Speak directly to the analyst to clarify any post sales queries you may have.

Charting the Foundations of Reactive Extrusion as a Cornerstone of Polymer Processing Advancements and Its Role in Modern Manufacturing Dynamics

Reactive extrusion has emerged as a vital process in modern polymer manufacturing, combining chemical modification and physical shaping in a single continuous operation. By integrating reactions such as grafting, crosslinking, and chain extension directly within the extruder, manufacturers achieve superior properties while streamlining production workflows. This synergy between reaction engineering and extrusion technology delivers significant advantages over conventional multi-step procedures, reducing energy consumption and minimizing the need for solvent usage.Moreover, the adaptability of reactive extrusion has fostered its adoption across diverse industries, ranging from automotive and aerospace to packaging and medical applications. As sustainability and performance requirements intensify, reactive extrusion offers a compelling platform for tailoring polymer functionalities, enhancing recyclability, and developing advanced composites with precise property control. Consequently, chemical producers, equipment manufacturers, and end users are collaborating to refine process parameters and explore new formulations that respond to evolving market demands.

Against this backdrop, this executive summary presents a concise overview of the reactive extrusion landscape. It highlights transformative shifts, regulatory influences, and segmentation insights crucial for informed decision making. In the sections that follow, readers will gain a comprehensive understanding of emerging trends, regional dynamics, and actionable strategies to navigate the complex environment surrounding reactive extrusion.

Uncovering the Pivotal Transformations Reshaping Reactive Extrusion through Breakthrough Technologies and Emerging Regulatory Frameworks

The landscape of reactive extrusion is undergoing significant transformations, driven by advancements in screw design, process monitoring, and digital integration. Recent developments in twin screw extrusion have enhanced mixing efficiency and enabled more precise control over reaction kinetics, thereby opening new avenues for customizing molecular architecture. Simultaneously, innovations in single screw and reciprocating pin screw extruders have expanded processing windows for high-viscosity materials, fostering adoption in sectors previously constrained by equipment limitations.In addition to hardware improvements, the integration of real-time analytical tools, such as inline spectroscopy and advanced torque sensors, has revolutionized process optimization. These capabilities allow for continuous monitoring of reaction progress and material dispersion, reducing trial-and-error cycles and accelerating scale-up. Furthermore, the adoption of predictive maintenance systems and digital twins enhances operational reliability and minimizes downtime, reinforcing the role of reactive extrusion as a cornerstone of Industry 4.0 initiatives.

Concurrently, regulatory frameworks have evolved to emphasize sustainability and recyclability, prompting stakeholders to explore greener chemistries and recycled feedstocks. As environmental imperatives intensify, the industry is pivoting toward bio-derived polymers and closed-loop recycling processes within reactive extrusion. These combined technological and regulatory shifts are reshaping the market, offering both challenges and opportunities for innovators seeking competitive differentiation.

Assessing the Ramifications of the 2025 United States Tariffs on Global Reactive Extrusion Supply Chains and Economic Interactions

The implementation of new United States tariffs on polymer materials and processing equipment in 2025 has introduced substantial complexities across global supply chains. Higher import duties on key catalysts, specialty resins, and extrusion machinery have led to increased production costs for reactive extrusion operations within and beyond North America. As a result, companies are reassessing supplier relationships, logistics networks, and inventory strategies to mitigate margin erosion and maintain competitive pricing.Consequently, manufacturers have accelerated investments in domestic production facilities and local partnerships to reduce reliance on tariff-impacted imports. This strategic shift not only addresses cost pressures but also aligns with broader trends in supply chain resilience, as organizations aim to minimize potential disruptions and geopolitical risks. Moreover, the elevated duty structure has spurred interest in alternative polymer chemistries and process routes that leverage readily available feedstocks, fostering innovation in material substitutions.

Despite these challenges, the tariffs have provoked a wave of collaborative initiatives, as stakeholders join forces to lobby for harmonized trade policies and explore regional sourcing alliances. By sharing best practices and co-developing localized solutions, companies are navigating the tariff landscape more effectively and identifying new pathways for market expansion. As 2025 unfolds, the cumulative impact of these measures will continue to influence strategic planning and investment decisions across the reactive extrusion value chain.

Delving into the Multifaceted Segmentation Landscape That Defines Reactive Extrusion Applications, Technologies, and Material Classifications

A nuanced understanding of market segmentation offers critical insight into the varied dynamics of reactive extrusion. Based on technology, the market is studied across reciprocating pin screw extruder, single screw extrusion, and twin screw extrusion, each presenting distinct processing capabilities and reaction control. The reciprocating pin screw design excels in handling high-viscosity systems, while single screw platforms support straightforward modifications. Twin screw extrusion, on the other hand, delivers superior mixing and molecular dispersion, making it the preferred choice for complex reactive applications.Equally important is polymer type segmentation, which encompasses elastomers, thermoplastics, and thermosetting plastics. Within the thermoplastic category, key materials include polyethylene (PE), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC), each offering unique property profiles for end uses ranging from packaging films to rigid pipes. Thermosetting plastics, such as epoxy resin, phenolic resins, and polyurethane (PU), facilitate high-performance coatings and composites. Process type segmentation further refines the landscape, covering chain extension or branching, crosslinking, degradation reactions, devolatilization, grafting reactions, polymerization, and reactive compatibilization, each representing a tailored approach to modifying molecular structures.

Application segmentation highlights sectors such as agriculture, automotive & aerospace, building & construction, electrical & electronics, medical & healthcare, and packaging. Within medical & healthcare, subsegments include medical devices and pharmaceutical packaging, while packaging extends to flexible and rigid formats. Lastly, output form segmentation spans films, granules, pellets, sheets, and strands, reflecting the diverse product configurations enabled by reactive extrusion processes. Together, these segmentation layers provide a comprehensive framework for assessing market drivers, opportunities, and competitive positioning.

Exploring the Diverse Regional Dynamics Driving Reactive Extrusion Adoption Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional analysis of reactive extrusion reveals distinct dynamics shaping adoption and innovation across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, robust infrastructure, strong regulatory support for advanced plastics, and established petrochemical capacities underpin market growth. This region benefits from significant downstream demand in packaging, automotive, and consumer goods sectors, complemented by a growing emphasis on recycled feedstocks and sustainability initiatives.Conversely, Europe Middle East & Africa exhibits a diverse regulatory mosaic, with stringent environmental standards driving investment in green chemistries and energy-efficient equipment. Western Europe serves as a hub for technological innovation, supported by collaborative research clusters and government incentives. Meanwhile, emerging markets in the Middle East are capitalizing on abundant feedstock availability to expand local production, and several African nations are initiating pilot projects focused on circular economy models within polymer processing.

Asia Pacific stands out as a dynamic growth corridor, characterized by rapid industrialization, expanding automotive manufacturing, and burgeoning consumer electronics demand. China, India, Japan, and South Korea lead in both equipment manufacturing and polymer processing expertise, fueling large-scale implementation of reactive extrusion. Moreover, regional trade agreements and infrastructure development are enhancing cross-border collaborations, positioning Asia Pacific as a pivotal arena for next-generation polymer innovations. Collectively, these regional insights illuminate the geographical complexities and strategic considerations integral to reactive extrusion market engagement.

Identifying Key Industry Players Shaping Reactive Extrusion Advancements through Strategic Collaborations, Technological Innovations, and Market Positioning

An examination of key industry players reveals a competitive landscape marked by strategic partnerships, technological leadership, and targeted acquisitions. Leading process equipment manufacturers are investing heavily in research and development to introduce advanced screw designs, modular extruder lines, and automation capabilities aimed at enhancing process flexibility. At the same time, specialty chemical suppliers are expanding their portfolios with bespoke reactive additives, catalysts, and compatibilizers that enable precise tuning of polymer properties.Collaborations between extruder OEMs and chemical innovators have intensified, resulting in co-development agreements that integrate tailored reagents with optimized extrusion platforms. Such alliances accelerate time to market for novel material solutions, while joint pilot facilities allow stakeholders to validate performance under real-world production conditions. In parallel, a wave of mergers and acquisitions is consolidating expertise, with larger companies acquiring niche technology providers to broaden their service offerings and reinforce global distribution networks.

Smaller specialized firms continue to differentiate themselves through agility and niche focus, often addressing specific applications such as high-performance coatings or bio-based polymers. By leveraging their specialized knowledge and maintaining close customer relationships, these players introduce disruptive innovations that challenge conventional approaches. Collectively, the interplay of established multinationals and agile challengers shapes a dynamic competitive environment, where collaboration and convergence drive the progression of reactive extrusion.

Actionable Strategies for Industry Leaders to Leverage Reactive Extrusion Opportunities and Navigate Emerging Challenges in a Competitive Market

Industry leaders seeking to capitalize on reactive extrusion should prioritize investments in advanced process control and digital integration. By implementing real-time monitoring systems and predictive analytics, companies can optimize reaction conditions, reduce waste, and accelerate product development cycles. In parallel, fostering collaborative partnerships with specialty chemical suppliers will unlock access to cutting-edge catalysts and compatibilizers tailored to specific applications, enabling a faster response to emerging performance requirements.Moreover, it is essential to evaluate supply chain strategies in light of new trade dynamics and sustainability mandates. Diversifying raw material sources and exploring recycled or bio-derived feedstocks will help mitigate cost volatility and align operations with environmental targets. Establishing localized production hubs or co-manufacturing agreements in key regions can further enhance resilience and reduce exposure to tariff fluctuations.

Finally, executives should embrace an innovation mindset, supporting cross-functional teams that bridge R&D, production, and marketing. Encouraging pilot projects and rapid prototyping will facilitate the exploration of novel polymer architectures and composite materials. By implementing an agile development framework, companies can adapt to shifting market demands, seize first-mover advantages, and reinforce their position as leaders in the reactive extrusion domain.

Outlining the Comprehensive Research Methodology Underpinning Reactive Extrusion Market Analysis and Ensuring Rigorous Data Integrity

The research methodology underpinning this analysis integrates both primary and secondary approaches to ensure comprehensive coverage and data integrity. Primary insights were gathered through interviews with process engineers, R&D directors, and supply chain managers across leading polymer manufacturers, equipment OEMs, and specialty chemical producers. These discussions provided qualitative perspectives on emerging trends, adoption barriers, and technology roadmaps.Complementing these interactions, secondary research entailed a thorough review of industry publications, technical white papers, patents, and regulatory filings relevant to reactive extrusion. Proprietary databases and process schematics were analyzed to map technological developments, competitive positioning, and partnership networks. Cross-validation of quantitative and qualitative inputs was conducted to verify consistency and address potential data gaps.

Additionally, comparative case studies of successful reactive extrusion implementations helped illustrate best practices and critical success factors. Geographic analyses leveraged trade statistics, policy documents, and infrastructure data to assess regional market dynamics. Throughout the research process, data quality protocols, including triangulation and peer review, were employed to safeguard the accuracy and reliability of findings.

Synthesizing Core Findings on Reactive Extrusion Market Evolution and Highlighting Future Directions for Stakeholders and Decision Makers

In summary, reactive extrusion stands at the forefront of polymer processing innovation, offering a versatile platform for material modification and functional enhancement. The integration of reaction and shaping in a single continuous operation delivers efficiencies that resonate across diverse applications, from automotive components to advanced medical devices. Recent technological strides in equipment design, digital monitoring, and sustainable feedstocks are further expanding the potential of reactive extrusion to address complex performance requirements and environmental imperatives.The imposition of new United States tariffs in 2025 has introduced supply chain complexities, prompting strategic realignments and renewed focus on regional resilience. Meanwhile, segmentation analysis underscores the multifaceted nature of the market, where technology choices, polymer types, process routes, application sectors, and product forms converge to shape opportunities. Regional insights highlight distinct growth drivers and regulatory frameworks in the Americas, Europe Middle East & Africa, and Asia Pacific, necessitating tailored market engagement strategies.

Looking ahead, collaboration among equipment manufacturers, chemical innovators, and end users will be vital to overcoming technical challenges and unlocking new applications. By embracing digitalization, sustainability, and agile development approaches, organizations can harness the full potential of reactive extrusion and secure a competitive edge in the evolving landscape.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Technology

- Reciprocating Pin Screw Extruder

- Single Screw Extrusion

- Twin Screw Extrusion

- Polymer Type

- Elastomers

- Thermoplastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Thermosetting Plastics

- Epoxy Resin

- Phenolic Resins

- Polyurethane (PU)

- Process Type

- Chain Extension or Branching

- Crosslinking

- Degradation Reactions

- Devolatilization

- Grafting Reactions

- Polymerization

- Reactive Compatibilization

- Application

- Agriculture

- Automotive & Aerospace

- Building & Construction

- Electrical & Electronics

- Medical & Healthcare

- Medical Devices

- Pharmaceutical Packaging

- Packaging

- Flexible

- Rigid

- Output Form

- Films

- Granules

- Pellets

- Sheets

- Strands

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AIMPLAS

- CLEXTRAL group

- Covestro AG

- Jieya Group

- Kimberly Clark Worldwide Inc

- Materia Nova ASBL

- Nanjing Chuangbo Machiney Co. Ltd

- Nanjing Kairong Machinery Tech. Co., Ltd.

- NFM/Welding Engineers, Inc.

- Steer Engineering Pvt. Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Reactive Extrusion market report include:- AIMPLAS

- CLEXTRAL group

- Covestro AG

- Jieya Group

- Kimberly Clark Worldwide Inc

- Materia Nova ASBL

- Nanjing Chuangbo Machiney Co. Ltd

- Nanjing Kairong Machinery Tech. Co., Ltd.

- NFM/Welding Engineers, Inc.

- Steer Engineering Pvt. Ltd.

Table Information

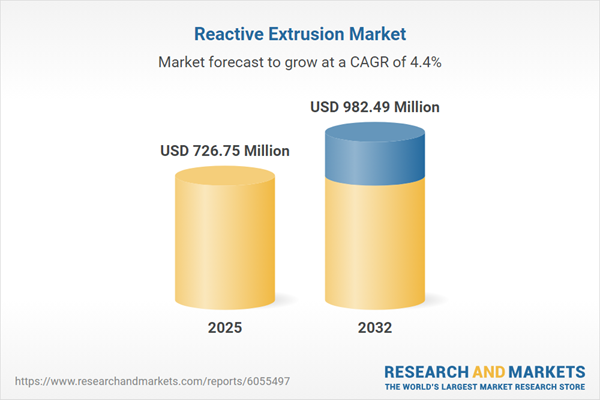

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 726.75 Million |

| Forecasted Market Value ( USD | $ 982.49 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |