The integration of cutting-edge technologies, including 3D-printed implants and bioengineered tissue scaffolds, is further driving market expansion. The growing focus on personalized treatment approaches and enhanced implant safety standards has led to significant product innovations. As regulatory frameworks evolve, manufacturers are prioritizing biocompatibility and durability in their implant designs, ensuring long-term efficacy and patient satisfaction. Moreover, the rising prevalence of breast cancer globally, coupled with an increase in the number of women undergoing mastectomy procedures, is expected to fuel the market’s upward trajectory over the next decade. Emerging markets, particularly in Asia-Pacific and Latin America, are experiencing a surge in demand for breast reconstruction procedures due to improved healthcare infrastructure and rising disposable incomes.

The breast reconstruction market is categorized into various product segments, including implants, tissue expanders, acellular dermal matrices, and other related products. Implants hold the largest market share, valued at USD 326.9 million in 2024, and include both silicone and saline breast implants. Silicone implants have gained substantial popularity due to their enhanced durability, cohesive gel formulations, and textured surface designs, which contribute to a more natural feel and improved safety profiles. Innovations in implant technology are expected to continue shaping market trends, with companies investing heavily in research and development to refine implant longevity and biocompatibility.

Breast reconstruction procedures are broadly classified into unilateral and bilateral reconstructions. In 2024, the unilateral breast reconstruction segment accounted for USD 299.4 million and is anticipated to grow at a CAGR of 4.5% from 2025 to 2034. This segment’s growth is primarily driven by an increasing demand for aesthetic symmetry following mastectomy. Patients seeking unilateral reconstruction are often focused on restoring balance and achieving a natural appearance, leading to a steady rise in surgical volumes. The availability of advanced surgical techniques and implant materials is further contributing to the segment’s sustained expansion.

The U.S. Breast Reconstruction Market generated USD 219.8 million in 2024, continuing its upward trend from previous years. This segment is set to grow at a CAGR of 4.4% between 2025 and 2034, driven by the presence of leading breast implant manufacturers dedicated to product innovation and enhanced safety measures. The U.S. market benefits from a strong healthcare infrastructure, high patient awareness, and a well-established reimbursement framework that encourages more women to opt for reconstructive procedures. Companies in the region are focusing on technological advancements, such as improved implant textures and bioengineered solutions, to meet the evolving needs of both patients and healthcare providers.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Breast Reconstruction market report include:- AbbVie

- arion LABORATORIES

- BIMINI HEALTH TECH

- CEREPLAS

- Establishment Labs

- GC Aesthetics

- HANSBIOMED

- INTEGRA

- Johnson & Johnson

- POLYTECH Health & Aesthetics

- RTI Surgical

- Sebbin

- Sientra

- SILIMED

- Wanhe

Table Information

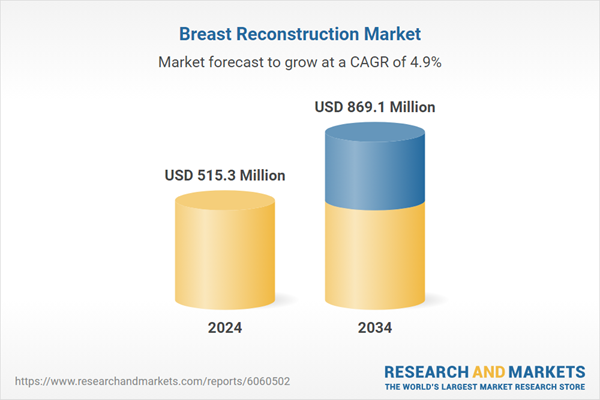

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | February 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 515.3 Million |

| Forecasted Market Value ( USD | $ 869.1 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |