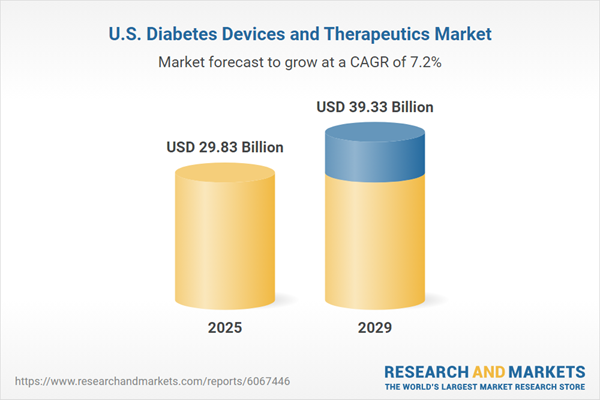

The diabetes market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 9.1%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 7.2% during 2025-2029. By the end of 2029, the diabetes market is projected to expand from its 2024 value of USD 25.47 billion to approximately USD 39.33 billion.

Key Trends and Drivers

The U.S. diabetes devices and therapeutics market is undergoing significant shifts with real-time monitoring, digital integration, advanced delivery systems, and evolving regulatory support. These trends will intensify over the next 2-4 years, shaping clinical practices and reimbursement structures while emphasizing data integration and precise patient management.Accelerate Adoption of Real-Time Glucose Monitoring

- U.S. healthcare providers increasingly use continuous glucose monitoring (CGM) systems to track patient glucose levels in real-time. Large healthcare networks have adopted CGM systems to support outpatient diabetes management.

- Recent publications indicate improvements in insurance reimbursement policies and favorable regulatory reviews. Enhanced clinical data on the reliability of CGM systems reinforces their use in routine diabetes care.

- Adoption is expected to increase, driven by wider coverage and enhanced device integration with electronic health records. The trend will likely intensify as more clinical studies validate the benefits of real-time monitoring in reducing long-term complications.

Integrate Digital Health Solutions into Diabetes Management

- U.S. providers are integrating device data with telehealth platforms and remote patient monitoring systems for diabetes management. Examples include healthcare systems deploying centralized digital dashboards to monitor patient metrics remotely.

- Recent industry reports highlight a shift in healthcare delivery models that suggests a push toward digital transformation in chronic disease management. Insurance models increasingly support telehealth consultations and remote monitoring, aligning with broader medtech trends.

- The integration of digital platforms is expected to grow, promoting data-driven decision-making and enhancing care coordination. This trend will likely intensify, leading to a more efficient tracking of treatment adherence and patient outcomes.

Advance Therapeutic Delivery Systems

- The market is witnessing the emergence of devices that support precise therapeutic delivery, such as smart insulin pens. U.S. manufacturers are introducing systems for accurate dosing and treatment adherence monitoring.

- Technological advancements in device miniaturization and data analytics are facilitating the development of these delivery systems. Recent healthcare publications note a rising focus on improving patient safety and treatment precision in diabetes care.

- Market penetration of smart delivery systems is expected to grow, influenced by evolving clinical practice guidelines and supportive reimbursement frameworks. This trend will intensify as precision therapy becomes a central focus in diabetes management.

Regulatory and Reimbursement Frameworks

- Recent changes in FDA and CMS policies support integrating digital tools in diabetes care. Updated guidelines and expanded reimbursement criteria for digital health applications evidence these regulatory adjustments.

- Broader healthcare policy initiatives for cost containment and improved patient outcomes drive these regulatory changes. Publications from the past year highlight a response to the increased demand for remote monitoring and digital therapeutics.

- Regulatory support is expected to maintain momentum, enabling continued investment in digital health and advanced therapeutics. The framework will further intensify market adoption of compliant and data-integrated devices.

Competitive Landscape in the U.S. Market

The U.S. diabetes devices and therapeutics market is characterized by a mix of established players and new entrants. Strategic partnerships, acquisitions, and the integration of digital health solutions are reshaping competitive dynamics. In the coming years, market consolidation and targeted innovation are expected to further define the competitive environment, influencing product offerings and patient management practices.Current Market Conditions

The market comprises established manufacturers and emerging firms.- A diverse portfolio of devices and therapeutics is present, ranging from established CGM systems to new smart delivery devices.

Assess Key Competitors and Emerging Entrants

- Major companies, such as large medical device manufacturers and specialized diabetes care firms, hold significant market share. Established firms maintain comprehensive product portfolios covering both devices and therapeutics.

- New market entrants focus on integrating digital health solutions with diabetes management systems. These entrants bring targeted innovations, complementing the existing product mix in the U.S. market.

Examine Strategic Partnerships and Corporate Activities

- Recent publications document acquisitions of smaller digital health companies by established device manufacturers. Strategic partnerships have been initiated between healthcare systems and technology firms to expand remote monitoring capabilities.

- The market shows signs of consolidation driven by competitive pressures and regulatory incentives. Collaborative efforts are aimed at enhancing integrated care delivery and data analytics capabilities.

Future Competitive Dynamics

- Continued consolidation and strategic alliances are expected as established players seek to enhance their technological offerings. New entrants with digital health expertise will likely drive niche innovations, altering competitive positioning.

- Over the next 2-4 years, the competitive landscape will likely evolve with intensified competition and targeted market consolidation. Companies will increasingly leverage partnerships to improve patient data integration and therapeutic outcomes.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view of emerging business and investment market opportunities.ScopeThis report provides an in-depth, data-centric analysis of the United States diabetes devices and therapeutics market 2020-2029. Below is a summary of key market segments:

Diabetes Devices and Therapeutics Market Share by Category

- Diagnosis and Monitoring Devices

- Therapeutics

Diabetes Devices and Therapeutics Market Share by Diagnosis and Monitoring Devices

- Blood Glucose Monitoring Devices

- Insulin Delivery Devices

- Diabetes Management and Mobile Applications

- Artificial Pancreas Devices

Diabetes Devices and Therapeutics Market Share by Blood Glucose Monitoring Devices

- Self-Monitoring Blood Glucose Devices

- Continuous Blood Glucose Monitoring Devices

- Test Strips

- Lancets

Diabetes Devices and Therapeutics Market Share by Insulin Delivery Devices

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

Diabetes Devices and Therapeutics Market Share by Therapeutics

- Oral Anti-Diabetic Drugs

- Insulin

- Non-Insulin Injectable Drugs

- Combination Drugs

Diabetes Devices and Therapeutics Market Share by Oral Anti-Diabetic Drugs

- Alpha-Glucosidase Inhibitors

- DPP-4 Inhibitors

- SGLT-2 Inhibitors

Diabetes Devices and Therapeutics Market Share by Insulin

- Basal or Long-Acting

- Bolus or Fast-Acting

- Traditional Human Insulin Drugs

- Insulin Biosimilars

Diabetes Devices and Therapeutics Market Share by Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Amylin Analogue

Diabetes Devices and Therapeutics Market Share by Combination Drugs

- Combination Insulin

- Oral Combination

Diabetes Devices and Therapeutics Market Share by Route of Administration

- Subcutaneous

- Intravenous

- Others

Diabetes Devices and Therapeutics Market Share by Type of Diabetes

- Type 1 Diabetes

- Type 2 Diabetes

Diabetes Devices and Therapeutics Market Share by Distribution Channels

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Diabetes Devices and Therapeutics Market Share by End User

- Hospitals

- Diabetes Clinics

- Homecare

Reasons to buy

- Comprehensive understanding of market structure and dynamics: Gain a detailed view of the diabetes devices and therapeutics market, including category-level segmentation (Diagnosis & Monitoring Devices and Therapeutics) and sub-segmentation by product type, route of administration, type of diabetes, distribution channel, and end user.

- Identify high-growth segments and strategic investment areas: Use segment-wise market sizing and forecasting to identify opportunities in areas such as continuous glucose monitoring, insulin delivery technologies, oral anti-diabetic drugs, and biosimilars. Tailor your market entry or expansion strategies accordingly.

- Benchmark performance across distribution and care settings: Access share analysis across online, hospital, and retail pharmacies, and evaluate usage patterns across hospitals, diabetes clinics, and homecare to support channel-specific planning and resource allocation.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 50 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 29.83 Billion |

| Forecasted Market Value ( USD | $ 39.33 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | United States |