The industry has rapidly shifted from a specialized environmental service to a central part of the clean energy supply chain worldwide. Over the past few years, hydrometallurgical processes have become the preferred option due to their ability to recover high-value metals such as lithium, cobalt, and nickel with far greater precision than conventional smelting. This transition is further supported by updated regulatory frameworks, including new global rules that reward recyclers achieving high metal recovery efficiencies, encouraging wider adoption of water-based refining technologies. The industry is also experiencing strong momentum in the production and trade of black mass, which serves as an intermediate material for further metal extraction. Smaller recyclers are increasingly participating in this segment by supplying black mass to larger hydrometallurgical refiners. With the growing volume of battery waste generated from electric mobility, energy storage projects, and manufacturing scrap, the market is positioned for accelerated expansion throughout the forecast period.

The hydrometallurgical segment was valued at USD 3.1 billion in 2024 and is forecast to grow at a 20.9% CAGR through 2034, reaching 36.1% of the global market. The shift toward hydrometallurgy is driven by its higher recovery efficiency, lower emissions profile, and ability to reclaim more than 90% of critical metals. Producers are scaling up water-based refining facilities to align with rising sustainability expectations and strengthen their metal recovery capabilities.

The automotive segment was valued at USD 5.1 billion in 2024 and is projected to grow at a 20.5% CAGR from 2025 to 2034, accounting for a 71.2% share. Most recyclable lithium-ion batteries originate from electric vehicles and related manufacturing activities. As EV production expands globally, the availability of end-of-life and defective batteries continues to increase, making the automotive sector a key contributor to recycling supply streams and long-term industry growth.

U.S. Lithium-Ion Battery Recycling Market generated USD 1.21 billion in 2024. Growth in the country is supported by large-scale recycling projects backed by policy incentives, funding programs, and expanding domestic battery manufacturing. Federal and state-level support is accelerating the development of recycling hubs near major production facilities, reinforcing the recovery of essential metals such as lithium, nickel, and cobalt.

Major companies active in the Lithium-Ion Battery Recycling Market include Redwood Materials, Ganfeng Lithium, Umicore, Glencore, and Attero Recycling. Companies in the Lithium-Ion Battery Recycling Market are implementing multiple strategies to strengthen their presence and expand their competitive advantage. Many are investing heavily in hydrometallurgical capacity to improve recovery rates and reduce environmental impact, while also modernizing facilities with automation and advanced separation technologies. Firms are forging long-term supply agreements with EV manufacturers and battery producers to secure consistent waste streams. Strategic collaborations with government agencies help unlock funding and regulatory support for large-scale recycling initiatives.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Lithium-Ion Battery Recycling market report include:- 3R Recycler

- ACE Green Recycling

- American Battery Technology Company

- Attero Recycling

- BatX Energies

- Cirba Solutions

- Ganfeng Lithium

- Glencore

- Li-Cycle Holdings Corporation

- Lohum Cleantech

- Neometals

- RecycLiCo Battery Material

- Redwood Materials

- SK TES

- Umicore

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

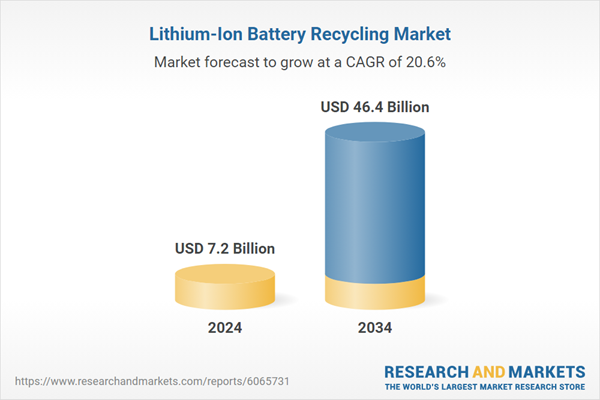

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 47 Billion |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |