamic adjustments during winding cycles, robust feedback loops, and seamless integration with enterprise resource planning systems. The strategic imperative for enterprises is clear: adopting cutting-edge automation not only addresses labor constraints and quality challenges, but also paves the way for data-driven continuous improvement initiatives. As we embark on this analysis, the interplay between technological maturation and evolving industry requirements will illustrate why automatic coil winding systems are now indispensable for competitive manufacturers.

Examining the Pivotal Technological and Operational Paradigm Shifts That Are Redefining Automatic Coil Winding Systems Across Various Industries

The landscape of automatic coil winding systems is undergoing profound transformation driven by breakthroughs in control logic, materials science, and digital connectivity. Traditional machines that once relied on manual calibration are giving way to sophisticated platforms equipped with programmable logic controllers and adaptive human-machine interfaces. These developments are redefining operational paradigms by enabling real-time process monitoring, predictive maintenance, and automated recipe adjustment based on dynamic feedback.Simultaneously, the advent of smart sensors and computer vision is empowering manufacturers to detect anomalies at micron-level tolerances, reducing scrap rates and ensuring compliance with ever-more rigorous industry standards. Cloud-based architectures further extend these capabilities by aggregating performance data across multiple production lines, unlocking insights that inform continuous optimization efforts. Consequently, organizations are transitioning from reactive maintenance schedules to proactive asset management models, driving sustained improvements in uptime and throughput. This shift underscores the strategic value of integrating digital solutions with proven mechanical designs to meet the demands of next-generation coil winding applications.

Assessing the Far-reaching Impacts of the 2025 United States Tariff Regime on Supply Chains Production Costs and Strategic Sourcing Decisions for Coil Winders

The tariff landscape enacted by the United States in 2025 has introduced multilayered complexities for suppliers and end users of coil winding equipment. Components sourced from overseas now carry elevated duties, prompting manufacturers to reassess supply chain architectures and inventory buffers. As a result, many enterprises are exploring nearshoring options or qualifying alternate vendors to mitigate the cost impact of shifting trade policies.Moreover, the increased duties have catalyzed strategic dialogues between original equipment manufacturers and their domestic partners, encouraging technology transfers and co-development initiatives to localize critical components. While these adjustments incur upfront investments, they also yield long-term resilience by reducing exposure to policy volatility. Ultimately, navigating the new tariff regime demands a balanced approach that harmonizes cost considerations with operational continuity and quality assurance. Manufacturers that successfully adapt to this paradigm will position themselves to deliver reliable, competitively priced coil winding solutions in an era of trade uncertainty.

In-depth Analysis of Product Types Components Coil Variations Automation Levels Materials Delivery Channels and End-user Industries Shaping Market Dynamics

A granular examination of market segments reveals that product types such as armature coil winders, film coil winders, stator coil winders, and toroidal coil winders each address distinct application challenges and precision requirements. Meanwhile, control systems, drive motors, sensors and feedback systems, guiding and layering equipment, winding head components, wire tensioners, and cutting and clamping tools form the backbone of modular platforms, with advanced PLCs, human-machine interfaces, and specialized coil-design software enhancing process flexibility.Within the coil type spectrum, choke coils, inductor coils, and relay coils serve industries as diverse as telecommunications, automotive, and energy storage, driving demand for tailored winding parameters and repeatable quality. Automation preferences diverge between fully automated systems and semi-automatic setups, reflecting variance in production volumes and workforce skill sets. Material choice between aluminum and copper windings further influences equipment configuration and maintenance protocols. The delivery channel-encompassing both offline and online sales-affects customer engagement models, while end-user industries from aerospace and defense to healthcare and industrial manufacturing dictate certification requirements and deployment timelines. Together, these segmentation insights illuminate the multifaceted nature of technology adoption and highlight areas for targeted innovation and service differentiation.

Discovering Regional Nuances and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in the Context of Automatic Coil Winding System Adoption

Geographical dynamics in the automatic coil winding arena underscore divergent growth catalysts and regulatory environments. In the Americas, investment in renewable energy infrastructure and electric mobility initiatives has driven heightened interest in robust winding platforms capable of handling high-volume stator and torque coil production. Cross-border partnerships and domestic content requirements further influence procurement strategies, with regional hubs emerging for specialized subassemblies.Europe, the Middle East, and Africa present a tapestry of technology adoption rates shaped by energy transition goals, defense procurement cycles, and industrial modernization programs. Stringent quality and environmental standards in Western Europe contrast with cost-driven priorities in other regions, necessitating flexible equipment configurations and localized support networks. Simultaneously, Asia-Pacific markets benefit from scale efficiencies, robust electronics and automotive sectors, and government incentives for advanced manufacturing. These regional insights reveal that successful players tailor their value propositions to local regulations, supply chain realities, and end-user expectations, ensuring alignment with specific market drivers.

Strategic Profiles and Competitive Positioning of Leading Manufacturers Innovators and Solution Providers Shaping the Landscape of Automatic Coil Winding Systems

Leading players in the automatic coil winding domain are pursuing a blend of organic innovation and strategic collaborations to fortify their market positions. Some have expanded R&D centers to prototype next-generation winding heads, integrating multi-axis motion systems with high-precision optical verification. Others have forged alliances with software developers to embed artificial intelligence capabilities, enabling adaptive control and autonomous error correction.On the operational front, partnerships with local service providers have extended after-sales support footprints, reducing response times for maintenance and retrofitting. Meanwhile, joint ventures with component specialists have unlocked cost synergies in sourcing drive motors and tension control devices. These strategies underscore a broader trend toward ecosystem building, where leading manufacturers leverage a network of technology, service, and distribution partners to deliver end-to-end solutions. As differentiation shifts from hardware specifications to holistic process performance, company initiatives that emphasize co-innovation and agile delivery models will set the benchmark for industry leadership.

Practical Strategic Roadmap and Best Practices for Industry Leaders to Navigate Complex Challenges and Capitalize on Opportunities in the Automatic Coil Winding Market

To thrive in the evolving coil winding ecosystem, industry leaders must pursue a multifaceted strategy that aligns technological investment with market realities. Prioritizing the integration of advanced sensor arrays and machine learning algorithms can enhance defect detection and yield optimization, translating to tangible cost savings. Concurrently, diversifying supply chains by qualifying regional component suppliers will mitigate the impact of tariff fluctuations and logistical disruptions.It is equally crucial to develop modular machine architectures that accommodate both aluminum and copper windings, as well as a spectrum of coil geometries, to address the needs of cross-industry customers. Embracing digital channels for equipment configuration, diagnostics, and remote support can strengthen customer relationships while unlocking new service-based revenue streams. Finally, forging partnerships with academic and research institutions will accelerate the assimilation of novel materials and process innovations, ensuring a sustained competitive edge. By implementing these targeted recommendations, manufacturers can navigate the challenges of a dynamic market and capitalize on emerging opportunities.

Comprehensive Overview of Research Design Data Collection Approaches and Analytical Frameworks Employed to Derive Robust Insights into Coil Winding Systems

This research employed a comprehensive blend of qualitative and quantitative methodologies to ensure the robustness of its insights. Primary data was gathered through structured interviews and surveys with equipment manufacturers, end users, and domain experts, supplemented by in-depth case studies of deployment scenarios across key industries. Secondary sources included patent filings, technical white papers, regulatory documentation, and industry conference proceedings, providing a holistic perspective on technological trends and strategic initiatives.Analytical frameworks such as SWOT analysis, value chain mapping, and scenario planning were applied to dissect market dynamics, competitive landscapes, and regulatory impacts. Data triangulation techniques validated findings, while sensitivity analyses explored the implications of alternative tariff and technology adoption scenarios. This rigorous approach ensures that conclusions are grounded in empirical evidence and reflect the nuanced interplay between innovation, policy, and customer requirements.

Synthesizing Critical Findings and Strategic Takeaways to Illuminate the Future Trajectory of Automatic Coil Winding Systems Amidst Evolving Market Forces

Throughout this executive summary, we have illuminated the technological advancements, market drivers, and strategic challenges shaping the automatic coil winding system landscape. From the integration of intelligent control systems to the recalibration of supply chains in response to new trade policies, industry participants must remain agile and forward-looking. Segmentation analysis has underscored the diversity of equipment configurations and materials requirements, while regional insights highlight the importance of tailored go-to-market strategies.As competitive pressures intensify and customer expectations evolve, the imperative for continuous innovation and partnership orchestration becomes ever more pronounced. Companies that embrace digital transformation, cultivate resilient supplier networks, and focus on customer-centric solutions will secure enduring advantage. This synthesis of findings serves as a strategic compass for stakeholders seeking to navigate and shape the future trajectory of automatic coil winding systems across global markets.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Armature Coil Winders

- Film Coil Winders

- Stator Coil Winders

- Toroidal Coil Winders

- Components

- Control Systems

- Human-Machine Interfaces

- Programmable Logic Controllers

- Cutting & Clamping Tools

- Drive Motors

- Guiding & Layering Equipment

- Sensors & Feedback Systems

- Winding Head Components

- Wire Tensioners

- Control Systems

- Coil Type

- Choke Coils

- Inductor Coils

- Relay Coils

- Automation Level

- Fully Automated Systems

- Semi-Automatic Systems

- Winding Material

- Aluminum Windings

- Copper Windings

- End-User Industry

- Aerospace & Defense

- Automotive

- Electronics

- Energy

- Healthcare

- Industrial Manufacturing

- Telecommunications

- Delivery Channel

- Offline Sales

- Online Sales

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Detzo Co., Ltd.

- Gorman Machine Corp

- ACME Electronics

- Armature Coil Equipment

- Bestec Co., Ltd.

- Broomfield Laboratories Inc.

- Changzhou Jinkang Precision Mechanism Co.,Ltd.

- CSM MACHINERY srl

- Heinrich Schümann (GmbH & Co. KG)

- Ingrid West Machinery Ltd

- K.D. Dowell and Keys

- Kirpekar Engineering

- Kisan Engineering

- KUK Group

- NevonSolutions Pvt. Ltd

- Nittoku Co., Ltd.

- Nortech System

- Oerlikon Textile GmbH and Co KG

- SanShine(Xiamen)Electronics Co.,Ltd

- SMT Intelligent Device Manufacturing (Zhejiang) Co., Ltd.

- Suzhou Sanao Electronic Equipment Co., LTD.

- Synthesis Winding Technologies Pvt. Ltd

- Trishul Winding Solutions

- Whitelegg Machines Ltd

- Wuxi Haoshuo Technology Co.,Ltd

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Automatic Coil Winding System market report include:- Detzo Co., Ltd.

- Gorman Machine Corp

- ACME Electronics

- Armature Coil Equipment

- Bestec Co., Ltd.

- Broomfield Laboratories Inc.

- Changzhou Jinkang Precision Mechanism Co.,Ltd.

- CSM MACHINERY srl

- Heinrich Schümann (GmbH & Co. KG)

- Ingrid West Machinery Ltd

- K.D. Dowell and Keys

- Kirpekar Engineering

- Kisan Engineering

- KUK Group

- NevonSolutions Pvt. Ltd

- Nittoku Co., Ltd.

- Nortech System

- Oerlikon Textile GmbH and Co KG

- SanShine(Xiamen)Electronics Co.,Ltd

- SMT Intelligent Device Manufacturing (Zhejiang) Co., Ltd.

- Suzhou Sanao Electronic Equipment Co., LTD.

- Synthesis Winding Technologies Pvt. Ltd

- Trishul Winding Solutions

- Whitelegg Machines Ltd

- Wuxi Haoshuo Technology Co.,Ltd

Table Information

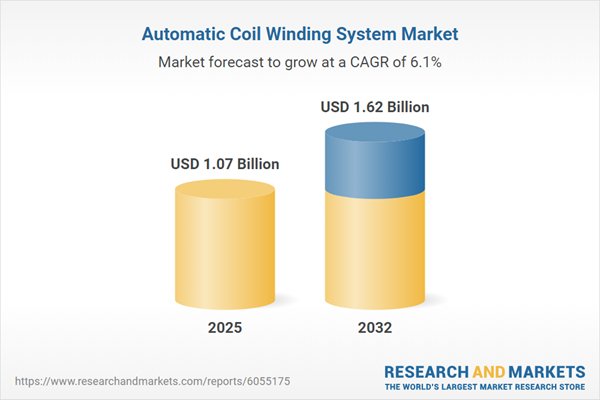

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.07 Billion |

| Forecasted Market Value ( USD | $ 1.62 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |