As businesses seek reliable and clean energy solutions, fuel cells are increasingly used to provide power in critical areas, reducing grid dependence and enhancing energy security. These systems offer uninterrupted power supply with minimal emissions, making them ideal for industries where downtime can lead to significant operational losses. Their scalability and flexibility also allow integration across a wide range of applications - from data centers and hospitals to remote facilities and backup power in manufacturing. Moreover, as sustainability goals tighten and carbon reduction targets become more stringent, the shift toward fuel cell technology aligns with broader environmental and regulatory mandates. This transition is driving investment and innovation across both public and private sectors, further accelerating fuel cell adoption globally.

The residential segment is estimated to reach over USD 2.2 billion by 2034, augmented by the growing need for smaller sizes and lower noise-level power sources in the residential environment. These features make stationary fuel cells highly efficient for suburban and urban residences in the form of reliable and compact energy solutions. Additionally, consumer awareness about energy independence, sustainability, and the benefits of clean energy will drive the industry expansion.

The CHP segment is estimated to be worth more than USD 0.9 billion by 2034, owing to the great thermal efficiency of fuel cell systems that generate power and heat together, maximizing the energy utilization and reducing losses. In February 2024, Scale Microgrids acquired a 9.6 MW CHP fuel cell project in Bridgeport, Connecticut, which includes a 1.6-mile thermal loop and will be fabricated and operated by HyAxiom. Moreover, growing demand for industrial process heat will influence product deployment.

Asia Pacific stationary fuel cell market is projected to hit USD 4.8 billion by 2034. Rapid urbanization in countries including China and India is expected to stimulate fuel cell adoption. Additionally, Asia Pacific’s major manufacturing hubs will foster substantial market growth as industries increasingly seek cost-effective, efficient, and sustainable energy solutions to meet their high-power requirements, further accelerating stationary fuel cell deployment in the region.

Eminent players operating in the stationary fuel cell industry are Altergy, AFC Energy, Bloom Energy, Ballard Power Systems, Cummins, Doosan Fuel Cell, Fuji Electric, Fuel Cell Energy, GenCell, poscoenergy, Plug Power, Nuvera Fuel Cells, Siemens Energy, SFC Energy, andToshiba Corporation.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Altergy

- AFC Energy

- Bloom Energy

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- Fuji Electric

- Fuel Cell Energy

- GenCell

- poscoenergy

- Plug Power

- Nuvera Fuel Cells

- Siemens Energy

- SFC Energy

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2025 |

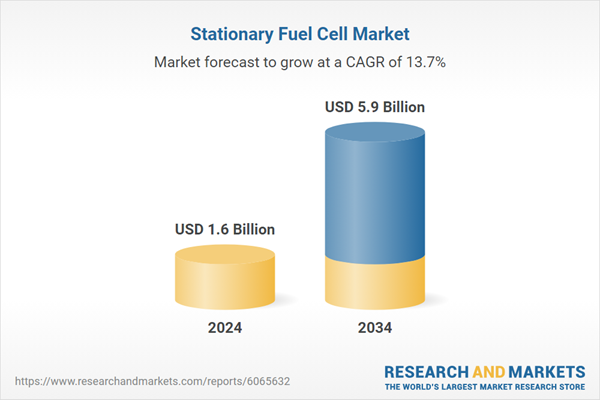

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |