Speak directly to the analyst to clarify any post sales queries you may have.

The commercial janitorial services market is reshaping the business landscape as organizations demand more sophisticated, sustainable, and technology-driven solutions for their facilities. As an executive, understanding the evolving drivers and shifting benchmarks is essential for building resilient operations and capturing emerging opportunities in this sector.

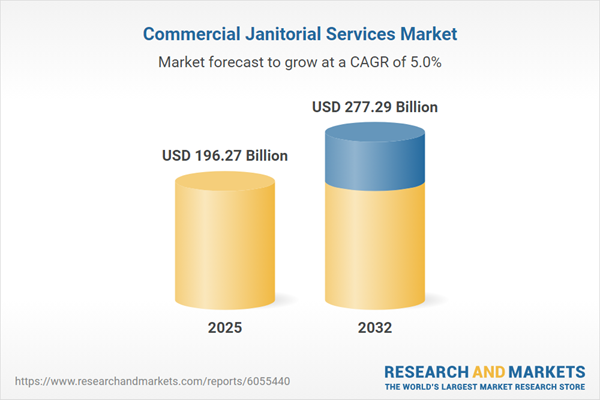

Market Snapshot: Commercial Janitorial Services Market Size and Growth

The Commercial Janitorial Services Market grew from USD 187.56 billion in 2024 to USD 196.27 billion in 2025. It is expected to continue growing at a CAGR of 5.00%, reaching USD 277.29 billion by 2032. Senior leaders in this market are witnessing rising urgency for integrated cleaning strategies that respond to new regulatory, environmental, and operational challenges.

Scope & Segmentation

This research report provides a detailed examination of market segments, technologies, and geographic coverage, enabling actionable decisions for senior decision-makers.

- Service Types: Mopping, Sweeping, Vacuuming

- Cleaning Frequencies: Daily Cleaning, Monthly Cleaning, Weekly Cleaning

- End-User Industries: Banking, Financial Services, and Insurance (BFSI); Education; Government & Public Sector; Healthcare; Hospitality; IT & Telecommunication; Retail & Consumer Goods

- Regions: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland), Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel), Africa (South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Technologies: Robotics, Automated Cleaning Systems, Internet of Things (IoT)-enabled sensors, Cloud-based platforms

- Key Market Participants: 4M Building Solutions, ABM Industries, Ace Janitorial Services, Allied Universal, Anago Cleaning Systems, ATX Janitorial Services, Blackstone Building Maintenance LLC., Commercial Cleaning Services, Dallas Janitorial Services, DBS Building Solutions, Edomey Janitorial & Building Services, Encore Corporate Services LLC, Harvard Maintenance, HiCare Services Pvt. Ltd., Innovation Cleaning LLC, JaniTek Cleaning Solutions, Janitorial Services & Office Cleaning, JSI Janitorial, Kellermeyer Bergensons Services, LLC, Miami Top Cleaning, Office Cleaning Long Beach Al, ServiceMaster OpCo Holdings LLC., Stathakis, Stratus Building Solutions, Theo-Clean Janitorial Services Inc., Vanguard Cleaning System

Key Takeaways for Senior Decision-Makers

- Expectations for commercial janitorial services now encompass health and environmental performance, not just cleanliness or cost.

- Technology integration is reshaping operations. Service providers implement robotics, predictive maintenance, and IoT-based monitoring to optimize workflows and demonstrate compliance.

- Sustainability initiatives, such as eco-friendly chemicals and water conservation, are core to client retention and competitive positioning.

- End-user differentiation drives service innovation—hospitality, healthcare, BFSI, education, and IT sectors each demand unique, compliant protocols.

- Providers are reforming workforce strategies with advanced training programs, knowledge-sharing, and digital communication tools, enabling faster adaptation to evolving client requirements.

- The regionally specific regulatory landscape and diverse economic environments require tailored engagement and investment approaches for growth and risk management.

Tariff Impact: United States Market Dynamics

Recent tariff adjustments in the United States have influenced procurement strategies and supply chain costs for cleaning chemicals and specialized equipment. Service firms are reacting with alternative sourcing, bulk purchasing, and increased domestic partnerships to strengthen supply continuity and protect profit margins. These adaptations are shaping how contracts are structured and negotiated in the current environment.

Methodology & Data Sources

The research methodology includes primary interviews with facility managers, service providers, and industry experts, combined with analysis of regulatory publications, trade association reports, and financial disclosures. This ensures a balanced, validated perspective leveraging both qualitative and quantitative data.

Why This Report Matters

- Enables evidence-based decisions through granular segmentation, regional insight, and coverage of transformational technologies.

- Identifies risk mitigation pathways in response to regulatory changes and disrupted supply chains, supporting resilient business models.

- Supports competitive benchmarking with analysis of leading providers, innovation drivers, and sustainability trends within the global commercial janitorial services sector.

Conclusion

The commercial janitorial services market is accelerating its transformation through technology, sustainability, and shifting end-user needs. Executives who leverage this report’s insights will be equipped to adapt strategies, navigate operational complexities, and identify forward-looking growth opportunities.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Commercial Janitorial Services market report include:- 4M Building Solutions

- ABM Industries

- Ace Janitorial Services

- Allied Universal

- Anago Cleaning Systems

- ATX Janitorial Services

- Blackstone Building Maintenance LLC.

- Commercial Cleaning Services

- Dallas Janitorial Services

- DBS Building Solutions

- Edomey Janitorial & Building Services

- Encore Corporate Services LLC

- Harvard Maintenance

- HiCare Services Pvt. Ltd.

- Innovation Cleaning LLC

- JaniTek Cleaning Solutions

- Janitorial Services & Office Cleaning

- JSI Janitorial

- Kellermeyer Bergensons Services, LLC

- Miami Top Cleaning

- Office Cleaning Long Beach Al

- ServiceMaster OpCo Holdings LLC.

- Stathakis

- Stratus Building Solutions

- Theo-Clean Janitorial Services Inc.

- Vanguard Cleaning System

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 196.27 Billion |

| Forecasted Market Value ( USD | $ 277.29 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |