The industry is gaining momentum as businesses across hospitality, healthcare, education, and commercial sectors increasingly demand energy-efficient, sustainable, and technologically advanced water heating solutions. The rising emphasis on reducing carbon footprints, coupled with growing urbanization and infrastructural developments, is further fueling the need for efficient water heating systems that meet modern-day requirements. Heightened consumer awareness of energy consumption, cost savings, and environmental benefits associated with advanced water heaters is significantly shaping market trends.

Moreover, governments worldwide are introducing favorable regulatory frameworks and incentives that support the adoption of high-efficiency and renewable energy-integrated water heating systems. As the focus on smart technology integration grows, commercial water heaters equipped with IoT, remote monitoring, and automation features are also gaining considerable traction, helping end-users optimize energy use and operational efficiency. This increasing demand for intelligent and eco-friendly systems is opening new avenues for manufacturers to innovate and deliver solutions tailored to the evolving needs of commercial establishments.

The market is segmented based on heater type, energy source, and design, catering to a broad range of commercial applications. Among these, the instant water heater segment is poised for remarkable growth and is projected to generate USD 2.5 billion by 2034. Instant water heaters, known for their compact design and rapid heating capability, are engineered to be installed close to points of use, reducing the need for extensive piping and minimizing heat loss. Their space-saving nature makes them an ideal solution for commercial buildings with limited space, such as hotels, offices, and restaurants. As commercial facilities prioritize energy efficiency and seek to lower operational costs, the demand for instant water heaters continues to rise, making them one of the fastest-growing categories in the market.

The commercial water heater industry is also classified by energy source, primarily into electric and gas heaters. Electric water heaters dominated the market with a 66.8% share in 2024, driven by their reliability, durability, and compatibility with emerging renewable energy sources like solar power. These units are designed with robust components to handle heavy-duty commercial usage while ensuring long-term performance. As sustainability goals push organizations to seek cleaner energy alternatives, the transition towards electric and hybrid solutions is accelerating. Manufacturers are focusing on innovating high-efficiency models that comply with tightening energy regulations, helping commercial entities meet stringent environmental and energy codes.

North America commercial water heater market accounted for USD 550 million and a 13% share in 2024, supported by strict energy efficiency mandates and attractive government incentives that encourage the installation of eco-friendly water heating systems. With more commercial properties aiming for LEED (Leadership in Energy and Environmental Design) certification, energy-efficient water heaters have become a critical component for achieving green building standards and reducing long-term energy costs.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Commercial Water Heater market report include:- American Standard Water Heaters

- A.O Smith

- AQUAMAX Australia

- Bosch Thermotechnology

- Bradford White Corporation

- BDR Thermea Group

- GE Appliances

- Heatre Sadia

- HTP

- ORBITAL HORIZON

- Powrmatic

- Racold

- Rinnai Corporation

- Rheem Manufacturing Company

- STIEBEL ELTRON GmbH & Co. KG

- State Industries

- Saudi Ceramic Company

- Toshiba Corporation

- Westinghouse Electric Corporation

Table Information

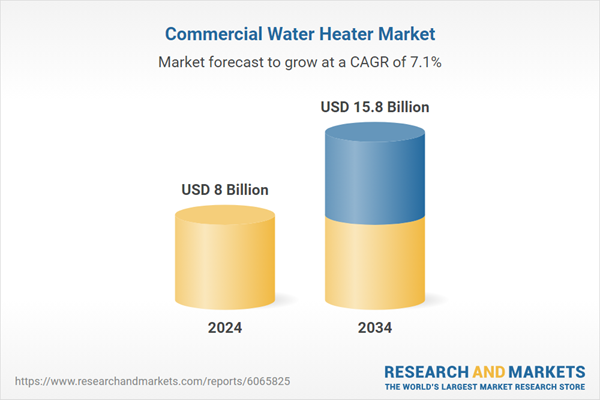

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 15.8 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |