1h Free Analyst Time

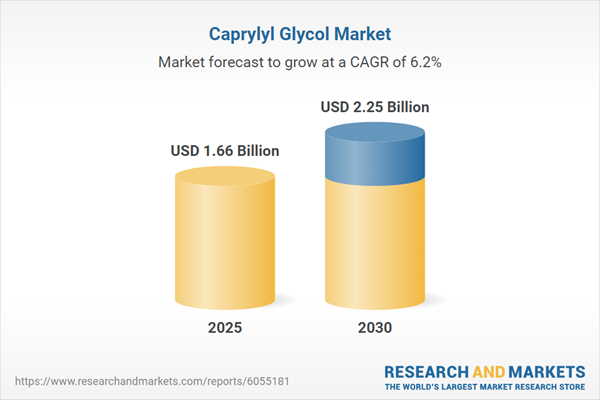

The Caprylyl Glycol Market grew from USD 1.56 billion in 2024 to USD 1.66 billion in 2025. It is expected to continue growing at a CAGR of 6.24%, reaching USD 2.25 billion by 2030. Speak directly to the analyst to clarify any post sales queries you may have.

Introduction to the Caprylyl Glycol Ecosystem

Caprylyl glycol has rapidly emerged as a critical ingredient across cosmetic and personal care formulations, prized for its multifunctional properties and compatibility with diverse product matrices. Its dual role as a humectant and preservative potentiator positions it uniquely at the intersection of efficacy and stability, driving interest from manufacturers seeking both performance and safety. Amid growing consumer demand for clean-label formulations, caprylyl glycol’s naturally derived profile further enhances its appeal, aligning with evolving preferences for transparency and ingredient traceability.As global supply chains adapt to post-pandemic realities, raw material sourcing and formulation resilience have become paramount. Caprylyl glycol suppliers are responding with innovations in synthesis pathways, including bio-based feedstocks that reduce carbon intensity while maintaining consistent quality. These developments are catalyzing broader adoption across haircare and skincare segments, where brands aim to differentiate through enhanced product experiences. Against this backdrop, market stakeholders require a comprehensive understanding of the drivers, constraints, and emerging opportunities shaping caprylyl glycol’s trajectory.

This executive summary offers a clear, concise entry point into a dynamic marketplace, distilling the most critical trends and actionable insights. Whether you are a formulation scientist refining a new serum, a procurement leader optimizing supply relationships, or an executive charting strategic investments, the following analysis equips you with the context and clarity needed to navigate the evolving landscape of caprylyl glycol.

Transformative Shifts Reshaping Industry Dynamics

The caprylyl glycol landscape has undergone transformative shifts in recent years, fuelled by heightened regulatory scrutiny, consumer expectations around product safety, and a relentless pursuit of innovation. Regulatory bodies in key markets have tightened guidelines on preservative systems, prompting formulators to seek multifunctional ingredients that can deliver broad-spectrum efficacy without compromising on gentler profiles. This regulatory impetus has accelerated investment into caprylyl glycol research and development, leading to refined grades with enhanced biocompatibility and sensory profiles.Simultaneously, sustainability has become a non-negotiable pillar for ingredient suppliers and brands alike. Advances in green chemistry and enzymatic synthesis are reducing the environmental footprint of caprylyl glycol production, enabling the transition toward renewable feedstocks. Circular economy principles are also influencing packaging and waste management strategies, with manufacturers exploring closed-loop systems to minimize resource consumption and bolster corporate responsibility credentials.

On the market side, partnerships between raw material providers and contract manufacturers are becoming increasingly strategic. Co-development agreements enable faster scale-up and streamline regulatory submissions, ensuring that new formulations can reach consumers without undue delay. Coupled with digitalization efforts across supply chains-from blockchain-based traceability solutions to AI-driven demand forecasting-the industry is embracing technology to enhance transparency and operational agility.

These transformative shifts collectively underscore a new era where compliance, sustainability, and innovation converge. Stakeholders who proactively integrate these dimensions into their strategic planning will unlock competitive advantages and future-proof their caprylyl glycol initiatives.

Cumulative Effects of 2025 United States Tariffs

By 2025, United States tariffs on key fatty alcohols and glycol derivatives have exerted a significant cumulative impact on the caprylyl glycol supply chain, prompting stakeholders to reassess sourcing strategies and cost structures. Import duties implemented in the late 2022-2023 window have gradually elevated raw material prices, particularly for intermediates derived from C8-C10 fatty alcohols. These increased input costs have reverberated throughout the value chain, influencing formulation budgets and final product pricing.Procurement teams have responded by diversifying supply partnerships, seeking alternative suppliers in duty-exempt zones and exploring domestic production expansions. Investment into local manufacturing facilities has accelerated, supported by government incentives aimed at bolstering chemical self-sufficiency and reducing reliance on single-source imports. This has led to incremental capacity additions across the Gulf Coast and Midwest regions, where access to feedstocks and logistical infrastructure is most favorable.

Concurrently, brands have initiated cost-transparency dialogues with downstream customers, articulating the necessity of modest price adjustments to sustain raw material quality and supply consistency. Those who have taken a proactive communication approach report higher retention of key accounts and reduced churn during negotiation cycles. Moreover, in response to tariff pressures, research teams are evaluating novel synthesis routes that bypass high-duty intermediates, including biocatalytic processes that leverage microbial fermentation to produce caprylyl glycol precursors domestically.

Overall, the cumulative impact of U.S. tariffs by 2025 has galvanized a strategic pivot towards regional self-reliance, innovation in production technologies, and deeper collaboration across the supply chain to mitigate cost volatility and secure sustained growth.

Key Segmentation Insights Driving Market Focus

Insight into the market’s segmentation by product type reveals distinct trajectories for natural caprylyl glycol and its synthetic counterpart. The natural variant benefits from an authenticity narrative and often commands a premium among clean-label brands, whereas synthetic caprylyl glycol offers cost efficiencies and consistent availability at scale. Formulators must balance these considerations based on brand positioning and target consumer perceptions.When analyzing the application segmentation, the haircare domain demonstrates robust uptake, driven by conditioners and shampoos that leverage caprylyl glycol’s conditioning and antimicrobial attributes. In contrast, the skincare domain captures growth through cleansers, foundations, and moisturizers that incorporate this ingredient to enhance skin hydration and product stability. Each sub-segment demands tailored functionalities: lightweight sensory profiles for foundations, gentle yet effective performance for cleansers, and long-lasting moisturization for creams, guiding R&D priorities accordingly.

Distribution channel dynamics also shape market strategies. Offline channels continue to capitalize on in-store sampling and personalized consultations, underpinned by rich educational content around ingredient benefits. Meanwhile, online platforms are accelerating through digital marketing, direct-to-consumer models, and e-commerce partnerships. Manufacturers and brands leverage these distinct pathways to synchronize promotional campaigns with consumer buying behaviors and optimize channel-specific margins.

Together, these segmentation insights illuminate where investment and innovation can deliver the greatest returns. By aligning product development, marketing, and distribution decisions with the unique demands of each segment, industry players can craft differentiated value propositions that resonate with end users and support sustainable revenue growth.

Diverse Regional Dynamics Shaping Global Trends

Regional analysis highlights the Americas as a market characterized by mature demand and sophisticated regulatory frameworks that prioritize product safety and transparency. Consumers in this region exhibit a strong preference for clean-label and multifunctional ingredients, prompting brands to prioritize natural sourcing claims and scientifically validated efficacy.In Europe, Middle East & Africa, diverse regulatory environments and varying levels of economic development create both opportunities and challenges. The European Union’s stringent cosmetic regulations foster high standards for ingredient purity and labeling, incentivizing investment into advanced testing and certification. Meanwhile, emerging markets in the Middle East and Africa offer growth potential driven by rising disposable incomes and increasing beauty and personal care consumption, requiring tailored approaches that address local preferences and distribution nuances.

Asia-Pacific stands out for its rapid growth rates and dynamic innovation hub, where consumer trends shift swiftly and digital adoption is particularly high. Brands in this region are early adopters of hybrid formulations that combine traditional botanicals with advanced chemistry, positioning caprylyl glycol as a versatile player in multifunctional skincare and haircare products. Partnerships between local players and global suppliers have accelerated product launches and localized manufacturing, ensuring responsiveness to evolving market demands.

Each region’s unique regulatory landscape, consumer expectations, and competitive dynamics underscore the importance of region-specific strategies. By calibrating product development, marketing, and operational investments to these insights, organizations can effectively capture regional growth pockets and build resilient market positions.

Competitive Landscape and Company Strategies

Leading suppliers and key ingredient innovators are at the forefront of the caprylyl glycol market, driving both incremental improvements and breakthrough innovations. Major chemical companies have expanded their portfolios to include high-purity grades optimized for sensitive formulations, while specialty players focus on niche applications that demand ultraclean processing and custom functionality.Collaborations between ingredient suppliers and contract manufacturers have proliferated, enabling co-development of caprylyl glycol blends that integrate complementary additives such as antimicrobial peptides or botanical extracts. This collaborative model accelerates product development timelines and reduces regulatory hurdles by leveraging shared expertise and established testing frameworks. Moreover, forward-thinking companies are investing in digital platforms to offer formulation support, regulatory advisory services, and supply chain transparency tools, enhancing customer experience and supporting loyalty.

Strategic mergers and acquisitions have also reshaped the competitive landscape, with tier-one players acquiring boutique chemical firms to incorporate unique technological capabilities and expand geographic reach. These moves not only strengthen product portfolios but also reinforce distribution networks, enabling faster market access in high-growth territories.

As the market continues to evolve, companies that maintain agile R&D pipelines, cultivate deep collaboration across the value chain, and align investments with emerging consumer and regulatory trends will secure leadership positions. Understanding each competitor’s strategic playbook is essential for anticipating shifts and identifying partnership or acquisition opportunities.

Actionable Strategies for Industry Leadership

Industry leaders should prioritize integrated innovation strategies that encompass both formulation excellence and supply chain resilience. By forging deeper partnerships with raw material suppliers, especially those investing in bio-based and circular production processes, organizations can secure priority access to next-generation caprylyl glycol grades.Parallel efforts should focus on expanding domestic manufacturing capabilities in regions impacted by import tariffs and logistical constraints. Strategic investments in local production facilities, coupled with government incentive programs, can mitigate cost volatility and enhance responsiveness to regional demand fluctuations. Moreover, cross-functional teams composed of R&D, regulatory, and procurement experts can expedite the evaluation and adoption of alternative synthesis pathways that circumvent high-duty intermediates.

On the market-facing front, brands should refine positioning by highlighting caprylyl glycol’s multifunctional benefits-such as moisture retention, mild preservative support, and improved sensory properties-in consumer communications. Tailoring narratives to regional preferences and distribution channels will maximize engagement and drive trial. Digital platforms present opportunities to educate end users through interactive content, virtual consultations, and personalized recommendation engines.

Finally, continuous monitoring of regulatory developments and competitor activities is vital. Establishing an internal market intelligence function or leveraging external research partnerships will ensure decision-makers receive timely insights to pivot strategies effectively. These combined actions will reinforce competitive differentiation and foster sustainable growth.

Comprehensive Research Methodology Overview

This research combines a multi-pronged approach to deliver comprehensive insights on caprylyl glycol. Primary interviews were conducted with formulation scientists, procurement specialists, and regulatory experts across key regions to validate market dynamics and identify emerging trends. Quantitative surveys of brand and supplier executives supplemented these qualitative findings, ensuring robust triangulation of data.Secondary research encompassed analysis of regulatory filings, patent databases, and scientific literature to map the evolution of synthesis technologies and regulatory frameworks. Trade association reports, customs data, and company financial disclosures provided a granular view of supply chain shifts, tariff impacts, and corporate strategies.

Segmentation analysis leveraged proprietary frameworks to dissect the market by product type, application, and distribution channel, enabling focused insights on growth drivers and constraints. Regional assessments combined macroeconomic indicators with industry-specific metrics to articulate differentiated opportunities and risks across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Competitive benchmarking involved profiling leading suppliers on innovation pipelines, capacity expansions, and partnership models. Additionally, scenario planning tools were employed to explore the potential implications of regulatory changes and tariff evolutions, supporting actionable recommendations. Rigorous data validation and peer review processes underpinned the research to ensure accuracy and relevance.

Concluding Perspectives on Future Directions

Caprylyl glycol’s journey from a niche functional ingredient to a mainstream formulation staple underscores the power of aligning innovation with market needs and regulatory imperatives. The evolving regulatory landscape, combined with shifting consumer preferences for clean-label and sustainable ingredients, has elevated caprylyl glycol’s strategic importance across cosmetic and personal care applications.Segmentation insights reveal that success hinges on tailored approaches: choosing the optimal product type, addressing distinct haircare and skincare requirements, and optimizing distribution channel strategies. Regional dynamics further emphasize the need for localized strategies to navigate complex regulatory regimes and capture high-growth markets.

The cumulative impact of U.S. tariffs has catalyzed a shift toward regional manufacturing and alternative synthesis pathways, reinforcing the importance of supply chain agility. Concurrently, competitive pressures and evolving business models necessitate continuous innovation, collaboration, and market intelligence to stay ahead.

By synthesizing these findings, stakeholders can identify high-impact opportunities, refine their strategic roadmaps, and allocate resources more effectively. The path forward will demand a balanced focus on formulation excellence, operational resilience, and consumer-centric marketing to drive sustainable growth in the caprylyl glycol arena.

Market Segmentation & Coverage

This research report categorizes to forecast the revenues and analyze trends in each of the following sub-segmentations:- Product Type

- Natural Caprylyl Glycol

- Synthetic Caprylyl Glycol

- Application

- Haircare

- Conditioners

- Shampoos

- Skincare

- Cleansers

- Foundations

- Moisturizers

- Haircare

- Distribution Channel

- Offline

- Online

- Americas

- United States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Canada

- Mexico

- Brazil

- Argentina

- United States

- Europe, Middle East & Africa

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- United Arab Emirates

- Saudi Arabia

- South Africa

- Denmark

- Netherlands

- Qatar

- Finland

- Sweden

- Nigeria

- Egypt

- Turkey

- Israel

- Norway

- Poland

- Switzerland

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Philippines

- Malaysia

- Singapore

- Vietnam

- Taiwan

- Ashland Inc.

- ATAMAN Kimya Ltd.

- BizinBiz Technologies Pvt Ltd

- Chemcopia Ingredient Private Limited

- Guangzhou Probig Fine Chemical Co., Ltd

- Haihang Group

- Inolex Inc.

- Jene Chemicals

- Krishana Enterprises

- Kumar Organic Products Limited

- Proto Chemicals Industries

- Saiper Chemicals Pvt Ltd.

- Shenyang East Chemical Science-Tech Co., Ltd.

- Shiv Shakti Trading Corporation

- The Dow Chemical Company

- The Symrise Group

- Thor Personal Care

- Xiamen Huaqiangda Biotechnology Co., Ltd.

- ZLEY GROUP

Table of Contents

1. Preface

2. Research Methodology

4. Market Overview

6. Market Insights

8. Caprylyl Glycol Market, by Product Type

9. Caprylyl Glycol Market, by Application

10. Caprylyl Glycol Market, by Distribution Channel

11. Americas Caprylyl Glycol Market

12. Europe, Middle East & Africa Caprylyl Glycol Market

13. Asia-Pacific Caprylyl Glycol Market

14. Competitive Landscape

16. ResearchStatistics

17. ResearchContacts

18. ResearchArticles

19. Appendix

List of Figures

List of Tables

Companies Mentioned

The companies profiled in this Caprylyl Glycol market report include:- Ashland Inc.

- ATAMAN Kimya Ltd.

- BizinBiz Technologies Pvt Ltd

- Chemcopia Ingredient Private Limited

- Guangzhou Probig Fine Chemical Co., Ltd

- Haihang Group

- Inolex Inc.

- Jene Chemicals

- Krishana Enterprises

- Kumar Organic Products Limited

- Proto Chemicals Industries

- Saiper Chemicals Pvt Ltd.

- Shenyang East Chemical Science-Tech Co., Ltd.

- Shiv Shakti Trading Corporation

- The Dow Chemical Company

- The Symrise Group

- Thor Personal Care

- Xiamen Huaqiangda Biotechnology Co., Ltd.

- ZLEY GROUP

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | May 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.66 Billion |

| Forecasted Market Value ( USD | $ 2.25 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |