Speak directly to the analyst to clarify any post sales queries you may have.

Exploring Strategic Impact and Advantages of Portable Ground Power Units as Essential Enablers of Operational Continuity in Aviation and Construction Sectors

Organizations around the globe rely on portable ground power units to ensure uninterrupted operations across critical sectors such as aviation, construction, and emergency response. These units serve as vital lifelines when grid power is unavailable or unreliable, delivering reliable electrical supply to support boarding operations, construction equipment, and backup systems during unforeseen outages. Recent years have witnessed a growing emphasis on enhancing on-site flexibility and reducing carbon intensity, further elevating the strategic value of portable ground power units in diverse environments.The increasing complexity of modern infrastructure projects and the imperative for rapid deployment under tight timelines have driven stakeholders to prioritize modular, easy-to-transport power solutions. In aviation, the need for ground support equipment capable of handling deicing, maintenance, and testing has intensified as airlines and ground handling agencies strive to minimize turnaround times. Meanwhile, in construction, high-capacity units are deployed at remote sites where conventional power access is impractical, supporting heavy machinery and lighting to sustain continuous productivity.

Furthermore, the rising frequency of extreme weather events and the corresponding demand for reliable emergency backup have underscored the importance of resilient power assets. Decision-makers increasingly view portable ground power units not merely as auxiliary equipment, but as indispensable components of operational resilience strategies. As stakeholders seek to balance performance, environmental considerations, and lifecycle costs, the portable ground power unit landscape has emerged as a focal point for innovation and investment.

Exploring Transformative Shifts Reshaping the Portable Ground Power Unit Landscape Through Digitalization, Sustainability Trends, and Technological Innovations

The portable ground power unit sector is undergoing significant transformation as digitalization, sustainability mandates, and advanced materials redefine traditional approaches. Connectivity platforms now integrate real-time monitoring, predictive analytics, and remote diagnostics, enabling operators to detect anomalies, optimize maintenance schedules, and reduce unplanned downtime. As a result, service providers can offer value-added support packages, shifting from reactive repair models toward proactive lifecycle management.Concurrently, the industry's commitment to decarbonization has accelerated the adoption of battery-based solutions. Lithium-ion technology, in particular, is gaining traction for its superior energy density and faster recharge cycles relative to legacy lead-acid systems. This shift is complemented by hybrid configurations that blend engine-driven generators with energy storage banks, delivering peak shaving capabilities and noise mitigation in noise-sensitive environments.

In parallel, regulatory frameworks in key markets are tightening emissions thresholds for on-site generators, prompting manufacturers to invest in low-emission engine technologies and explore alternative fuels such as renewable diesel and green hydrogen. These convergent trends are catalyzing R&D initiatives aimed at reducing total ownership costs and enhancing unit portability through lightweight composite enclosures and modular design philosophies. Consequently, stakeholders are positioned to benefit from more versatile, cleaner, and digitally empowered power solutions.

Assessing the Cumulative Impact of the 2025 United States Tariffs on Portable Ground Power Units and Their Supply Chains from Manufacturing to Deployment

The implementation of new United States tariffs slated for 2025 has introduced a layer of complexity across the portable ground power unit value chain. Inbound components sourced from high-tariff regions face incremental cost pressures that ripple through manufacturing budgets and dealer margins. Manufacturers are compelled to reevaluate sourcing strategies, negotiate updated supplier agreements, and reassess production footprints to mitigate duty-related expenses.End users in aviation and construction have felt the downstream effects of these tariffs, with leasing firms and service providers adapting pricing models to reflect elevated acquisition costs. As a consequence, some operators are extending equipment lifecycles through intensified maintenance programs rather than committing to early fleet renewals. Others are exploring secondary markets and refurbishment platforms to secure competitively priced power assets.

In response, industry participants are diversifying supply chains by forging partnerships in lower-tariff jurisdictions and expediting nearshoring initiatives to maintain cost efficiency and delivery reliability. Additionally, cross-border collaboration agreements have emerged, whereby distributors consolidate import volumes to leverage preferential duty treatments. As stakeholders navigate the evolving tariff regime, agility in procurement planning and strategic inventory positioning have become essential practices for preserving operational continuity and margin integrity.

Revealing Key Market Segmentation Insights for Portable Ground Power Units Spanning Product Types, Components, Applications, End Users, and Sales Channels

Deep insights emerge when examining the portable ground power unit market through multiple segmentation lenses. In terms of product type, the industry divides into two primary categories: units powered by conventional engines and those driven by battery systems. The latter cohort encompasses both lead-acid variants, prized for established reliability, and advanced lithium-ion solutions that deliver higher energy density and faster recharge cycles. This bifurcation highlights a clear trajectory toward greater electrification while acknowledging legacy installations that remain integral to current operations.When dissecting component-level dynamics, attention centers on four critical elements that collectively determine performance and serviceability. Control interfaces dictate user experience and adaptability to varying load profiles. The electrical generator module remains the heart of engine-driven designs, while power cables and distribution architectures influence deployment speed and safety protocols. Finally, the underlying power source-whether fossil-fuel or battery-derived-governs emissions profiles and total cost of ownership over a unit's lifecycle.

Application segmentation further clarifies market demand patterns. Dedicated units facilitate aircraft ground support tasks, including boarding operations, deicing support, routine maintenance, and system testing. Complementary deployments occur at construction sites, where robust power delivery is essential for heavy machinery and temporary facilities. In emergency backup scenarios, rapid-response mobile units safeguard critical infrastructure during grid disruptions. Each scenario imposes unique performance, noise, and emissions criteria that shape product development roadmaps.

Examining end-user categories reveals distinct stakeholder requirements. Airlines seek turnkey solutions with minimal footprint and quick mobilization. Ground handling agencies prioritize modular fleets capable of servicing diverse aircraft models. Military operators demand ruggedized configurations that withstand extreme environments. Finally, sales channels bifurcate into aftermarket service networks, which emphasize part replacement and technical support, and original equipment manufacturer pathways that focus on integrated system sales and project-based contracts.

Uncovering Regional Market Dynamics for Portable Ground Power Units Across the Americas, Europe Middle East Africa, and Asia Pacific in Emerging and Established Economies

Regionally, portable ground power unit deployment follows distinctive contours shaped by infrastructure maturity and regulatory landscapes. Across the Americas, extensive airport networks and thriving construction markets drive demand for versatile power solutions. Stakeholders leverage established dealer networks to secure rapid equipment delivery and comprehensive maintenance packages, ensuring continuity in mission-critical operations.In Europe, the Middle East, and Africa, stringent emissions frameworks and sustainability objectives have catalyzed a shift toward cleaner, battery-centric systems. Regulatory bodies across these regions emphasize air quality standards at urban airports and construction sites, prompting operators to adopt low-noise, zero-emission units. Meanwhile, infrastructure development programs in emerging African economies highlight the need for reliable backup power in sectors ranging from logistics to humanitarian relief.

The Asia-Pacific landscape features a blend of high-growth aviation hubs and expanding construction corridors. Rapid urbanization in key markets amplifies demand for ground power support, encompassing both traditional engine-driven units and innovative hybrid configurations. Growth in naval and defense modernization further sustains procurement pipelines for rugged, high-capacity solutions. Cross-border trade agreements and localized manufacturing capacities are instrumental in optimizing cost structures and delivering high-volume projects in this dynamic region.

Analyzing Strategic Moves and Performance Trends of Leading Manufacturers in the Portable Ground Power Unit Industry Shaping Competitive Dynamics

Leading players in the portable ground power unit domain have demonstrated agility through targeted product launches, strategic alliances, and service ecosystem enhancements. Established engine-generator manufacturers are expanding their portfolios to integrate battery modules and digital monitoring platforms. At the same time, specialized power solutions firms are forging OEM partnerships to embed telematics and predictive maintenance capabilities directly into unit offerings.Collaborative R&D agreements have become commonplace as companies aim to accelerate innovation cycles and reduce time to market. By aligning with technology providers and component specialists, manufacturers gain access to advanced battery chemistries, lightweight structural materials, and AI-driven control algorithms. These joint ventures also facilitate entry into new geographic markets by leveraging local expertise in regulatory compliance and distribution.

On the service front, leading organizations are differentiating through comprehensive maintenance contracts that bundle training, remote diagnostics, and rapid parts replacement. Such offerings not only enhance uptime for end users but also generate recurring revenue streams that bolster long-term financial resilience. Moreover, mergers and acquisitions among aftermarket providers are creating end-to-end support networks capable of addressing a broad spectrum of customer needs, from initial installation to complete refits.

Proposing Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Disruption, Regulatory Pressures, and Evolving Demand in Portable Ground Power Units

To capitalize on emerging opportunities and navigate market headwinds, industry leaders should prioritize digitally enabled service models, investing in telematics infrastructure that delivers real-time insights into fleet health. By deploying predictive analytics, organizations can shift from time-based maintenance to condition-based strategies, thereby extending equipment life and reducing unscheduled downtime. Furthermore, embracing modular battery architectures will enable rapid scalability as demand fluctuates across aviation, construction, and emergency response scenarios.Supply chain resilience is another critical focus area. Companies should diversify component sourcing across multiple regions and establish strategic stockpiles for high-turnover parts. Nearshoring certain manufacturing processes can mitigate tariff exposures while fostering closer collaboration with regional stakeholders. Engaging proactively with regulatory agencies will also allow manufacturers to anticipate compliance requirements and secure early approvals for low-emission offerings.

Strategically, forging alliances with infrastructure developers and ground handling service providers can reveal new application niches, from renewable energy integration at remote sites to microgrid support in disaster recovery contexts. Finally, cultivating a culture of continuous innovation-informed by customer feedback loops and cross-functional hackathons-will ensure that product roadmaps remain aligned with evolving operational demands.

Detailing a Rigorous Multi-Stage Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Expert Validation for Portable Ground Power Units Study

This research employs a comprehensive multi-stage methodology to ensure rigor and accuracy. Initially, secondary data sources were scrutinized to establish foundational context, including industry white papers, regulatory publications, and technical specifications. These insights were then cross-referenced against proprietary trade databases and case study archives to validate emerging trends and performance benchmarks.Subsequently, primary research engaged senior executives, field service engineers, and purchasing managers across multiple continents through structured interviews. These interactions provided qualitative perspectives on procurement hurdles, maintenance practices, and technology adoption drivers. Key findings from direct stakeholder dialogues were triangulated with quantitative shipment and production figures to ensure consistency and eliminate bias.

In the final validation phase, an expert panel comprising independent consultants, academic researchers, and regulatory advisors reviewed the synthesized results. Their feedback refined the interpretation of regional dynamics, tariff impacts, and segmentation nuances. Throughout the process, quality controls-such as audit trails, peer reviews, and iterative revisions-ensured that conclusions remain robust, transparent, and actionable.

Concluding Insights Emphasizing the Strategic Imperatives for Stakeholders to Leverage Emerging Trends and Mitigate Risks in Portable Ground Power Unit Markets

Portable ground power units stand at the intersection of operational resilience, sustainability imperatives, and digital transformation. As stakeholders contend with evolving regulatory regimes, shifting tariff environments, and diverse application requirements, the imperative for adaptable, low-emission, and connected power solutions has never been greater. Strategic deployment of battery-based configurations and hybrid offerings will unlock new avenues for reducing noise, emissions, and lifecycle costs.In tandem, digital capabilities-including remote monitoring, predictive maintenance, and telematics-will underpin service differentiation and unity management. Organizations that invest deliberately in these technologies will secure higher asset utilization and stronger customer loyalty. Supply chain agility, fostered through diversified sourcing and nearshoring, will further strengthen margins and capacity to respond to sudden market disruptions.

Ultimately, the portable ground power unit market is poised for continued evolution as environmental targets intensify and technological possibilities expand. Stakeholders who meld innovative engineering with data-driven service models are positioned to deliver superior value propositions, cultivate deeper end-user partnerships, and drive sustainable growth across aviation, construction, and emergency support sectors.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Battery-Based Units

- Lead-Acid Battery

- Lithium-Ion Battery

- Engine-Driven Units

- Battery-Based Units

- Component

- Control Pane

- Electrical Generator

- Power Cable

- Power Source

- Application

- Aircraft Ground Support

- Boarding Operations

- Deicing Support

- Maintenance

- Testing

- Construction Sites

- Emergency Backup

- Aircraft Ground Support

- End User

- Airlines

- Ground Handling Agencies

- Military

- Sales Channel

- Aftermarket

- Original Equipment Manufacturer

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AERO Specialties

- Air+MAK Industries Inc.

- Avtron Aerospace, Inc.

- Bertoli Srl

- Effeti

- GUINAULT SA

- Hitzinger UK Ltd.

- HYDRO SYSTEMS GmbH & Co. KG

- Oshkosh Corporation

- Piller Power Systems by Langley Holdings plc

- Pilot John International by Carolina GSE Inc.

- Power Systems International

- PowerAll Systems

- Powervamp Ltd.

- Red Box International Ltd.

- Sino-Asia Global Limited

- START PAC LLC

- TLD Group by Alvest Group

- Tronair Inc.

- Unitron LP

- Suzhou Lingfran Electric Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Portable Ground Power Units Market report include:- AERO Specialties

- Air+MAK Industries Inc.

- Avtron Aerospace, Inc.

- Bertoli Srl

- Effeti

- GUINAULT SA

- Hitzinger UK Ltd.

- HYDRO SYSTEMS GmbH & Co. KG

- Oshkosh Corporation

- Piller Power Systems by Langley Holdings plc

- Pilot John International by Carolina GSE Inc.

- Power Systems International

- PowerAll Systems

- Powervamp Ltd.

- Red Box International Ltd.

- Sino-Asia Global Limited

- START PAC LLC

- TLD Group by Alvest Group

- Tronair Inc.

- Unitron LP

- Suzhou Lingfran Electric Co., Ltd.

Table Information

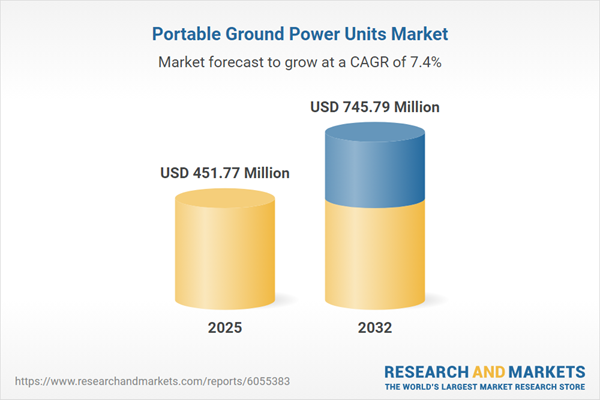

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 451.77 Million |

| Forecasted Market Value ( USD | $ 745.79 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |