E-commerce is driving the Australia last-mile delivery market due to the increasing rise in digital activity and online shopping.

The increasing digital activity among individuals has propelled Australia last-mile delivery market, as they offer convenience by delivering purchases directly to customers' homes. They meet the need for timely delivery in the competitive online market resulting in the overall market growth.

According to the data from the Australian Bureau of Statistics (ABS), e-commerce retail share in total digital activity in the Australian economy has increased to 7.1% in 2021-22 from 6.8% in 2020-21.

With rising urbanization, last-mile delivery becomes crucial for efficiently reaching densely populated areas. E-commerce platforms provide reliable and efficient last-mile delivery, and e-commerce businesses can enhance customer satisfaction, and encourage repeat purchases resulting in the growth of Australia last-mile delivery market.

In March 2024, Amazon announced plans to expand its delivery network in Australia by enlisting local entrepreneurs through its Delivery Service Partner initiative. The retail giant aimed to collaborate with small businesses operating 20 to 40 vehicles, employing numerous local drivers, in the top three cities of the country.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- B2B

- B2C

- C2C

Market Breakup by Destination

- International

- Domestic

Market Breakup by Mode of Operation

- Non-Autonomous

- Autonomous

Market Breakup by Vehicle

- Motorcycle

- HCV

- Drones

- LCV

Market Breakup by Delivery Mode

- Regular Delivery

- Same-day Delivery or Express Delivery

Market Breakup by Application

- E-Commerce

- Retail and FMCG

- Mails and Packages

- Healthcare

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Last-Mile Delivery Market Share

Same-day delivery or express delivery mode meets the rising consumer demand for speed and convenience, especially for e-commerce purchases. The ability to receive products within hours enhances customer satisfaction and loyalty. Retailers and logistics companies are increasingly adopting same-day delivery to stay competitive, driven by advancements in technology and logistics infrastructure. The preference for quick delivery options is a key factor propelling the growth of express delivery services in the last-mile delivery market.Leading Companies in the Australia Last-Mile Delivery Market

The growth of the last-mile delivery market is fuelled by increasing online shopping, and digital activity.- Australia Post Group

- Fleets Flyers Pty Limited

- Drive Yello Pty Ltd.

- Yellow Express Pty Ltd.

- BHF Couriers Express Pty Ltd.

- Pack & Send Online Pty Ltd

- Allied Express Transport Pty Ltd.

- StarTrack Express Pty Limited

- Toll Holdings Limited

- Whale Logistics (Australia) Pty Ltd.

- Others

Table of Contents

Companies Mentioned

- Australia Post Group

- Fleets Flyers Pty Limited

- Drive Yello Pty Ltd.

- Yellow Express Pty Ltd.

- BHF Couriers Express Pty Ltd.

- Pack & Send Online Pty Ltd

- Allied Express Transport Pty Ltd.

- StarTrack Express Pty Limited

- Toll Holdings Limited

- Whale Logistics (Australia) Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | October 2025 |

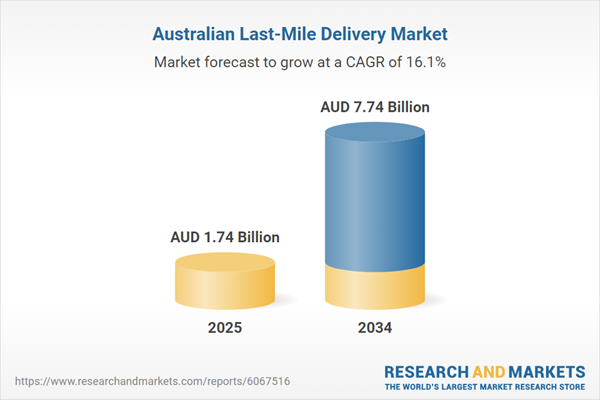

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.74 Billion |

| Forecasted Market Value ( AUD | $ 7.74 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |