Industrial PC Market Size:

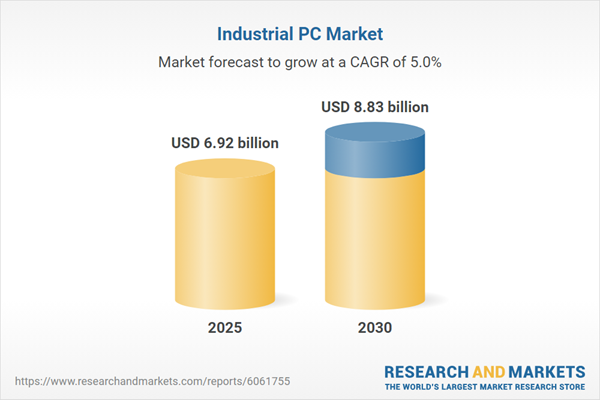

The industrial PC market is expected to grow from USD 6.916 billion in 2025 to USD 8.827 billion in 2030, at a CAGR of 5.00%.Industrial PCs represent specialized computing systems designed specifically for industrial applications, delivering high reliability and efficiency in demanding operational environments. These computers are engineered to operate under harsh environmental conditions including extreme temperatures, high humidity, shock, and vibration while maintaining extended product life cycles. The global industrial PC market demonstrates robust growth potential driven primarily by the worldwide rise in industrial automation across manufacturing and industrial sectors.

Market Segmentation

The industrial PC market classification encompasses multiple dimensions including type-based segmentation featuring Embedded IPC, DIN Rail IPC, Panel IPC, Box IPC, and Rack Mount IPC solutions. End-user segmentation includes IT & telecommunications, chemical, aerospace & defense, semiconductor & electronics, energy & power, automotive, and other industrial sectors. Geographic market analysis covers North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions.Growth Drivers

Industrial Automation Expansion

The primary growth driver for the industrial PC market stems from accelerating industrial automation adoption worldwide. Companies increasingly integrate IoT technology and automated systems, creating substantial demand for industrial PCs and robotics to handle complex industrial processes. Recent industry data indicates significant growth in industrial robot sales, with the North American region experiencing notable expansion. The automotive sector represents a major contributor to industrial robot adoption, while non-automotive sectors also demonstrate strong growth patterns.Industrial automation provides numerous operational advantages including increased production output rates, improved quality and consistency, enhanced product manufacturing flexibility, better working conditions, reduced material waste with increased yield, space optimization, and cost reduction. These compelling benefits drive companies to accelerate industrial automation adoption, creating sustained demand for industrial PC solutions throughout the forecast period.

Technological Integration Benefits

The integration of advanced technologies enhances industrial PC value propositions through improved productivity, reduced operational costs, and superior product quality. These advantages position industrial PCs as essential components in modern manufacturing environments where efficiency and reliability are critical success factors.Market Restraints

High Initial Investment Requirements

Despite numerous operational advantages, industrial PCs present significant barriers through high initial investment costs. The specialized features, additional components, and enhanced capabilities that distinguish industrial PCs from traditional computers result in substantially higher pricing, creating adoption challenges for potential users. These elevated costs often prevent companies from implementing industrial PC solutions, hindering overall market growth.Operational and Maintenance Challenges

Industrial PCs require substantial repair and maintenance investments while occupying considerable physical space, creating inconvenience particularly for smaller firms. Additionally, operating industrial PCs demands skilled personnel, necessitating further investment in training programs and specialized expertise. These factors combine to create ongoing operational expenses that may obstruct market growth until pricing becomes more accessible.Recent Market Developments

Industry innovation continues advancing through new product launches and technological enhancements. Recent developments include the introduction of compact industrial computers featuring enhanced performance and expansion flexibility, incorporating wireless transmission capabilities including Wi-Fi, 5G, and GNSS technologies alongside specialized I/O interfaces for industrial applications.Advanced industrial PC solutions now feature enhanced AI capabilities with significantly accelerated processing power, enabling complex AI task execution in advanced industrial automation settings, AI-based robotics, predictive maintenance, and quality inspection applications.

Geographic Market Analysis

Asia Pacific Growth Leadership

The Asia Pacific region demonstrates the highest anticipated market growth due to large-scale manufacturing presence, particularly in countries like China. Growing IoT and artificial intelligence penetration within the region supports industrial automation expansion, driving industrial PC market growth during the forecast period.North American Market Position

North America maintains significant market share through technological advancement leadership in countries including the United States and Canada, supporting continued market development and adoption.Competitive Landscape

The industrial PC market features prominent players including Mitsubishi Electric Corporation, OMRON Corporation, and Rockwell Automation, Inc. These companies implement various growth strategies to maintain competitive advantages through technological innovation, strategic partnerships, and market expansion initiatives that strengthen their positions in the evolving industrial PC marketplace.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Industrial PC Market Segments:

By Type

- Embedded IPC

- DIN Rail IPC

- Panel IPC

- Box IPC

- Rack Mount IPC

By Application

- Communication & Network Infrastructure

- Digital Security & Surveillance

- Digital Signage

- Gaming

- Medical

- Instrumentation/Test Automation

- Others

By End-User

- IT & Telecom

- Chemical

- Aerospace & Defense

- Semiconductor & Electronics

- Energy & Power

- Automotive

- Others

By Geography

North America

- USA

- Canada

- Mexico

South America

- Brazil

- Argentina

- Others

Europe

- Germany

- France

- United Kingdom

- Spain

- Others

Middle East and Africa

- Saudi Arabia

- UAE

- Others

Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Siemens AG

- Schneider Electric

- Kontron S&T AG

- Beckhoff Automation GmbH & Co. KG

- Industrial PC, Inc.

- Lanner Electronics Incorporated

- Advantech Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 6.92 billion |

| Forecasted Market Value ( USD | $ 8.83 billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |