Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Foundational Importance of Chenodeoxycholic Acid API in Pharmaceutical Synthesis and Cosmetic Formulations for Innovative Health Solutions

Chenodeoxycholic Acid API stands at the forefront of innovative therapeutic and cosmetic solutions, offering a versatile biochemical foundation for a range of applications. As a primary bile acid derivative, it plays a critical role in targeted drug formulations, aiding in the stabilization and bioavailability of active pharmaceutical ingredients. Simultaneously, its unique emulsifying properties have positioned it as a valuable component in advanced skincare and personal care products. Together, these dual realms of utilization reflect the molecule's inherent strengths and its capacity to address evolving industry demands.Against this backdrop, rising investment in novel metabolic therapies and a growing emphasis on natural and high-purity ingredients have propelled interest in both natural and synthetic variations of Chenodeoxycholic Acid. Industry stakeholders are increasingly focused on leveraging its biochemical profile to develop differentiated offerings, enhancing therapeutic efficacy while meeting stringent safety and regulatory standards. Transitioning from foundational research to large-scale commercial use, the compound is emerging as a pivotal asset in the next generation of pharmaceutical and cosmetic pipelines.

In the sections that follow, we explore the transformative shifts reshaping synthesis technologies, assess the ramifications of newly imposed trade policies, and present deep segmentation and regional analysis to guide strategic decision-making.

Identifying the Key Technological Advancements and Regulatory Changes Driving Transformation in the Chenodeoxycholic Acid API Sector

Recent years have ushered in a wave of technological breakthroughs that are redefining how Chenodeoxycholic Acid API is synthesized and integrated into product development. Advances in continuous-flow chemistry have enabled more efficient and scalable manufacturing processes, reducing impurity profiles and accelerating time to market. At the same time, green chemistry principles are guiding the adoption of environmentally sustainable synthesis routes, minimizing hazardous byproducts and improving overall process safety.Concurrently, regulatory bodies worldwide have intensified scrutiny of API purity and manufacturing controls, driving harmonization of global standards. This shift has prompted companies to enhance quality management systems and adopt novel analytical techniques-such as ultra-high-performance liquid chromatography-to ensure compliance. Moreover, this regulatory convergence is fostering cross-border collaborations among contract manufacturing organizations and research institutions, accelerating the exchange of best practices.

As digital tools and artificial intelligence become embedded in process optimization and supply chain management, stakeholders are gaining unprecedented visibility into production parameters and logistical networks. These transformative forces collectively signal a new era of innovation and operational excellence in the Chenodeoxycholic Acid API sector, setting the stage for evolving market dynamics.

Assessing the Comprehensive Impact of Newly Enforced United States Tariffs and Trade Policies on Chenodeoxycholic Acid API Dynamics in 2025

The introduction of enhanced tariff measures in 2025 has had a pronounced effect on Chenodeoxycholic Acid API supply chains, particularly for imports into the United States. Increased duties have elevated landed costs for foreign-sourced material, prompting manufacturers to reevaluate supplier relationships and explore domestic production alternatives. As a result, some players have initiated capacity expansions in North America to insulate themselves from volatile trade conditions.These adjustments have generated both challenges and opportunities: while elevated input costs have squeezed margins for companies reliant on established import streams, they have also catalyzed investments in localized manufacturing infrastructure and dual-sourcing strategies. This diversification of supply bases supports greater resilience in the face of policy shifts, even as it introduces new complexities in regulatory compliance and operational coordination.

Looking ahead, the cumulative impact of these trade policies is expected to influence contractual negotiations, pricing structures, and long-term capital allocation. Navigating this evolving landscape will require agility and strategic foresight, as organizations balance cost containment with the imperative to maintain consistent product quality and availability.

Revealing Critical Product Type, Grade, Sales Channel, and End User Segmentation Insights to Inform Strategic Decisions in the API Market

Market segmentation by product type reveals a clear delineation: natural Chenodeoxycholic Acid sourced through extraction processes offers a high degree of structural fidelity for specialized applications, while synthetic variants provide scalability and uniform purity profiles that appeal to large-volume pharmaceutical requirements. This duality in product offerings necessitates tailored sourcing strategies that align with cost targets and regulatory expectations.In parallel, the distinction between chemical grade and pharmaceutical grade underscores varying compliance thresholds. Chemical grade material, often deployed in cosmetic or research settings, emphasizes cost-effectiveness, whereas pharmaceutical grade pervades drug development pipelines, demanding rigorous adherence to pharmacopoeial standards and comprehensive quality documentation.

Sales channel segmentation introduces further nuance: traditional offline distribution channels continue to serve core manufacturing hubs, offering established relationships and logistical support, while online procurement platforms are gaining traction among agile research entities and smaller cosmetics manufacturers seeking rapid, on-demand access.

End-user segmentation spans contract manufacturing organizations, cosmetics and personal care companies, pharmaceutical companies, and research institutions and universities. Each cohort navigates unique value drivers-from volume flexibility and formulation expertise to regulatory dossiers and exploratory research partnerships-underscoring the importance of a multifaceted approach to market engagement.

Examining Regional Variations and Growth Drivers across Americas, Europe Middle East Africa, and Asia Pacific for Chenodeoxycholic Acid API Applications

The Americas region benefits from a robust biopharmaceutical infrastructure, supported by advanced process engineering capabilities and government incentives that bolster domestic API production. Within this ecosystem, companies are increasingly investing in state-of-the-art facilities to mitigate exposure to international trade fluctuations and to streamline supply chains for critical intermediates.Europe, Middle East, and Africa present a diverse regulatory environment characterized by the European Union's unified pharmacopoeial standards alongside unique registration pathways in the Gulf Cooperation Council and emerging markets across Africa. This blend of harmonized and localized regulatory frameworks offers strategic levers for market entry, especially when coupled with targeted collaborations between regional distributors and local research bodies.

Asia-Pacific remains the dominant manufacturing hub, where China and India lead in cost-efficient production and capacity. Government subsidies for environmental upgrades and quality certifications are enhancing regional competitiveness, while innovation centers in Japan and South Korea emphasize precision synthesis and stringent quality assurance. Cross-border partnerships and technology transfer initiatives continue to reshape supply networks, fostering resilience and driving incremental advancements in production methodologies.

Collectively, these regional dynamics inform a global matrix of opportunity, risk, and competitive advantage within the Chenodeoxycholic Acid API landscape.

Highlighting Leading Industry Players and Their Strategic Initiatives Shaping the Future of Chenodeoxycholic Acid API Supply Chains

Leading industry participants are deploying a range of strategies to consolidate their positions within the Chenodeoxycholic Acid API market. Major API producers have prioritized capacity expansions and backward integration, securing raw material sources to strengthen cost control and quality assurance. Concurrently, strategic alliances with specialty chemical firms and biopharma innovators are facilitating knowledge transfer and joint development programs focused on high-purity applications.Several top players have also embarked on targeted acquisitions to augment their geographical footprint and technological capabilities. These transactions enable rapid entry into key markets and enhance service offerings, from custom synthesis through to regulatory support. In parallel, investments in advanced analytics and process digitalization are being leveraged to optimize yield, reduce cycle times, and ensure batch consistency.

Moreover, emerging competitors are carving out niches by specializing in ultra-high-purity grades or by offering rapid, small-batch production services tailored to research institutions and boutique cosmetic brands. This proliferation of specialized providers is intensifying competition and fostering a climate of continuous improvement, ultimately benefitting end-users through expanded choice and innovation potential.

Delivering Actionable Strategic Recommendations to Enhance Competitiveness and Operational Efficiency for Chenodeoxycholic Acid API Stakeholders

To thrive in an increasingly complex API environment, industry leaders should prioritize investments in sustainable synthesis routes that reduce environmental footprint and enhance process safety. By adopting continuous-flow manufacturing and green chemistry practices, organizations can achieve cost efficiencies while meeting evolving regulatory mandates.Diversification of supply chains is essential: engaging multiple, geographically dispersed suppliers and establishing dual-sourcing agreements will mitigate the impact of trade policy shifts and logistical disruptions. At the same time, bolstering quality management systems to exceed pharmaceutical grade standards will unlock new opportunities in high-value drug formulations and specialty applications.

Leveraging digital tools-such as AI-driven process modeling and blockchain-enabled traceability-can enhance real-time visibility into production parameters and shipment status. These technologies not only support operational agility but also fortify compliance documentation and customer assurance efforts.

Finally, forging strategic partnerships with contract manufacturing organizations, academic research centers, and regulatory consultants will accelerate innovation pipelines and facilitate smoother market access. By aligning collaborative expertise with clearly defined project goals, stakeholders can navigate complexity and unlock sustainable growth trajectories.

Detailing Rigorous Research Methodology and Data Collection Techniques Underpinning the Credibility of the Chenodeoxycholic Acid API Industry Analysis

The research framework underpinning this analysis integrates both primary and secondary data sources to ensure methodological rigor and credibility. Primary research involved in-depth interviews with senior executives, supply chain managers, and technical experts across the API landscape. These conversations provided first-hand insights into operational challenges, strategic priorities, and innovation roadmaps.Secondary research encompassed comprehensive reviews of peer-reviewed journals, patent filings, regulatory guidelines, and industry white papers. Proprietary databases were utilized to map competitive positioning and track merger and acquisition activity. Rigorous data triangulation was conducted to validate qualitative findings against quantitative indicators, ensuring consistency and depth.

Analytical techniques included SWOT assessments for key market participants, scenario modeling to evaluate the impact of tariff changes, and segmentation analysis across product types, grades, sales channels, and end-user categories. Regional analysis drew upon trade statistics, policy reviews, and case studies to capture the nuanced dynamics of each geographic cluster.

This multifaceted methodology underpins the report's robustness, offering stakeholders an evidence-based foundation for strategic decision-making in the dynamic Chenodeoxycholic Acid API sector.

Concluding Insights Summarizing the Strategic Imperatives and Long Term Prospects of Chenodeoxycholic Acid API in Evolving Global Markets

As the Chenodeoxycholic Acid API landscape continues to evolve, strategic imperatives crystallize around innovation, quality, and supply chain resilience. Technological advancements in green chemistry and digital process optimization are redefining production norms, while escalating regulatory scrutiny underscores the need for uncompromising purity standards.Heightened trade barriers have prompted a recalibration of sourcing strategies, accelerating investments in localized manufacturing and dual-sourcing frameworks. At the same time, segmentation across product types, grades, sales channels, and end-user categories highlights the multifaceted nature of demand, compelling stakeholders to adopt tailored value propositions.

Region-specific drivers-ranging from favorable policy incentives in the Americas to environmental compliance upgrades in Asia-Pacific-further shape competitive dynamics. Leading companies are responding with targeted capacity expansions, strategic partnerships, and digital transformations designed to maintain agility.

Looking forward, sustainable growth will hinge on the ability to integrate scientific innovation with operational excellence. Organizations that effectively navigate regulatory changes, leverage emerging technologies, and forge collaborative ecosystems will be best positioned to capture long-term value in the Chenodeoxycholic Acid API market.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Natural Chenodeoxycholic Acid

- Synthetic Chenodeoxycholic Acid

- Grade

- Chemical Grade

- Pharmaceutical Grade

- Sales Channel

- Offline

- Online

- End-User

- Contract Manufacturing Organizations (CMOs)

- Cosmetics & Personal Care Companies

- Pharmaceutical Companies

- Research Institutions & Universities

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ACIC Pharmaceuticals Inc

- Axplora Group GmbH

- Bacto Chem

- BASF SE

- Cayman Chemical Company

- Faran Shimi Pharmaceutical

- Glentham Life Sciences Limited

- Hangzhou Keyingchem Co., Ltd.

- ICE S.p.a.

- Jigs Chemical

- LKT Laboratories, Inc.

- MANUS AKTTEVA BIOPHARMA LLP

- Merck KGaA

- Sanofi SA

- Solvay SA

- Tokyo Chemical Industry Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Chenodeoxycholic Acid API market report include:- ACIC Pharmaceuticals Inc

- Axplora Group GmbH

- Bacto Chem

- BASF SE

- Cayman Chemical Company

- Faran Shimi Pharmaceutical

- Glentham Life Sciences Limited

- Hangzhou Keyingchem Co., Ltd.

- ICE S.p.a.

- Jigs Chemical

- LKT Laboratories, Inc.

- MANUS AKTTEVA BIOPHARMA LLP

- Merck KGaA

- Sanofi SA

- Solvay SA

- Tokyo Chemical Industry Co., Ltd.

Table Information

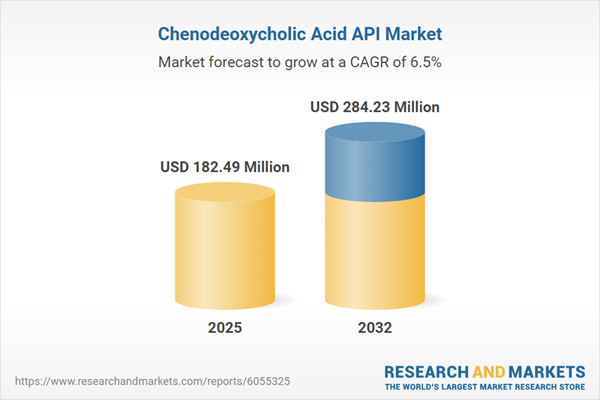

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 182.49 Million |

| Forecasted Market Value ( USD | $ 284.23 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |