Speak directly to the analyst to clarify any post sales queries you may have.

Senior executives navigating the alcoholic beverage sector will find the low carb beer market at a pivotal stage, shaped by accelerating health trends, evolving production technologies, and dynamic consumer expectations. This analysis equips leaders with actionable intelligence to inform market strategies and investment decisions as the landscape transforms.

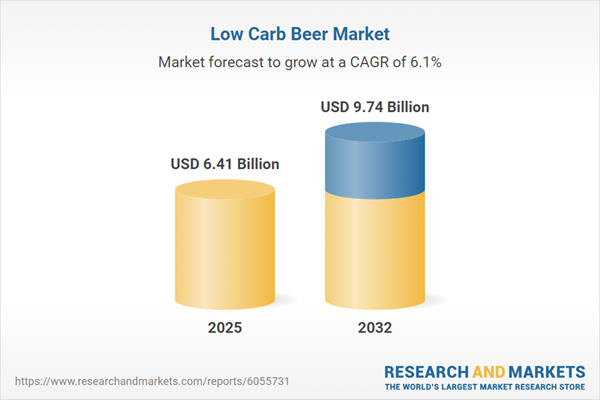

Market Snapshot: Low Carb Beer Market Size and Growth Trends

The low carb beer market grew from USD 6.07 billion in 2024 to USD 6.41 billion in 2025, and is projected to reach USD 9.74 billion by 2032 at a CAGR of 6.09%. This expansion reflects heightened consumer focus on health and wellness, as well as industry adaptation to contemporary drinking habits and ingredient preferences. Market momentum is supported by both established brewers and a wave of innovation from craft and specialty producers.

Scope & Segmentation of the Low Carb Beer Market

- Product Types: Craft beer, light beer, and non-alcoholic beer each address unique consumer motivations, ranging from artisanal appeal to calorie moderation and alcohol abstinence.

- Alcohol Content Categories: High-alcohol (above 6% ABV), low-alcohol (under 4% ABV), and standard-alcohol (4–6% ABV) segments serve varied tastes and occasions—from full-bodied options to beverages designed for moderation.

- Packaging Formats: Cans, glass bottles, and kegs offer solutions for portability, eco-consciousness, and premium experience; each impacts consumer perception and downstream logistics.

- Distribution Channels: Online sales, bars and restaurants, liquor stores, and supermarkets & hypermarkets balance digital access with crucial offline visibility and sampling opportunities.

- Key Geographic Regions: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan) each drive demand through regional consumer preferences, regulatory factors, and local partnerships.

- Leading Players: Comprehensive analysis includes companies like Anheuser-Busch InBev, Asahi Breweries, Carlsberg, Heineken, Sapporo, SweetWater Brewing Company, Yuengling Brewery, Brewdog plc, Diageo, and others contributing to competitive diversity and innovation.

Key Takeaways for Senior Decision-Makers

- The low carb beer market is driven by consumer desire to balance taste with mindful consumption, attracting new demographics and expanding traditional beer audiences.

- Producers leverage functional ingredients and advanced brewing methods to offer flavor-forward products with reduced carbohydrates, meeting evolving sensory and nutritional standards.

- Digital platforms and e-commerce provide access to niche brands, facilitate rapid adoption of new SKUs, and enable real-time feedback on launches and brand storytelling.

- Strategic supplier relationships and technological collaborations support robust supply chains, assist with agile product formulation, and help mitigate regulatory risks.

- Sustainability and ingredient transparency are at the forefront of marketing narratives as companies seek to earn trust and differentiate offers, especially in premium and mature consumer segments.

- Segment diversity—from packaging format to alcohol content—enables stakeholders to tailor portfolios and channel strategies to capture growth across regions and occasions.

Tariff Impact in the Low Carb Beer Market

Recent United States tariff adjustments have created input cost variability for brewers relying on internationally sourced malt, hops, equipment, and packaging materials. To address these challenges, many producers are forming strategic partnerships with domestic suppliers and adopting nearshoring initiatives. These tactics reduce tariff exposure, improve supply chain resilience, and support localized product adaptation in response to shifting regulatory and market environments.

Methodology & Data Sources

This report employs a rigorous blend of qualitative and quantitative techniques, including executive interviews, in-depth consumer surveys, trade reports, and regulatory analysis. Findings are triangulated across proprietary and public databases to ensure validity, with external expert review further enhancing reliability.

Why This Report Matters to Your Strategy

- Leverage nuanced segmentation and regional insights to inform targeted product launch, distribution, and marketing investments.

- Understand supply chain and regulatory pressures so you can future-proof procurement, vendor management, and innovation programs.

- Align your portfolio with health, sustainability, and digital-first preferences to build brand equity and accelerate category penetration.

Conclusion

The low carb beer market’s ongoing expansion is defined by consumer-centric innovation, adaptive supply strategies, and the interplay of regulatory and competitive factors. Timely, evidence-based insight allows industry leaders to make confident decisions and capitalize on this evolving landscape.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Low Carb Beer market report include:- Anheuser-Busch InBev

- Asahi Breweries, Ltd.

- Bavaria S.A.

- Bell's Brewery, Inc.

- Brewdog plc

- Brooklyn Brewery

- Carlsberg Breweries A/S.

- Constellation Brands, Inc.

- Diageo plc

- Firestone Walker Brewing Company by Duvel Moortgat Brewery

- Founders Brewing Co. by Mahou San Miguel

- Great Lakes Brewing Company

- Heineken N.V.

- Kirin Brewery Company, Limited

- Lion Corporate

- Molson Coors Beverage Company

- New Glarus Brewing Company

- Odell Brewing Company, Inc.

- Samuel Adams by Boston Beer Company

- San Miguel Corporation

- Sapporo Breweries Ltd.

- Sierra Nevada Brewing Co.

- SweetWater Brewing Company, LLC

- Yuengling Brewery

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 6.41 Billion |

| Forecasted Market Value ( USD | $ 9.74 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |