As businesses worldwide continue to emphasize efficiency and sustainability, FIBCs are gaining traction due to their eco-friendly properties, reusability, and compliance with international packaging standards. The growing preference for sustainable bulk packaging, particularly in developed regions, is further supporting market expansion. The rise of e-commerce has also played a pivotal role as online retailers and logistics companies increasingly adopt FIBCs for cost-effective and secure bulk transportation. In sectors such as pharmaceuticals and food processing, these containers ensure contamination-free storage and transit, adhering to strict hygiene and safety regulations. Moreover, continuous innovations in FIBC technology, including moisture-resistant, UV-protected, and anti-static bags, are making them more adaptable to diverse industrial needs.

The 250kg-750kg segment generated USD 2.5 billion in 2024, primarily catering to medium-sized industries such as agriculture, food processing, and construction. These containers provide a cost-efficient solution for handling large volumes of goods while reducing labor costs and improving operational efficiency. The demand for hygienic and contamination-free packaging is growing across various industries, particularly in food, chemicals, and pharmaceuticals, where safety and regulatory compliance are paramount. The increasing adoption of advanced bulk packaging solutions in these sectors is expected to sustain the segment’s upward trajectory over the coming decade.

Among the key application areas, the food and beverage industry stands out as the fastest-growing segment, anticipated to expand at a CAGR of 7.2% from 2025 to 2034. Stricter government regulations regarding hygienic food packaging, coupled with the rising global trade of grains, pulses, and other food commodities, are driving this growth. The need for reliable and large-capacity bulk packaging solutions has led to an increased demand for FIBCs in the food sector. Furthermore, advancements in FIBC materials and designs, including tamper-proof, moisture-resistant, and UV-shielded options, are enhancing their appeal, ensuring product integrity during long-distance transportation.

The United States Flexible Intermediate Bulk Container (FIBC) Market generated USD 985.6 million in 2024, driven by robust demand from the pharmaceutical, food, and chemical industries. Stricter sustainability regulations, coupled with an increasing shift toward cost-effective and environmentally friendly packaging solutions, are propelling market growth. Businesses across the U.S. are prioritizing efficient material handling, with FIBCs emerging as a preferred choice for reducing operational costs and improving productivity. The heightened focus on sustainable and hygienic packaging in industries such as food processing, pharmaceuticals, and chemicals has further strengthened the demand for these bulk containers, positioning the market for steady expansion in the years ahead.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Flexible Intermediate Bulk Container (FIBC) market report include:- Bag Corp

- Berry Global Group Inc.

- Bulk Container Europe BV

- Bulk Lift International

- C.L. Smith

- FlexiblePackagingSolutions.com

- Global-Pak

- Halsted

- Intertape Polymer Group

- Isbir Sentetik

- Jumbo Bag Limited

- Langston Companies Inc.

- LC Packaging International BV

- Masterpack Group

- Palmetto Industries International Inc.

- Rishi FIBC Solutions

- Taihua Group

Table Information

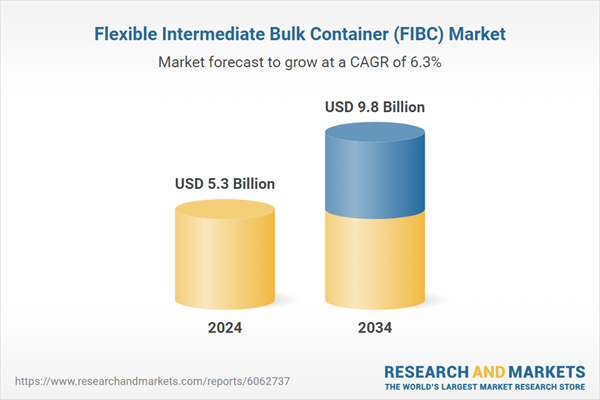

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 9.8 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |