Speak directly to the analyst to clarify any post sales queries you may have.

The Drilling Optimization Service Market is evolving rapidly as advancements in engineering, digital technologies, and operational practices converge to offer operators new pathways to improve drilling performance in increasingly complex and varied fields. Senior decision-makers seeking resilient, efficient solutions will find this market at the center of transformation, where technical innovation and adaptability are critical for ongoing value creation.

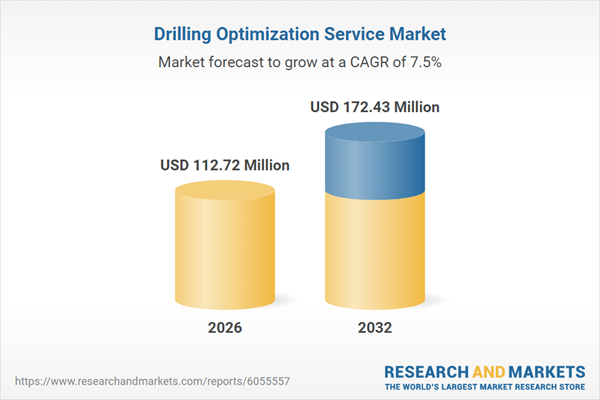

Market Snapshot: Drilling Optimization Service Market Growth and Trajectory

The Drilling Optimization Service Market advanced from USD 104.12 million in 2025 to USD 112.72 million in 2026 and is set to reach USD 172.43 million by 2032, expanding at a CAGR of 7.47%. Sustained demand is being driven by operators aiming for greater efficiency, tighter cost control, and adaptability as they navigate increasing geological and regulatory challenges worldwide. Senior leaders now recognize that optimizing drilling operations is no longer optional, but essential for maintaining operational continuity, minimizing non-productive time, and unlocking new value in both challenging and mature reservoirs.

Scope & Segmentation of the Drilling Optimization Service Market

This report provides a comprehensive analysis of the Drilling Optimization Service Market, highlighting the convergence of engineering capabilities, digital intelligence, and operational flexibility. The study covers critical market segments and technology drivers relevant to organizations seeking practical, field-ready solutions.

- Service Types: Includes drilling fluid and hydraulic optimization, rate of penetration (ROP) optimization, real-time drilling performance monitoring, and wellbore trajectory and geosteering optimization, reflecting growing requirements for accuracy, uptime, and productivity in diverse drilling environments.

- Deployment Environments: Offshore applications emphasize remote autonomy and heightened safety standards, while onshore operations benefit from increased accessibility and the modular deployment of digital tools and analytics.

- End User Verticals: Relevant for civil engineering and construction (where precision and minimal site disruption are key), the mining sector (focused on throughput and seam targeting), and oil & gas (emphasizing reservoir access, well integrity, and optimization of production processes).

- Regional Coverage: Includes Americas, Europe, Middle East & Africa, and Asia-Pacific. Each region demonstrates unique adoption drivers, infrastructure maturity, and regulatory dynamics, shaping market needs and solution design.

- Technological Scope: Encompasses the integration of advanced sensors, analytics platforms, interoperable data solutions, and adaptable mechanical kits, providing a robust toolkit for real-time optimization and long-term performance gains.

Primary Keyword Focus: Drilling Optimization Service Market

Key Takeaways for Senior Decision-Makers

- Integrated engineering and digital solutions enable operators to quickly identify and respond to drilling faults, reducing costly delays and enabling adaptive performance improvements at scale.

- Collaboration among drilling engineers, data specialists, and field operations teams is essential to drive measurable and repeatable outcomes, helping organizations sustain ongoing innovation pipelines.

- Deploying modular services supported by standardized data platforms makes it easier for organizations to scale operations or reconfigure solutions without major infrastructure changes.

- Outcome-based service contracts and robust remote support models reduce operational friction, foster transparency, and enhance workforce expertise in both established and emerging markets.

- Providers that deliver transparent, field-tested digital systems and align with regional compliance requirements gain a competitive advantage, positioning their clients for greater long-term value.

- Continuous workforce development in digital analytics and system integration is a key lever for supporting successful project deployment and delivering sustained performance improvements.

Tariff Impact: United States 2025 Measures on Drilling Optimization Services

Recent tariff measures in the United States have reshaped procurement and supply chain strategies for drilling optimization services. Operators now assess total landed costs more closely and adjust sourcing decisions to favor regionally manufactured equipment and local content, mitigating the financial impact of tariffs. This shift promotes closer collaboration between service providers and OEMs, strategic avoidance of tariff-sensitive components, and greater supply chain transparency. Project managers are recalibrating drilling schedules and capital deployment, emphasizing diversified sourcing and resilient design to withstand ongoing market volatility. These adjustments reflect a broader move toward supply chain flexibility and risk mitigation in sourcing for drilling projects.

Methodology & Data Sources

This report leverages a mixed-methods research approach, incorporating direct interviews with subject-matter experts, detailed analysis of operational case studies, and a comprehensive review of peer-reviewed literature and up-to-date market data. Inputs from field engineers, procurement professionals, and program managers ensure that all insights are well aligned with practical market realities, providing decision-makers with evidence-based recommendations.

Why This Report Matters

- Empowers executives to benchmark service models and assess readiness for regulatory shifts in the drilling optimization service market across global regions.

- Offers frameworks that support strategic investments in modular deployments, data interoperability, and resilient supply chains in response to policy and market evolution.

- Guides planning by identifying tangible opportunities for drilling efficiency gains and alignment with operational, environmental, and commercial objectives.

Conclusion

Achieving sustainable drilling optimization relies on integrating engineering, interoperable digital technologies, and strong supply chain management. Organizations that prioritize these areas and ongoing workforce development will secure operational excellence and lasting value in a shifting market environment.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Drilling Optimization Service Market

Companies Mentioned

- Atlas Copco AB

- Baker Hughes Company

- Boart Longyear Limited

- Cameron International Corporation by Schlumberger

- Drillmec S.p.A. by MEIL group

- Epiroc AB

- Halliburton Company

- Helmerich & Payne, Inc.

- Houghton Mifflin Harcourt Company

- Leam Drilling Systems

- Liebherr-International AG

- Nabors Industries Ltd.

- National Oilwell Varco, Inc.

- NOV Inc.

- Oceaneering International, Inc.

- PetroGM

- Sandvik AB

- Schlumberger Limited

- Scientific Drilling International

- Sumitomo Heavy Industries, Ltd.

- Superior Energy Services, Inc.

- TechnipFMC plc

- Weatherford International plc

- Weir Group PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 112.72 Million |

| Forecasted Market Value ( USD | $ 172.43 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |