The growing demand for eco-friendly packaging across the food, beverage, cosmetics, and pharmaceutical sectors is fueling the adoption of glass containers. Manufacturers are also capitalizing on the aesthetic appeal of glass, which offers a premium and high-end look, making it an ideal choice for luxury and artisanal products. Moreover, ongoing innovations in lightweight and recyclable glass packaging solutions are helping companies meet evolving regulatory standards and consumer expectations. The increasing shift toward circular economy models and sustainable packaging practices is further driving growth in this market as businesses aim to reduce their carbon footprint and appeal to environmentally conscious consumers.

The market is segmented based on glass type, including type 1, type 2, and type 3 grades. Among these, the type 3 segment is set to grow at a CAGR of 4.3% from 2025 to 2034. The surging demand for alcoholic beverages, including beer, wine, and spirits, is fueling the need for type 3 glass packaging, which is highly favored for its affordability, clarity, and recyclability. Consumers and manufacturers are increasingly leaning toward packaging solutions that align with sustainability goals, and type 3 glass perfectly fits this requirement. In addition to beverages, type 3 glass is widely used in the food industry for packaging products such as pickles, jams, sauces, and baby food, offering an ideal combination of cost-effectiveness and high-quality presentation.

Retail glass packaging is also classified based on end-use industries, including food and beverage, cosmetics, pharmaceuticals, and household goods. The food and beverage segment alone generated USD 3.5 billion in 2024, propelled by the growing preference for premium, organic, and artisanal products. Glass packaging stands out as the top choice for brands focusing on product purity, safety, and visual appeal. It is increasingly used for packaging luxury beverages like craft beer, gourmet sauces, and specialty drinks, catering to consumers seeking quality and environmentally responsible packaging.

The U.S. Retail Glass Packaging Market generated USD 2.7 billion in 2024, driven by the escalating demand for premium alcoholic beverages, craft spirits, and sustainable packaging solutions. American consumers are prioritizing high-quality packaging that not only maintains product integrity but also aligns with eco-conscious values, making glass packaging a compelling solution for brands targeting this market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Retail Glass Packaging market report include:- AGI Glaspac

- Ardagh Group

- Beatson Clark

- Calaso

- Gerresheimer

- Glassco

- Heinz-Glas

- Jarsking

- O-I Glass

- PGP Glass

- Quadpack Industries

- Saverglass

- Schott

- Stoelzle Glass Group

- Verallia

- Vetropack Holding

- Vidrala

- Vitro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

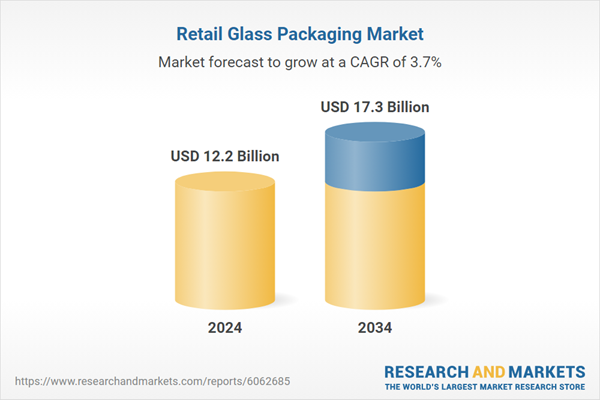

| Estimated Market Value ( USD | $ 12.2 Billion |

| Forecasted Market Value ( USD | $ 17.3 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |