Alongside this, the industry is witnessing a major transition toward sustainable, organic CBD farming practices, resulting in more efficient and cost-effective extraction methods that are benefiting both new and established players. The rising inclination toward eco-friendly production methods is creating opportunities for brands to cater to environmentally conscious consumers while maintaining high-quality standards. Additionally, favorable regulatory frameworks, particularly in key markets such as the United States, are encouraging further investments and driving innovation in the CBD nutraceuticals space.

The market is segmented into several product categories, including CBD oils, tinctures, capsules, soft gels, gummies, and other forms. CBD oils have emerged as the most popular segment, generating USD 3 billion in 2023. These oils, known for their high absorption rate and ease of use, provide effective relief from chronic pain, stress, and anxiety. Administered sublingually, CBD oils act quickly and efficiently, making them a preferred choice for individuals seeking fast-acting and long-lasting effects. Available in various concentrations, these oils cater to a wide range of consumer preferences and therapeutic needs, making them one of the most versatile products in the market.

The application of CBD nutraceuticals spans across pain management, sleep disorders, mental health, stress reduction, and other health concerns. The pain management segment dominated the market with a significant share of 35.5% in 2024, driven by the increasing prevalence of chronic pain conditions such as arthritis, fibromyalgia, and migraines. CBD’s proven anti-inflammatory and analgesic properties have positioned it as a safer and more effective alternative to traditional pain medications, which often come with undesirable side effects. Both healthcare providers and patients are increasingly opting for CBD due to its non-addictive nature and ability to provide sustained relief.

The U.S. CBD nutraceuticals market is projected to generate USD 25.7 billion by 2034, maintaining a robust CAGR of 17.5% from 2025 to 2034. As the largest market for CBD nutraceuticals globally, the U.S. benefits from favorable regulations, high consumer awareness, and increasing acceptance of cannabis-derived products. The growing incidence of chronic conditions, including arthritis, anxiety, and sleep disorders, has further fueled the demand for CBD-based nutraceuticals in the region. The evolving regulatory landscape and ongoing research into the therapeutic potential of CBD are expected to drive sustained growth, positioning the U.S. market at the forefront of the global CBD nutraceuticals industry.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this CBD Nutraceuticals market report include:- Bluebird Botanicals

- Charlotte's Web

- CV Sciences

- Diamond CBD

- Elixinol

- ENDOCA

- Foria Wellness

- Garden of Life (Nestle)

- Green Roads

- Irwin Naturals

- Isodiol

- Medical Marijuana

- MEDTERRA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | March 2025 |

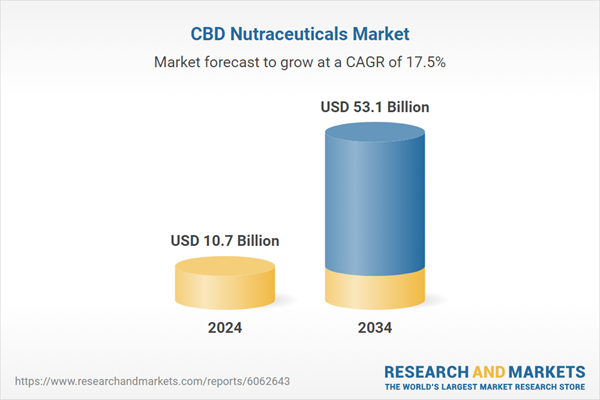

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 10.7 Billion |

| Forecasted Market Value ( USD | $ 53.1 Billion |

| Compound Annual Growth Rate | 17.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |