Speak directly to the analyst to clarify any post sales queries you may have.

The custom cloud solutions market is rapidly evolving, driven by digital transformation, rising security standards, and the strategic shift toward infrastructure tailored to organizational needs. Senior decision-makers face a dynamic landscape where agility and operational intelligence are increasingly vital for competitive advancement.

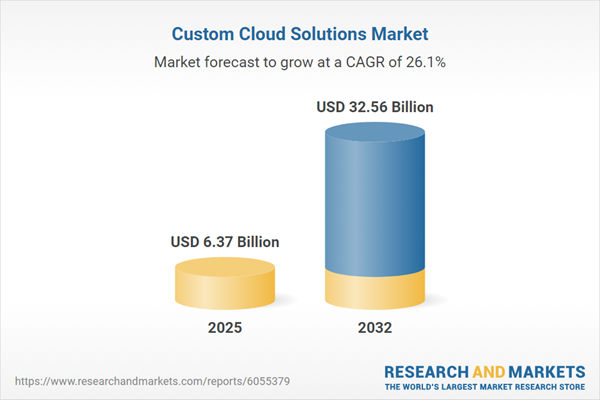

Market Snapshot: Custom Cloud Solutions Market Growth

The custom cloud solutions market grew from USD 5.10 billion in 2024 to USD 6.37 billion in 2025. It is projected to sustain strong momentum with a CAGR of 26.07%, reaching USD 32.56 billion by 2032. Amid rapid enterprise digitalization, organizations are adopting custom cloud solutions to achieve scalability, enhanced security, and IT agility. This growth reflects a sector that is now central to IT modernization for businesses across geographies and verticals.

Scope & Segmentation

- Solution Types: Cloud Automation, Cloud Backup & Disaster Recovery, Cloud Integration, Cloud Monitoring & Management, Cloud Security, Cloud Storage

- Deployment Models: Private Cloud, Public Cloud

- End Users: Banking, Financial Services & Insurance; Education; Energy; Government; Healthcare; IT & Telecom; Manufacturing; Retail

- Enterprise Sizes: Large Enterprises, Small & Medium Enterprises (SMEs)

- Regional Coverage: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru); Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya); Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Companies Analyzed: Accenture PLC; Alibaba Cloud Computing Ltd.; Amazon Web Services, Inc.; Atos SE; Broadcom, Inc.; Capgemini SE; DigitalOcean, Inc.; DXC Technology Company; Fujitsu Limited; Google LLC by Alphabet Inc.; Hewlett Packard Enterprise Company; Infosys Limited; International Business Machines Corporation (IBM); KPMG International Cooperative; Microsoft Corporation; NTT DATA Corporation; Oracle Corporation; Rackspace Technology, Inc.; Salesforce Inc.; SAP SE; Virtusa Corporation; Wipro Limited

Key Takeaways

- The primary keyword, custom cloud solutions, frames the market narrative as businesses move beyond generic models, seeking environments aligned with specific operational goals and regulatory demands.

- Hybrid and multi-cloud architectures fuel widespread adoption, enabling seamless workload allocation and enhancing business agility.

- Technologies such as artificial intelligence, advanced orchestration, and edge computing are fundamentally reshaping IT operations, supporting real-time analytics and lower-latency performance.

- Security and compliance requirements are now central, elevating the adoption of zero-trust frameworks and granular policy enforcement—especially in heavily regulated sectors.

- Enterprise size continues to influence procurement and service models, with large organizations favoring customized agreements and SMEs prioritizing managed, modular offerings.

- Regional adoption patterns reveal that regulatory environments, infrastructure maturity, and workforce capabilities significantly shape cloud deployment strategies.

Tariff Impact

With the introduction of new U.S. tariffs in 2025, supply chains for custom cloud infrastructure and services have become more complex. Organizations are strategically managing procurement and sourcing to reduce exposure to price volatility and geopolitical disruption. Providers are recalibrating pricing and vendor agreements, leading to increased negotiation around service terms and risk allocation. These developments present both challenges and opportunities to optimize long-term cost structures and enhance resilience in global cloud operations.

Methodology & Data Sources

The report relies on a combination of primary interviews with industry executives and technical experts as well as in-depth secondary research from leading reports, filings, and technical white papers. This approach ensures both market trends and implementation challenges are grounded in real-world data and validated through rigorous triangulation and expert review.

Why This Report Matters

- Enables informed decision-making by distilling critical market trends and regional nuances specific to custom cloud solutions adoption.

- Supports strategic planning with insightful analysis on technology integration, security protocols, and procurement optimization.

- Equips leadership teams to benchmark competitive positioning and enhance long-term resilience in the face of regulatory or supply-chain shifts.

Conclusion

Custom cloud solutions are now integral to digital transformation strategies. Market participants who adapt to evolving technology, compliance, and operational standards will secure a strong foundation for sustainable growth and transformation.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Custom Cloud Solutions market report include:- Accenture PLC

- Alibaba Cloud Computing Ltd.

- Amazon Web Services, Inc.

- Atos SE

- Broadcom, Inc.

- Capgemini SE

- DigitalOcean, Inc.

- DXC Technology Company

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation (IBM)

- KPMG International Cooperative

- Microsoft Corporation

- NTT DATA Corporation

- Oracle Corporation

- Rackspace Technology, Inc.

- Salesforce Inc.

- SAP SE

- Virtusa Corporation

- Wipro Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 6.37 Billion |

| Forecasted Market Value ( USD | $ 32.56 Billion |

| Compound Annual Growth Rate | 26.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |