The growth is driven by rising investments in power generation and increased adoption of energy-efficient solutions across industries. As global energy consumption surges, governments and private sector players are heavily investing in renewable energy, thermal power plants, and hydroelectric facilities, all of which rely on gear motors for power transmission. Wind turbines use gear motors for pitch and yaw control, ensuring optimal energy generation, while solar power plants integrate them into tracking systems to adjust solar panels for maximum sunlight exposure. Hydroelectric and thermal plants also use gear motors in conveyors, turbines, and cooling circuits to enhance operational efficiency and reliability. The demand for IoT-enabled gear motors with predictive maintenance capabilities is also rising, enabling real-time performance monitoring and driving sustained growth in the power generation sector.

In 2024, the bevel gear segment generated USD 1.4 billion in revenue and is expected to grow at a CAGR of 5.4% through 2034. Bevel gear motors remain dominant due to their efficiency, flexibility, and ability to transmit power at various angles. These motors are widely used in automotive, material handling, mining, and industrial automation applications due to their compact size and high torque capabilities. They operate with minimal energy loss, making them a preferred choice in numerous power transmission systems. As industries increasingly adopt smart manufacturing practices and integrate automation, gear motors are essential for maintaining efficient and reliable operations. According to the U.S. Department of Energy, industrial motors, including gear motors, account for nearly 70% of electricity consumption in manufacturing plants, underscoring the importance of energy-efficient designs.

Material handling accounted for over 22.3% of the market share in 2024 and is expected to grow at a rate of 5% until 2034. Gear motors play a crucial role in material handling applications, including conveyors, cranes, hoists, and automated storage systems used across logistics, warehousing, and manufacturing sectors. The growth of e-commerce and the widespread adoption of warehouse automation have fueled the demand for modern systems equipped with gear motors to streamline material movement. Additionally, heavy-duty gear motors are deployed in industries such as mining, steel, and cement to manage bulk materials under challenging conditions. Government investments in infrastructure, which rose by 6.2% in 2023 as per the U.S. Bureau of Economic Analysis, continue to drive demand for advanced material handling systems, further boosting the gear motor market.

The direct distribution channel held a major share of 73.1% in 2024, driven by the advantages of cost reduction, customization, and direct technical support. Manufacturers prefer direct sales to maintain control over product quality and offer tailored solutions to industries with critical accuracy and reliability requirements, such as robotics, aerospace, and medical equipment. Direct sales also allow for competitive pricing and bulk discounts, benefiting industries such as automotive, construction, and energy. The rise of online portals and direct sourcing platforms has simplified purchasing and enabled real-time inventory monitoring, further enhancing the efficiency of direct sales channels.

North America accounted for around 28.3% of the global market share in 2024, generating approximately USD 1.76 billion in revenue. The region’s growth is driven by the increasing demand for industrial automation, robotics, and energy-efficient solutions across manufacturing, food processing, and logistics industries. With rising investments in renewable energy projects and the adoption of IoT-enabled smart motors, the demand for precision gear motors continues to increase. Europe also exhibits strong market growth, particularly in countries such as Germany, France, and Italy, where strict energy efficiency regulations and a focus on sustainability drive demand for high-performance gear motors.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Gear Motor market report include:- Bauer Gear

- Bonfiglioli

- Emerson Electric

- Flender

- Harmonic Drive

- Jiangsu Guomao Reducer

- Nabtesco

- Nidec

- Portescap

- Power Build

- Regal Rexnord

- SEW Eurodrive

- Shanthi Gears

- Siemens

- Sumitomo Heavy Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

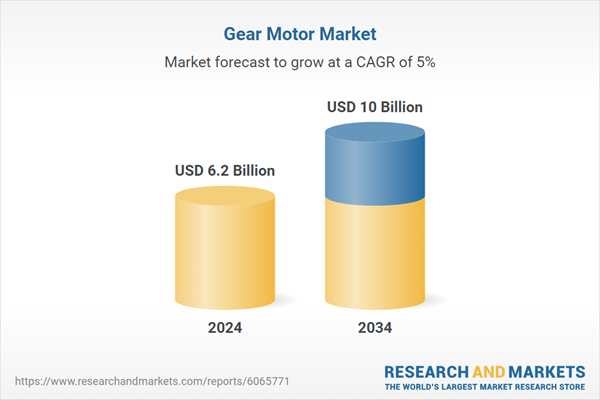

| Estimated Market Value ( USD | $ 6.2 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |