Furthermore, greater awareness about the benefits of modern surgical implants in animals has created new opportunities for industry participants. Investments in animal healthcare infrastructure in emerging economies have further reinforced market expansion. Additionally, ongoing R&D efforts are focused on developing cost-effective and user-friendly implant technologies, which are expected to significantly boost adoption rates across both developed and developing markets.

Veterinary orthopedic procedures are in particularly high demand for treating musculoskeletal conditions in companion animals. The prevalence of injuries and degenerative diseases in animals, especially those involving joints and ligaments, continues to rise, prompting increased use of surgical implants. Demand is also climbing for bioabsorbable implant materials that dissolve naturally in the body, eliminating the need for follow-up removal surgeries.

These materials, often developed using polymers like polylactic acid and polyglycolic acid, are gaining popularity for their safety, efficiency, and cost advantages. Innovations such as smart implants embedded with sensors or drug-releasing coatings are also becoming more prominent. These devices help monitor healing processes and reduce post-operative infections, further enhancing treatment outcomes.

In terms of product type, the market is segmented into implants and instruments. The implants category is further broken down into plates, joint implants, bone screws and anchors, pins and wires, and other related components. This segment led the market in 2024, reaching a valuation of USD 442 million, and is expected to grow to USD 977.9 million by 2034. This dominance can be attributed to growing awareness around orthopedic care in pets and the increasing availability of sophisticated implant technologies.

By animal type, the market is categorized into small and medium animals and large animals. The small and medium animals segment - which includes dogs, cats, and other similarly sized animals - accounted for 72.6% of the market share in 2024 and is projected to expand at a CAGR of 8.5% through 2034. Growth in this segment is driven by the rising global pet population and the increasing frequency of orthopedic issues, such as fractures and joint disorders. Additionally, enhanced accessibility to surgical treatments and a greater willingness among pet owners to invest in high-quality care are further propelling segment growth.

When analyzed by application, the market includes procedures such as Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), joint replacement, trauma, and other uses. Among these, TPLO surgery remains a primary application, accounting for USD 141.2 million in 2024, and is projected to grow to USD 303.2 million by 2034, with a CAGR of 8.1%. This procedure is particularly known for restoring joint stability and promoting faster recovery in animals suffering from ligament injuries.

On the basis of end use, the market is segmented into veterinary hospitals and clinics and other veterinary care facilities. In 2024, veterinary hospitals and clinics dominated with a market value of USD 537.1 million, expected to reach USD 1.2 billion by 2034 at a CAGR of 8.5%. The robust presence of well-equipped clinics and hospitals, paired with the growing demand for comprehensive veterinary care, has been instrumental in driving this segment forward. Clinics and hospitals also serve as the initial point of consultation for most pet owners, making them key contributors to overall market revenue.

Geographically, North America led the global market in 2024, holding a share of 41.9%. High levels of pet ownership, rising disposable incomes, and strong demand for advanced veterinary care are core factors fueling regional growth. The region also benefits from the presence of several major veterinary implant manufacturers, streamlined regulatory pathways, and substantial clinical research activities, all of which contribute to the continued expansion of this market.

The market is moderately consolidated, with key players adopting strategies such as acquisitions, partnerships, product innovation, and R&D investments to maintain their competitive edge. The top five companies - DePuy Synthes (Johnson & Johnson), Movora (Vimian Group), Veterinary Instrumentation, Arthrex Vet Systems, and Rita Leibinger GmbH - collectively accounted for approximately 60% of global market revenue. These firms continue to focus on expanding their portfolios and entering new markets to address the growing global need for veterinary orthopedic care.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this veterinary orthopedic implants market report include:- AmerisourceBergen Corporation (Cencora- Inc.)

- Arthrex Vet Systems

- B. Braun

- BlueSAO

- DePuy Synthes (Johnson & Johnson)

- Fusion Implants

- GerVetUSA

- GPC Medical Ltd.

- Integra LifeSciences

- Movora (Vimian Group)

- Narang Medical Limited

- Ortho Max

- Orthomed

- Rita Leibinger

- Veterinary Instrumentation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

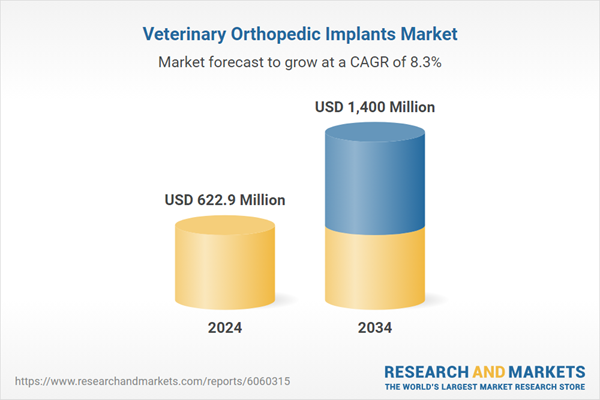

| Estimated Market Value ( USD | $ 622.9 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |