Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Convergence of Biological Engineering and Technological Innovation That Fuels Breakthrough Advancements Across Synthetic Biology Platforms Globally

Over the past decade synthetic biology platforms have emerged at the forefront of technological innovation by integrating principles of engineering design with molecular biology to accelerate the development of novel biological systemsThis paradigm shift has enabled cross-disciplinary teams to reimagine biological processes as programmable modules

Transitioning from traditional trial and error methodologies toward systematic design build test cycles, practitioners now leverage advanced automation, high-throughput instrumentation, and computational modeling to streamline complex workflows

As a result innovative applications spanning therapeutic development, sustainable agriculture, and industrial biotechnology have progressed from conceptual frameworks to practical implementations

Furthermore the maturation of digital biology ecosystems has reduced both the time and cost required to iterate genetic constructs while improving reproducibility and scalability

By harnessing automated platforms for DNA synthesis, sequencing and mRNA assembly researchers can rapidly validate hypotheses at unprecedented speed, fueling a virtuous cycle of data-driven discovery

Historically these platforms evolved from early genetic engineering techniques and have matured into modular toolkits that democratize access to synthetic constructs and genomic editing at scale

Collaboration across academia, industry and government research facilities has fostered open innovation networks that accelerate knowledge sharing and de-risk complex projects by pooling resources and expertise

Looking ahead this executive summary synthesizes critical market dynamics, key growth enablers, and emerging challenges that industry stakeholders must navigate

Each subsequent section delves into transformative technology shifts, the impact of recent policy measures, nuanced segmentation and regional trends along with competitive intelligence and strategic recommendations

Collectively these insights provide a comprehensive roadmap for decision-makers to align R&D priorities and commercial strategies with evolving market demands

Identifying Key Technological Breakthroughs and Industry Dynamics That Are Redefining the Synthetic Biology Platforms Landscape with Unprecedented Momentum

In recent years the synthetic biology landscape has undergone a profound transformation as emerging tools and platforms converge to redefine experimental workflows and accelerate discovery pipelinesArtificial intelligence driven algorithms have become integral to design stage optimization, leveraging predictive modeling to refine genetic circuit architectures before physical synthesis

At the bench rapid innovations in CRISPR base editing and prime editing techniques have expanded the boundaries of precise genome manipulation, enabling targeted interventions with minimal off-target effects

Simultaneously cell free expression systems and microfluidic lab on a chip devices have democratized access to complex assays by reducing reliance on traditional cell culture facilities

The proliferation of cloud connected biofoundries and virtual lab environments has further catalyzed collaboration by facilitating remote experiment orchestration and real time data analysis across distributed teams

Moreover the integration of multiomics datasets including transcriptomics, proteomics and metabolomics provides a holistic view of system level responses, informing iterative design cycles with unprecedented depth

In parallel funding models have evolved to emphasize milestone based partnerships between startups, established biopharma and academic centers, creating agile ecosystems that accelerate the translation of innovations into commercial applications

Decentralized manufacturing networks empowered by portable bioreactors and continuous flow processes are poised to transform supply chain resilience, enabling localized production of biologics and custom biomaterials on demand

This dynamic landscape requires strategic alignment of R&D investments with emerging technology priorities, as stakeholders seek to capitalize on the convergence of digital and biological innovations to maintain competitive advantage

Examining How Recent Tariff Measures Enacted by the United States in 2025 Are Reshaping Supply Chains and Cost Structures in Synthetic Biology Platforms

In mid 2025 the United States government implemented a revised tariff schedule targeting imported biological reagents, instrumentation and specialized consumables used in synthetic biology research and developmentThese measures have introduced additional cost burdens across critical inputs such as oligonucleotides, sequencing flow cells and microfluidic cartridge components, prompting immediate reassessment of procurement strategies

Consequently many organizations have accelerated initiatives to diversify supplier networks by engaging domestic manufacturers and exploring alternative sourcing hubs in markets with favorable trade agreements

This shift has also intensified partnerships between platform providers and end users aimed at co developing localized production capabilities to mitigate freight congestion and regulatory complexity

At the same time R&D budgets have been recalibrated to absorb higher overheads, leading some research teams to optimize experimental designs through advanced computational screening and pooled resource models to preserve project viability

Meanwhile platform vendors are adapting by negotiating tiered pricing structures and establishing consortia that facilitate group purchasing agreements, thereby diffusing cost increases across multiple stakeholders

The cumulative effect of these tariff actions is a renewed emphasis on supply chain resilience, as companies integrate inventory management dashboards and predictive analytics to anticipate material shortages and minimize operational disruptions

Furthermore the evolving trade environment underscores the importance of policy monitoring and proactive scenario planning, ensuring that shifts in import regulations do not stall critical innovation pipelines

As these adjustments take hold the industry is witnessing a gradual rebalancing of global value chains, with increased interest in technology transfer agreements and intellectual property licensing to streamline cross border collaboration

Ultimately these developments demonstrate that while tariff changes pose near term challenges, they also catalyze structural improvements that can fortify the synthetic biology ecosystem against future geopolitical uncertainties

Revealing Critical Segmentation Patterns Based on Offering Application and End User to Illuminate Growth Drivers in Synthetic Biology Platforms

Detailed analysis of platform capabilities reveals that DNA sequencing has evolved into a robust cornerstone of synthetic biology, providing high fidelity readouts that inform downstream design iterationsMeanwhile DNA synthesis services are experiencing steady expansion as parallelized assembly techniques and enzymatic synthesis methods lower barriers to entry for custom gene construction

Moreover mRNA synthesis platforms have recently surged in prominence, driven by the accelerated demand for rapid vaccine development and RNA based therapeutics, establishing a new standard for in vitro transcription efficiency

When considering specific use cases the synergy between antibody discovery and next generation sequencing underscores a growing need for integrative platforms that couple library screening with high throughput readouts to accelerate lead identification

In contrast cell and gene therapy applications require multifaceted workflows that integrate vector design, cell line engineering and scalable production processes, placing a premium on modular systems capable of bridging bench scale and clinical manufacture

The vaccine development segment continues to exert significant influence on platform roadmaps, with emphasis on flexible production frameworks that accommodate mRNA lipid nanoparticle formulations alongside traditional attenuated or subunit approaches

On the end user side agricultural companies are leveraging synthetic biology tools to engineer crop traits that enhance yield resilience and reduce chemical inputs, reflecting an increased focus on sustainable practices

Within the food and beverage sector innovators are exploiting fermentation platforms to produce alternative proteins and flavor compounds, meeting growing consumer demand for cleaner label and plant based products

Pharmaceutical and life science research organizations remain the largest adopters of end to end platform solutions, driven by the imperative to accelerate drug discovery pipelines through integrated digital and automated infrastructure

Exploring Distinct Regional Growth Trajectories across the Americas Europe Middle East Africa and Asia Pacific Synthetic Biology Ecosystems

The Americas region leads in commercialization of synthetic biology platforms, supported by robust R&D infrastructure, significant venture capital investments and a concentration of established biotechnology clusters in North AmericaResearch hubs on the west and east coasts have fostered dense innovation ecosystems where academic institutions, startup accelerators and large corporations collaborate to translate emerging technologies into viable products

Regulatory frameworks in the region have progressively adapted to accommodate advanced biological engineering applications, creating clear pathways for clinical trials, environmental releases and agricultural field testing

Shifting focus to Europe, the Middle East and Africa, stakeholders benefit from a diverse tapestry of policy initiatives and funding programs aimed at bolstering competitiveness in bioeconomy domains, particularly in northern Europe and the United Kingdom

Collaborative consortia spanning multiple countries have enabled knowledge transfer and shared infrastructure, while nascent markets in the Middle East and Africa are beginning to invest in capacity building for biomanufacturing and synthetic biology education

In the Asia Pacific corridor rapid industrialization alongside supportive government strategies has accelerated the adoption of automated platform technologies in East and Southeast Asia, fueling growth in contract research services and biopharmaceutical manufacturing

Regional centers in China, Japan and Australia are driving breakthroughs in gene editing, protein engineering and cell culture systems, positioning the subcontinent as a critical node in global supply chains

Cross border partnerships between technology providers and regional governments are emerging to optimize localization strategies and ensure that platform deployments align with local regulatory and economic priorities

Highlighting Leading Industry Participants and Strategic Initiatives That Are Shaping Competitive Dynamics in the Synthetic Biology Platforms Market

Leading platform providers such as Illumina, Thermo Fisher Scientific and Pacific Biosciences continue to reinforce their market positions by advancing sequencing capabilities, enhancing read accuracy and expanding throughput optionsAt the intersection of synthesis and automation, companies like Twist Bioscience and Synthace have differentiated through proprietary silicon based synthesis processes and cloud enabled design environments that accelerate iterative workflows

The rapid ascendance of mRNA technology has elevated players such as BioNTech and Moderna to the forefront, prompting adjacent technology vendors to optimize in vitro transcription modules and lipid nanoparticle encapsulation systems

Ginkgo Bioworks and Zymergen exemplify biofoundry models that integrate high throughput experimentation with machine learning to expedite strain engineering for diverse industrial applications

Meanwhile next generation entrants such as Synthego are carving out niches in CRISPR based editing platforms, enabling precise multiplexed genome modifications and streamlined cell line development services

Strategic collaborations have emerged as a pivotal growth strategy, evidenced by partnerships between established chemical suppliers and platform innovators to co develop reagent libraries and specialized consumables

Geographic diversification is also influencing corporate trajectories, with major players establishing regional centers of excellence and customized service offerings to meet localized research demands

As competition intensifies, companies are investing heavily in end to end platform integration, forging alliances across automation instrumentation, bioinformatics and synthetic biology to deliver comprehensive solutions

Delivering Strategic Guidance and Actionable Roadmaps to Empower Industry Leaders Navigating the Evolving Synthetic Biology Platforms Landscape

Industry leaders should prioritize investment in integrated digital ecosystems that unify design, execution and data analysis to maximize throughput and minimize error ratesEstablishing strategic partnerships across academia, contract research organizations and equipment suppliers can accelerate technology validation while distributing development risks

Organizations are advised to explore modular supply chain architectures that incorporate domestic and regional manufacturing nodes, reducing exposure to trade policy volatility and logistical bottlenecks

Embracing open innovation frameworks such as pre competitive consortia can streamline standards development and foster interoperability across diverse platform technologies

Allocating resources toward workforce training in computational biology and automation engineering will ensure that teams possess the interdisciplinary skill sets required to operate sophisticated platform environments

Companies should integrate predictive analytics and real time monitoring tools within their production pipelines to proactively identify performance deviations and optimize operational efficiency

Finally leadership teams must incorporate scenario planning exercises to anticipate regulatory shifts and emerging geopolitical trends, positioning organizations to adapt swiftly to new market realities

Outlining a Rigorous Research Framework Integrating Qualitative and Quantitative Methods to Ensure Robust Insights into Synthetic Biology Platforms

This report synthesizes insights through a structured research approach that combines comprehensive secondary analysis with targeted primary engagementsSecondary research encompassed a thorough review of peer reviewed publications, government policy documents, patent databases and technology white papers to establish a foundational understanding of platform innovations and market drivers

Primary research involved in depth interviews with key opinion leaders spanning academic research centers, biotechnology firms, instrument manufacturers and end user organizations to validate emerging trends and operational challenges

Quantitative data was triangulated using multiple independent sources to ensure robustness, while qualitative inputs provided contextual nuance that enriched strategic interpretation

Data collection and analysis were supported by proprietary databases tracking technology deployments, partnership networks and regional activity clusters, enabling granular examination of growth patterns

Rigorous quality checks were conducted at each stage, including cross validation of interview findings against documented case studies and verification of secondary sources through expert advisory panels

This methodological framework ensures that the resultant insights reflect both the depth of empirical evidence and the breadth of stakeholder perspectives necessary for informed decision making

Synthesizing Core Insights to Emphasize How Synthetic Biology Platforms Are Poised to Transform Industries and Drive Future Innovation

Synthetic biology platforms have transcended early proof of concept stages to become indispensable engines of innovation across therapeutic, industrial and agricultural domainsThe confluence of advanced automation, computational analytics and modular biological engineering has ushered in a new era where rapid prototyping and scalability coexist

While policy shifts such as revised tariff schedules introduce near term cost pressures, they simultaneously incentivize supply chain diversification and domestic capacity building that can fortify long term resilience

Nuanced segmentation insights reveal that offerings ranging from sequencing to mRNA synthesis cater to distinct application landscapes, underscoring the need for tailored platform strategies

Regional dynamics highlight divergent growth trajectories that reflect varied maturity levels, regulatory environments and investment climates, necessitating localization of commercial approaches

Strategic positioning within this ecosystem hinges on forging collaborative networks, embracing data driven decision frameworks and maintaining agility in the face of evolving technological and policy landscapes

In sum, stakeholders equipped with robust strategic roadmaps and adaptive operational models will be best positioned to harness the full potential of synthetic biology platforms

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Offering

- DNA Sequencing

- DNA Synthesis

- mRNA Synthesis

- Application

- Antibody Discovery & NGS

- Cell & Gene Therapy

- Vaccine Development

- End User

- Agriculture Industry

- Food & Beverage Industry

- Pharmaceutical & Life Science Industry

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Agilent Technologies, Inc.

- American Institute of Chemical Engineers

- Amyris, Inc.

- Antheia, Inc.

- Arbor Biosciences

- Codexis, Inc.

- CSIRO

- DNA Script

- ElevateBio, LLC

- Engineering Biology Research Center

- Genetic Engineering & Biotechnology

- Genomatica, Inc.

- Genome Canada

- Ginkgo Bioworks, Inc.

- Gniubiotics

- Harvard Medical School

- Illumina Inc

- Integrated DNA Technologies, Inc.

- LanzaTech

- Mammoth Biosciences, Inc.

- New England Biolabs

- Sojitz Corporation

- Synbio Technologies

- Twist Bioscience Corporation

- Zymergen Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Synthetic Biology Platforms market report include:- Agilent Technologies, Inc.

- American Institute of Chemical Engineers

- Amyris, Inc.

- Antheia, Inc.

- Arbor Biosciences

- Codexis, Inc.

- CSIRO

- DNA Script

- ElevateBio, LLC

- Engineering Biology Research Center

- Genetic Engineering & Biotechnology

- Genomatica, Inc.

- Genome Canada

- Ginkgo Bioworks, Inc.

- Gniubiotics

- Harvard Medical School

- Illumina Inc

- Integrated DNA Technologies, Inc.

- LanzaTech

- Mammoth Biosciences, Inc.

- New England Biolabs

- Sojitz Corporation

- Synbio Technologies

- Twist Bioscience Corporation

- Zymergen Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | November 2025 |

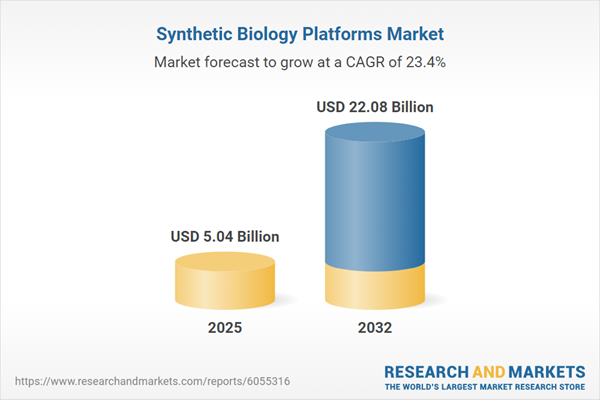

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5.04 Billion |

| Forecasted Market Value ( USD | $ 22.08 Billion |

| Compound Annual Growth Rate | 23.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |