Speak directly to the analyst to clarify any post sales queries you may have.

The isoparaffin market stands at a complex intersection of regulatory transformation, sustainability imperatives, and heightened performance demands. Senior executives navigating this landscape face critical decisions as isoparaffins increasingly underpin innovation, operational resilience, and competitive advantage across a range of industries.

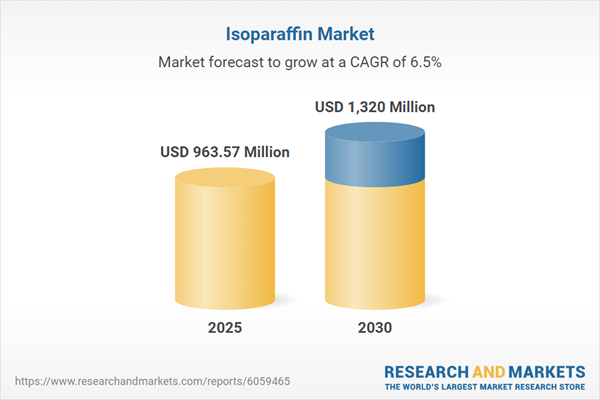

Isoparaffin Market Snapshot

The isoparaffin market expanded from USD 906.55 million in 2024 to USD 963.57 million in 2025 and is projected to reach USD 1.32 billion by 2030, advancing at a CAGR of 6.50%. Market growth is powered by innovation, the uptake of sustainability-minded processes, and regulatory evolution. Major application sectors include personal care, lubricants, coatings, and specialty chemicals. As each of these sectors increases its focus on safety and regulatory alignment, manufacturers are refining their sourcing and production strategies to strengthen compliance and boost product efficacy. Shifts in application techniques and processing practices further underscore the market's response to operational and policy-driven forces.

Scope & Segmentation of the Isoparaffin Market

This report presents a comprehensive evaluation of the isoparaffin market structure, with actionable segmentation insights for investment, procurement, and supply chain planning on a global scale. The following dimensions define the landscape:

- Type: Includes High Carbon Isoparaffins, Low Carbon Isoparaffins, and Medium Carbon Isoparaffins. Type impacts applications in various industries, affecting volatility, solvency, and use-case versatility.

- Grade Type: Covers Cosmetic & Pharmaceutical Grade, High Purity Grade, and Industrial Grade. Each grade aligns with sector-specific regulatory and quality requirements, influencing supply decisions and safety benchmarking.

- Production Method: Encompasses Alkylation, Fischer-Tropsch Process, Hydrocracking, and Isomerization. The choice of production influences operational efficiency, carbon footprint, and the resulting chemical profile.

- Functionality: Spans roles as Carrier Fluid, Cleaning Agent, Dispersant, Emollient, Lubricant, and Solvent. Functionality determines value across multiple downstream applications, enabling tailored solutions.

- Application: Incorporates Agrochemicals, Automotive, Cosmetics & Personal Care, Industrial Cleaning, Metalworking, Paints & Coatings, Pharmaceuticals, and Polymers & Plastics. Each application area brings unique compliance and formulation demands.

- Distribution Channel: Differentiates between Offline and Online pathways. Distribution strategy affects market reach, logistics complexity, and customer engagement.

- Region: Americas, Europe, Middle East & Africa, and Asia-Pacific. Regional nuances shape market entry, growth strategy, and regulatory adaptation, with specific countries included in each area.

- Key Companies: Features Arham Petrochem Private Limited, Braskem S.A., Calumet Specialty Products Partners, L.P., Chevron Phillips Chemical Company LLC, Dowpol Corporation, Exxon Mobil Corporation, Idemitsu Kosan Co., Ltd., Mehta Petro Refineries Limited, RB Products, Inc., Shell PLC, TotalEnergies SE, ITW Reagents, S.R.L., OLEOTECNICA S.p.A., Zhejiang Ouya Petrochemical Co., Ltd., Eil Industrial Co., LTD., Sasol Limited, CORECHEM Inc., GIHI CHEMICALS CO., LIMITED, Hefei TNJ Chemical Industry Co.,Ltd., Zhengmao Petrochemical Co., Ltd., Marine Chemicals, INEOS Group Holdings S.A. This segmentation reveals a broad competitive landscape with both global and regional players.

Key Takeaways for Senior Decision-Makers

- Isoparaffins offer the formulation flexibility needed to address rigorous regulatory, safety, and environmental objectives across diverse application sectors.

- Digitization, including advanced process control and monitoring, enhances real-time optimization, allowing early detection of quality deviations and continuous performance improvements in manufacturing operations.

- The transition to renewable sourcing models and circular economy initiatives is reshaping supply portfolios, driving organizations to strengthen their approach to environmental stewardship.

- Collaborative research and technology sharing, combined with integrated supply networks, empower companies to deliver specialized end-use solutions aligned with dynamic market expectations.

- Regional differentiation is increasingly important, requiring companies to implement localized strategies that adjust to evolving policy landscapes, bio-based trends, and changing customer demands.

Impact of United States Tariff Policy on Isoparaffin Trade

Recent changes in U.S. tariff structures have prompted industry leaders to reassess supply contracts and rethink logistics. These shifts have expanded sourcing options and led to greater procurement diversification. As organizations adapt, some have updated pricing models to manage cost increases—either absorbing additional charges or passing them along the value chain. This has influenced cross-border contract negotiations and placed renewed emphasis on agile supply chain strategies to navigate shifting geopolitical risk and adjust to new tariff-related cost structures.

Research Methodology & Data Sources

The findings in this report are grounded in secondary research from technical literature, regulatory records, and industry sources, complemented by primary interviews with industry executives and technical experts. Triangulated analysis and structured frameworks, alongside expert validation, support robust and reliable conclusions.

Why This Isoparaffin Market Report Matters

- Directs senior leaders to actionable insights for linking technology trends, regulatory changes, and sustainability priorities with effective isoparaffin market strategies.

- Delivers thorough segmentation and geographic insights to guide targeted decision-making in investment and procurement planning.

- Offers strategic recommendations for organizations to remain adaptable during tariff shifts, digital transformation, and industry-wide sustainability transitions.

Conclusion

This research equips executives with the intelligence needed to navigate changing regulatory, technological, and regional environments, supporting stronger strategic responses and new growth opportunities in the isoparaffin sector.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Isoparaffin market report include:- Arham Petrochem Private Limited

- Braskem S.A.

- Calumet Specialty Products Partners, L.P.

- Chevron Phillips Chemical Company LLC

- Dowpol Corporation

- Exxon Mobil Corporation

- Idemitsu Kosan Co., Ltd.

- Mehta Petro Refineries Limited

- RB Products, Inc.

- Shell PLC

- TotalEnergies SE

- ITW Reagents, S.R.L.

- OLEOTECNICA S.p.A.

- Zhejiang Ouya Petrochemical Co., Ltd.

- Eil Industrial Co., LTD.

- Sasol Limited

- CORECHEM Inc.

- GIHI CHEMICALS CO., LIMITED

- Hefei TNJ Chemical Industry Co.,Ltd.

- Zhengmao Petrochemical Co., Ltd.

- Marine Chemicals

- INEOS Group Holdings S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 963.57 Million |

| Forecasted Market Value ( USD | $ 1320 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |