Speak directly to the analyst to clarify any post sales queries you may have.

Discovering the Fundamentals of Assembly Automation and Its Strategic Influence on Manufacturing Efficiency and Innovation Trajectories in Modern Industries

The realm of assembly automation stands at the crossroads of innovation and operational efficiency, redefining how manufacturers approach repetitive tasks and intricate processes. In recent years, this convergence of robotics, control systems, and intelligent software has shifted the paradigm from manual labor toward precision-driven, high-throughput production. As organizations grapple with changing market demands and increasing customization, automation has emerged as a strategic lever to achieve consistency, reduce error rates, and unlock new value chains.At its core, assembly automation encompasses a spectrum of technologies-from conveyor and inspection systems to advanced pick-and-place stations and multifaceted robot automation equipment. These components work in concert to deliver seamless material flow, real-time quality assurance, and dynamic adaptability. Moreover, the integration of articulated, Cartesian, and SCARA robots has broadened the scope of tasks that can be automated, enabling manufacturers to reimagine their production footprints and respond to fluctuating order volumes with agility.

Furthermore, assembly automation plays a pivotal role in the broader digital transformation journey. By embedding sensors, analytics engines, and control software into every stage of the process, manufacturers gain end-to-end visibility into performance metrics and supply chain health. This transparency fosters continuous improvement cycles, supports predictive maintenance strategies, and lays the groundwork for fully autonomous operations. Ultimately, as enterprises invest in these capabilities, they secure a competitive edge in speed, quality, and cost management, setting the stage for the next wave of manufacturing excellence.

Unveiling Critical Transformative Shifts Reshaping Assembly Automation Landscapes Through Technological Breakthroughs and Operational Paradigm Movements

The landscape of assembly automation is undergoing rapid metamorphosis, driven by breakthroughs that challenge traditional manufacturing paradigms. At the forefront, artificial intelligence and machine learning are being deployed to enable robots to make real-time decisions, adapt to unexpected variations, and self-optimize based on historical performance data. Simultaneously, the rise of collaborative robots has ushered in a new era of human-machine teamwork, allowing production lines to harness the strengths of both precise automation and human dexterity.In parallel, the integration of digital twin technologies and edge computing architectures is reshaping how manufacturers plan, simulate, and execute assembly processes. Digital twins offer virtual replicas of physical systems, empowering engineers to test configurations and predict outcomes before committing changes on the shop floor. Edge computing, in turn, ensures that critical data processing occurs near the source, reducing latency and enabling instantaneous feedback loops within assembly cells.

Moreover, sustainability considerations have become a major catalyst for innovation. Energy-efficient actuators, eco-friendly materials, and closed-loop recycling schemes are being embedded into new automation designs to meet rising regulatory and corporate responsibility standards. These shifts are complemented by an increased emphasis on modular architectures that simplify system upgrades and support rapid reconfiguration, helping enterprises navigate evolving product portfolios. Collectively, these transformational forces are redefining the very nature of assembly automation, equipping manufacturers with unprecedented agility, resilience, and efficiency.

Assessing the Multifaceted Impact of United States Tariffs in 2025 on Supply Chain Dynamics and Cost Structures Within the Assembly Automation Sector

The implementation of new United States tariffs in 2025 has introduced complex variables into the assembly automation supply chain, prompting companies to recalibrate sourcing strategies and cost models. Many automation components, such as high-precision actuators, specialized controllers, and advanced sensors, now face elevated import duties, driving up acquisition costs and squeezing margins for original equipment manufacturers and system integrators alike. As a result, procurement teams are compelled to explore alternative suppliers, reconsider regional sourcing hubs, and negotiate volume commitments to mitigate financial exposure.In response, an increasing number of manufacturers are adopting nearshoring practices, relocating critical fabrication and assembly operations closer to end markets in North America. This shift not only shortens lead times but also reduces exposure to fluctuating tariff structures. At the same time, design engineers are reevaluating bill-of-materials configurations, seeking component substitutions that preserve performance characteristics while aligning with accelerated compliance requirements.

Furthermore, the new tariff environment has accelerated the digitalization of procurement processes. Advanced analytics platforms are being deployed to model cost impacts, simulate multiple sourcing scenarios, and optimize total cost of ownership. This data-driven approach empowers decision-makers to understand the trade-offs between imported and domestically produced hardware, anticipate regulatory changes, and build more resilient supply chain networks. Through these adaptive measures, industry players are striving to uphold the economic rationale for automation investments while safeguarding operational continuity in a shifting trade landscape.

Illuminating Key Segmentation Insights Revealing How Diverse Product Types Components Automation Levels and End Uses Drive Assembly Automation Opportunities

The assembly automation market is characterized by a diverse array of product types, starting with conveyor systems that manage material handling flows and inspection systems that ensure quality control across production lines. Complementing these are pick and place systems designed for rapid and precise component positioning. At the pinnacle of the product taxonomy lies robot automation equipment. This category encompasses articulated robots capable of complex multi-axis movements, Cartesian architectures suited for linear tasks, and SCARA configurations optimized for high-speed horizontal operations, each tailored to specific manufacturing requirements.Integral to the value chain are the components underpinning these products. Hardware elements include actuators that drive motion, controllers that orchestrate system logic, and sensors that provide real-time feedback on position and condition. On the services front, professional teams deliver installation, preventive maintenance, and training & consulting, ensuring systems perform reliably and personnel can operate and troubleshoot effectively. Software layers comprise analytics solutions that uncover process inefficiencies, control software that synchronizes machine operations, and monitoring platforms that deliver visibility into equipment health and throughput metrics.

Automation levels further distinguish market segments. Fixed automation solutions are engineered for high-volume, low-variation production, while flexible automation architectures adapt to changing product variants and batch sizes. Lean automation emphasizes minimal waste, streamlined workflows, and continuous flow principles to achieve optimal resource utilization. Applications span assembly tasks, material handling choreography, packaging operations, and rigorous testing & inspection routines, each demanding specific automation capabilities.

Enterprises of all sizes engage with these technologies. Large organizations pursue expansive automation programs to standardize processes globally, whereas small and medium enterprises implement modular solutions to enhance competitiveness and respond swiftly to niche opportunities. Deployment models range from cloud-based platforms that deliver remote control and data aggregation to on-premises installations that ensure local data sovereignty. End-use sectors, including aerospace, automotive, electronics, food & beverage, and healthcare, drive distinct requirements, while distribution channels involve independent software vendors, original equipment manufacturers, and value-added resellers that tailor offerings to meet customer demands.

Exploring Essential Regional Dynamics and Growth Trends Shaping Assembly Automation Adoption Across the Americas Europe Middle East Africa and Asia Pacific Territories

Regional dynamics play a pivotal role in shaping the adoption trajectory of assembly automation solutions. In the Americas, the push toward digital manufacturing has been coupled with supply chain reconfiguration initiatives. Manufacturers across the United States, Canada, and Mexico are leveraging automation to bolster nearshoring efforts, reduce lead times, and address labor constraints. This strategic repositioning has been further accelerated by incentives aimed at enhancing domestic production capabilities.Conversely, the Europe, Middle East & Africa region presents a tapestry of maturity levels and regulatory frameworks. Western Europe has long been a stronghold for high-precision automation, driven by advanced industries such as automotive manufacturing and aerospace. Meanwhile, emerging economies in Eastern Europe, the Gulf states, and Africa are beginning to embrace automation to elevate productivity, supported by government programs targeting industrial modernization and workforce development.

In the Asia-Pacific theater, rapid industrialization and strong export-oriented manufacturing have positioned countries like China, Japan, South Korea, and India as critical growth engines. Driven by the need to manage escalating labor costs and fulfill stringent quality standards, enterprises in this region are investing heavily in both fixed and flexible automation platforms. Moreover, local technology firms are innovating bespoke solutions that cater to regional supply chain nuances, reinforcing Asia-Pacific's status as a dynamic hub for automation advances.

Highlighting Prominent Industry Players Strategies Partnerships and Technological Investments Driving Innovation and Competitive Advantage in Assembly Automation Ecosystems

The competitive landscape of assembly automation is defined by a blend of established system integrators, specialized robotics original equipment manufacturers, and agile software developers. Leading integrators are expanding their portfolios through strategic partnerships, enabling them to deliver turnkey automation cells that combine mechanical design, control logic, and advanced analytics. At the same time, top-tier robotics providers continue to invest in research and development, unveiling next-generation manipulators with enhanced force control and vision-guided capabilities.Software innovators are also staking their claim by offering open-architecture platforms that facilitate seamless interoperability with legacy equipment and third-party devices. Through platform-as-a-service models, these software firms provide subscription-based access to control algorithms, predictive maintenance applications, and digital twin simulations. This approach has resonated with enterprises seeking scalable solutions without committing to large up-front capital expenditures.

Moreover, cross-sector alliances between automation providers and industry consortia have accelerated standardization efforts, promoting the adoption of common communication protocols and safety guidelines. By aligning product roadmaps and co-developing demonstration facilities, these collaborations are fostering a more cohesive ecosystem. As a result, manufacturers benefit from reduced integration risks, streamlined commissioning processes, and accelerated time to value.

Delivering Actionable Recommendations to Empower Industry Leaders in Assembly Automation to Optimize Operations Mitigate Risks Capitalize on Emerging Trends

To maximize the return on assembly automation investments, industry leaders should adopt a phased approach that aligns with corporate strategy and operational readiness. Initially, enterprises must identify high-impact use cases where automation can deliver immediate improvements in cycle time, quality, or ergonomic safety. By piloting modular robotic cells or advanced inspection stations in targeted areas, organizations can build internal expertise and validate business cases before scaling up.Continuously, it is vital to diversify component supply chains to mitigate exposure to geopolitical and tariff-related disruptions. Engaging multiple hardware and software vendors through qualification trials fosters competitive pricing and innovation, while maintaining the flexibility to switch suppliers as market conditions evolve. At the same time, integrating cloud-native analytics platforms with on-premises control systems creates a hybrid architecture that supports both real-time operations and strategic data insights.

Furthermore, investing in workforce upskilling initiatives is essential to sustain automation performance. Cross-functional training programs that encompass robotics programming, control system troubleshooting, and data interpretation empower teams to proactively optimize operations and address emergent challenges. Finally, maintaining a dedicated center of excellence for automation best practices ensures ongoing governance, fosters continuous improvement, and accelerates the adoption of emerging technologies such as augmented reality-assisted diagnostics and autonomous mobile robots.

Detailing a Rigorous Research Methodology Combining Extensive Data Collection Statistical Analysis and Expert Validation to Guarantee Robust Automation Insights

The research underpinning this analysis combines primary and secondary methodologies to ensure a comprehensive and balanced perspective. Initially, expert interviews were conducted with senior engineers, system integrators, and supply chain managers to capture qualitative insights into emerging challenges and strategic priorities. These discussions informed the design of a structured survey targeting a cross-section of manufacturing firms, gathering quantitative data on technology adoption rates, investment drivers, and regional deployment patterns.In parallel, extensive secondary research was performed, drawing on industry journals, technical white papers, and publicly available company documentation. This phase enabled the mapping of competitive landscapes, technology roadmaps, and tariff schedules, which were cross-referenced with global trade databases to validate cost impact assessments.

Subsequently, data triangulation techniques were applied to reconcile quantitative findings with expert testimony, while statistical reliability checks ensured consistency across sample segments. Finally, a multi-stage review process involved independent validation by subject matter specialists, ensuring that conclusions reflect both empirical evidence and practical industry experience. This rigorous methodology provides stakeholders with confidence in the robustness and relevance of the insights presented.

Synthesizing Core Findings and Strategic Imperatives to Provide a Coherent Framework for Stakeholders Navigating the Evolving Assembly Automation Landscape

In synthesizing the findings, it becomes clear that assembly automation is not merely a collection of technologies but a strategic enabler of manufacturing resilience and growth. The industry is being propelled forward by transformative innovations such as AI-driven control systems, collaborative robotics, and digital twin frameworks, which together are reshaping traditional production models. At the same time, external pressures-most notably evolving trade policies and tariff regimes-underscore the need for agile supply chain strategies and proactive cost management.Segmentation analysis reveals that success hinges on selecting the optimal combination of product types, components, and automation levels tailored to specific application requirements, enterprise sizes, and deployment models. Regional insights highlight distinct adoption drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each offering unique opportunities and challenges. Competitive benchmarking illustrates how leading integrators, robotics OEMs, and software providers are forging alliances and investing in next-generation capabilities to maintain differentiation.

Looking ahead, organizations that embrace the recommended action plans-diversifying suppliers, pursuing phased automation rollouts, investing in workforce development, and leveraging hybrid IT architectures-will be best positioned to capitalize on emerging trends. By aligning technological investments with strategic business objectives, stakeholders can navigate the evolving landscape with confidence and unlock sustainable operational excellence.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Conveyor Systems

- Inspection Systems

- Pick & Place Systems

- Robot Automation Equipment

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Component

- Hardware

- Actuators

- Controllers

- Sensors

- Services

- Installation

- Maintenance

- Training & Consulting

- Software

- Analytics Software

- Control Software

- Monitoring Software

- Hardware

- Automation Level

- Fixed Automation

- Flexible Automation

- Lean Automation

- Application

- Assembly

- Material Handling

- Packaging

- Testing & Inspection

- Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- Deployment Model

- Cloud-Based

- On-Premises

- End-Use

- Aerospace

- Automotive

- Electronics

- Food & Beverage

- Healthcare

- Distribution Partner

- Independent Software Vendors

- Original Equipment Manufacturers

- Value Added Resellers

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ABB Ltd.

- ATC Automation by TASI Group

- BOS INNOVATIONS INC.

- Bosch Rexroth AG

- C-Link Solutions India Pvt Ltd

- Comau S.p.A.

- DENSO Corporation

- FANUC Corporation

- GROB-WERKE GmbH & Co. KG

- Hirata Corporation

- Honeywell International Inc.

- Intec Automation, Inc. by Machine Solutions Inc.

- KRISAM Automation Pvt. Ltd.

- KUKA AG

- Midwest Engineered Systems, Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Panasonic Connect Co., Ltd. by Panasonic Corporation

- PIA Automation Holding GmbH

- RNA Automation Limited

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- SMC Ltd.

- Thales Group

- thyssenkrupp AG

- Universal Robots A/S by Teradyne, Inc.

- Yamaha Motor Co., Ltd.

- Yaskawa Electric Corporation

- Zebra Technologies Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Assembly Automation market report include:- ABB Ltd.

- ATC Automation by TASI Group

- BOS INNOVATIONS INC.

- Bosch Rexroth AG

- C-Link Solutions India Pvt Ltd

- Comau S.p.A.

- DENSO Corporation

- FANUC Corporation

- GROB-WERKE GmbH & Co. KG

- Hirata Corporation

- Honeywell International Inc.

- Intec Automation, Inc. by Machine Solutions Inc.

- KRISAM Automation Pvt. Ltd.

- KUKA AG

- Midwest Engineered Systems, Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Panasonic Connect Co., Ltd. by Panasonic Corporation

- PIA Automation Holding GmbH

- RNA Automation Limited

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- SMC Ltd.

- Thales Group

- thyssenkrupp AG

- Universal Robots A/S by Teradyne, Inc.

- Yamaha Motor Co., Ltd.

- Yaskawa Electric Corporation

- Zebra Technologies Corporation

Table Information

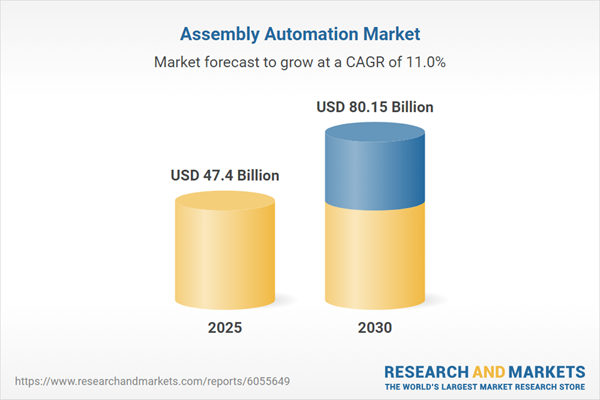

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 47.4 Billion |

| Forecasted Market Value ( USD | $ 80.15 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |