Speak directly to the analyst to clarify any post sales queries you may have.

The biopharmaceutical TPE tubing market is evolving rapidly, requiring senior stakeholders to proactively align purchasing, compliance, and operational strategies with advancements in technology and shifting regulatory requirements. Strategic foresight is necessary to remain resilient and competitive as industry dynamics accelerate.

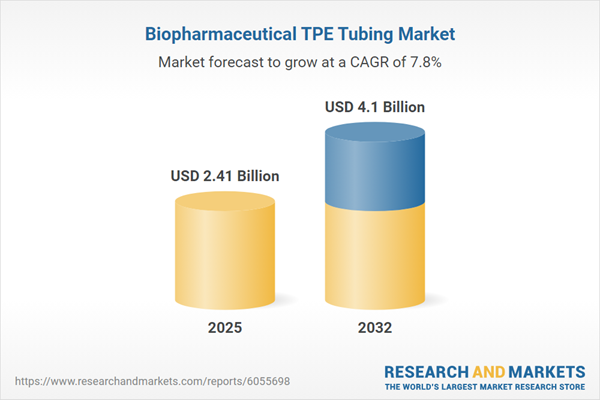

Market Snapshot: Biopharmaceutical TPE Tubing Market

The Biopharmaceutical TPE Tubing Market expanded from USD 2.25 billion in 2024 to USD 2.41 billion in 2025. It is projected to continue its upward trajectory, reaching USD 4.10 billion by 2032 at a CAGR of 7.81%. This robust growth reflects sustained demand for specialized tubing solutions, with industry players emphasizing enhanced operational reliability and adherence to evolving regulatory mandates. Decision-makers are adapting to greater supply chain complexity, recognizing the need for comprehensive solutions that can support demanding bioprocessing applications and streamline compliance.

Scope & Segmentation of the Biopharmaceutical TPE Tubing Market

- Material Type: Polyolefin elastomers, styrenic block copolymers, thermoplastic polyurethane (TPU), and thermoplastic vulcanizates (TPV) all offer a diverse range of chemical resistance and durability, backing tailored use in varying bioprocess applications from media transfer to critical sampling.

- Tubing Type: Braided reinforced tubing, multi-lumen variants, and non-reinforced formats serve workflow-specific performance requirements, addressing the needs of fluid dynamics in complex biopharmaceutical production environments.

- Product Form: Bulk coils, spools, pre-cut tubing, and sterile tubing sets or manifolds support both high-volume processes and specialized tasks, offering flexibility for end users scaling batches or handling niche applications.

- Functional Grade: General transfer, pump grade, and high-pressure options enable adaptation to multiple production environments, supporting both standard transfers and demanding process conditions without compromising quality.

- Inner Diameter/Size Class: Large-bore, micro-flow, and standard bioprocess sizes deliver compatibility with diverse systems, improving integration and operational efficiency in settings ranging from research to production.

- Size Specifications: Inner diameters, coil lengths, and wall thickness options meet strict guidelines for mechanical performance and long-term durability, minimizing contamination risk and process variability.

- Packaging: Cleanroom packaging, gamma-sterilized double-bagged solutions, non-sterile bulk, and pre-assembled sterile manifolds all provide appropriate safety and setup features supporting rapid, compliant deployment.

- Application: Market applications include downstream processing such as chromatography and filtration, fill-finish operations for aseptic transfers, upstream roles in buffer and media handling, and utilities that require precise storage and transfer.

- End User: Key segments encompass academic institutions, biopharmaceutical manufacturers, cell and gene therapy developers, diagnostic laboratories, and contract manufacturing organizations, each prioritizing process integrity and regulatory compliance.

- Distribution Channel: Direct sales, distribution partners, and online platforms ensure product accessibility and support a global supply framework for customers across mature and developing regions.

- Regional Coverage: The Americas, Europe, Middle East & Africa, and Asia-Pacific regions all drive ongoing market activity, with both established and emerging players responding to the diverse regulatory and operational needs unique to each geography.

- Competitive Landscape: Leaders include DuPont de Nemours, Compagnie de Saint-Gobain, Avantor, Avient, BiomatiQ Scientific, Eldon James, Entegris, FOXX Life Science, Freudenberg Medical, IDEX Health & Science, Medline Industries, Meridian Industries, NewAge Industries, Nordson, Optinova Holding, Qosina Corp., Raumedic AG, SaniSure, Seisa Group, TE Connectivity, Tekni-Plex, Thermo Fisher Scientific, W. L. Gore & Associates, Watson-Marlow Fluid Technology Group, and WHK BioSystems.

Key Takeaways for Senior Decision-Makers

- Advancements in digital monitoring and polymer technology are setting new standards for quality and traceability, encouraging more robust systems for end-to-end process validation.

- Market uptake of modular production technologies and continuous manufacturing is driving a strong need for tubing solutions supporting accelerated changeovers and minimized contamination risks.

- Organizations are prioritizing environmental responsibility, with procurement teams integrating recyclable and biodegradable tubing materials into sourcing strategies to balance sustainability and compliance.

- Diversified regional sourcing, including domestic and nearshore options, is increasingly important for supply security and adherence to varied regional regulations.

- Comprehensive documentation for traceability and regulatory validation is now expected across the product lifecycle by both regulators and industry customers.

Tariff Impact on Biopharmaceutical TPE Tubing

The introduction of U.S. tariffs on imported thermoplastic elastomer resins in 2025 is impacting sourcing models across the sector. Organizations are strengthening supply chain resilience by shifting toward domestic and near-shore resin sources. This adjustment is catalyzing vertical integration within the value chain, helping reduce vulnerabilities tied to international trade shifts while supporting ongoing manufacturing reliability in a dynamic policy climate.

Methodology & Data Sources

This market report leverages interviews with senior executives, leading tubing manufacturers, and material experts. Supplemented by analysis of regulatory filings, technical documentation, and procurement datasets, these inputs collectively establish an evidence-based resource designed for executive decision-making.

Why This Report Matters for B2B Leaders

- Supports technology and material investment decisions aligned with fast-changing regulations and operational priorities.

- Provides actionable segmentation to refine sourcing, risk management, and entry strategies across multiple regional and functional domains.

- Delivers industry-validated benchmarks for supplier evaluation and regulatory compliance, enhancing confidence in procurement strategies.

Conclusion

Senior leaders who anticipate shifts in technology, supply chains, and regulatory frameworks are better positioned for sustainable growth. Effective adaptation to market changes fosters resilience and secures competitive advantage in the evolving biopharmaceutical TPE tubing landscape.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Biopharmaceutical TPE Tubing market report include:- DuPont de Nemours, Inc.

- Compagnie de Saint-Gobain

- Avantor, Inc.

- Avient Corporation

- BiomatiQ Scientific Pvt. Ltd.

- Eldon James Corporation

- Entegris, Inc.

- FOXX Life science

- Freudenberg Medical, LLC.

- IDEX Health & Science LLC

- Medline Industries, LP

- Meridian Industries, Inc

- NewAge Industries

- Nordson Corporation

- Optinova Holding Ab

- Qosina Corp.

- Raumedic AG by REHAU Group

- SaniSure

- Seisa Group, Inc.

- TE Connectivity Ltd.

- Tekni-Plex, Inc.

- Thermo Fisher Scientific Inc.

- W. L. Gore & Associates, Inc.

- Watson-Marlow Fluid Technology Group

- WHK BioSystemss, LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.41 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |