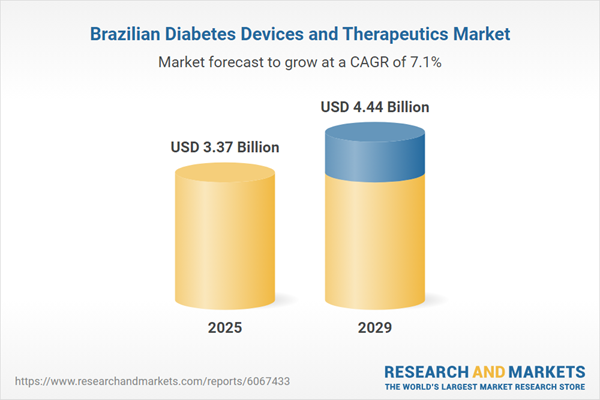

The diabetes market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 9.2%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 7.1% during 2025-2029. By the end of 2029, the diabetes market is projected to expand from its 2024 value of USD 2.87 billion to approximately USD 4.44 billion.

Key Trends and Drivers in Brazil

The Brazilian diabetes devices and therapeutics market is evolving with increased CGM adoption, broader integration of digital health solutions, the introduction of connected therapeutic delivery systems, and updated regulatory frameworks. These trends will intensify over the next 2-4 years, resulting in improved patient monitoring, more precise treatment adjustments, and overall market growth.Expand Adoption of Continuous Glucose Monitoring (CGM)

- Brazilian healthcare providers are increasingly incorporating continuous glucose monitoring systems into diabetes management. Pilot projects in major urban centers such as São Paulo and Rio de Janeiro are integrating CGM data into routine patient care.

- Updates to reimbursement policies under Brazil’s public health system (SUS) and evolving clinical guidelines support broader CGM use. Recent local studies emphasize the benefits of real-time data for glycemic control, aligning with global shifts in diabetes management.

- CGM adoption will intensify as reimbursement models and clinical evidence further solidify its clinical value. Enhanced real-time monitoring may improve treatment adjustments and patient outcomes across Brazil.

Integrate Digital Health Solutions for Remote Monitoring

- Digital health platforms facilitating remote monitoring and telemedicine are deployed in diabetes care settings. Regional initiatives in states such as Minas Gerais and Paraná have introduced digital dashboards to consolidate patient data.

- Government initiatives to expand digital health infrastructure and increased investments in healthcare IT drive this trend. Broader changes in healthcare delivery models and the gradual integration of private insurer support further promote remote care solutions.

- The adoption of digital health solutions is projected to grow steadily, enhancing connectivity between patients and providers. Over the medium term, remote monitoring is expected to improve clinical decision-making and overall diabetes management.

Enhance Therapeutic Delivery Systems

- Connected therapeutic devices - such as smart insulin pens and automated insulin pumps - are entering the Brazilian market. Early evaluations in selected hospitals are examining these devices for their impact on dosing precision and adherence.

- Technological progress and supportive outcomes from recent local clinical trials drive the development of connected delivery systems. Increased R&D investments and gradual adjustments in reimbursement policies are paving the way for these technologies.

- Adopting advanced therapeutic delivery systems is expected to increase as clinical practices and reimbursement frameworks adapt. This trend is likely to lead to more precise treatment regimens and improvements in diabetes management outcomes.

Regulatory and Reimbursement Frameworks

- Regulatory authorities in Brazil are updating approval processes and reimbursement models to better support new diabetes devices and therapies. Recent guidelines from ANVISA and policy updates from SUS illustrate efforts to streamline market access.

- Broader healthcare reform initiatives and cost-containment strategies are prompting these regulatory adjustments. Publications from local health policy institutes underscore the need for clear reimbursement pathways for conventional and digital solutions.

- A more defined regulatory framework is anticipated to enhance market confidence and stimulate further investments in advanced diabetes technologies. These changes are expected to intensify, leading to broader adoption and improved patient access over the medium term.

Competitive Landscape in Brazil

The Brazilian diabetes devices and therapeutics market features a dynamic mix of established multinational leaders and emerging domestic players. Recent strategic partnerships, mergers, and acquisitions are reshaping competitive dynamics, focusing on digital integration and regulatory alignment. In the coming years, intensified competition and strategic consolidation are expected to drive innovation and enhance patient management across Brazil.Analyze Current Market Conditions

- The Brazilian market includes multinational corporations and emerging local innovators in diabetes care. A dual healthcare system - comprising the public system (SUS) and a growing private sector - creates multiple channels for product adoption.

Key Players and New Entrants

- Multinational manufacturers maintain a strong presence through long-term collaborations with public and private healthcare institutions. These companies offer comprehensive portfolios that cover monitoring devices and therapeutic systems.

- Domestic startups and technology firms are entering the market with digital health and connected therapeutic solutions tailored to local needs. Recent analyses indicate that these new entrants are leveraging regional pilot programs and forming strategic collaborations with local hospitals.

Review Recent Partnerships, Mergers, and Acquisitions

- Recent publications report partnerships between established global firms and local innovators to improve device connectivity and data integration. Mergers and acquisitions over the past 12 months indicate efforts to consolidate expertise and expand product portfolios.

- These strategic activities lead to a more interconnected market landscape, facilitating shared innovation and smoother regulatory compliance. Consolidation efforts are aligning product development with the specific needs of Brazil’s healthcare system.

Future Competitive Dynamics (Next 2-4 Years)

- The competitive landscape is expected to evolve with further consolidation as multinational firms expand their digital health offerings and local entrants secure strategic alliances. Industry reports suggest an emerging segmentation between providers of traditional devices and those prioritizing digital innovations.

- Intensified competition will likely drive further product innovation and refine patient management strategies. Over the next 2-4 years, strategic collaborations and market consolidation are expected to reinforce Brazil's competitive positioning.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view of emerging business and investment market opportunities.ScopeThis report provides an in-depth, data-centric analysis of the Brazil diabetes devices and therapeutics market 2020-2029. Below is a summary of key market segments:

Diabetes Devices and Therapeutics Market Share by Category

- Diagnosis and Monitoring Devices

- Therapeutics

Diabetes Devices and Therapeutics Market Share by Diagnosis and Monitoring Devices

- Blood Glucose Monitoring Devices

- Insulin Delivery Devices

- Diabetes Management and Mobile Applications

- Artificial Pancreas Devices

Diabetes Devices and Therapeutics Market Share by Blood Glucose Monitoring Devices

- Self-Monitoring Blood Glucose Devices

- Continuous Blood Glucose Monitoring Devices

- Test Strips

- Lancets

Diabetes Devices and Therapeutics Market Share by Insulin Delivery Devices

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

Diabetes Devices and Therapeutics Market Share by Therapeutics

- Oral Anti-Diabetic Drugs

- Insulin

- Non-Insulin Injectable Drugs

- Combination Drugs

Diabetes Devices and Therapeutics Market Share by Oral Anti-Diabetic Drugs

- Alpha-Glucosidase Inhibitors

- DPP-4 Inhibitors

- SGLT-2 Inhibitors

Diabetes Devices and Therapeutics Market Share by Insulin

- Basal or Long-Acting

- Bolus or Fast-Acting

- Traditional Human Insulin Drugs

- Insulin Biosimilars

Diabetes Devices and Therapeutics Market Share by Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Amylin Analogue

Diabetes Devices and Therapeutics Market Share by Combination Drugs

- Combination Insulin

- Oral Combination

Diabetes Devices and Therapeutics Market Share by Route of Administration

- Subcutaneous

- Intravenous

- Others

Diabetes Devices and Therapeutics Market Share by Type of Diabetes

- Type 1 Diabetes

- Type 2 Diabetes

Diabetes Devices and Therapeutics Market Share by Distribution Channels

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Diabetes Devices and Therapeutics Market Share by End User

- Hospitals

- Diabetes Clinics

- Homecare

Reasons to buy

- Comprehensive understanding of market structure and dynamics: Gain a detailed view of the diabetes devices and therapeutics market, including category-level segmentation (Diagnosis & Monitoring Devices and Therapeutics) and sub-segmentation by product type, route of administration, type of diabetes, distribution channel, and end user.

- Identify high-growth segments and strategic investment areas: Use segment-wise market sizing and forecasting to identify opportunities in areas such as continuous glucose monitoring, insulin delivery technologies, oral anti-diabetic drugs, and biosimilars. Tailor your market entry or expansion strategies accordingly.

- Benchmark performance across distribution and care settings: Access share analysis across online, hospital, and retail pharmacies, and evaluate usage patterns across hospitals, diabetes clinics, and homecare to support channel-specific planning and resource allocation.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 50 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.37 Billion |

| Forecasted Market Value ( USD | $ 4.44 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Brazil |