The Australia jam jelly and preserves market is undergoing a significant transformation, driven by shifting consumer preferences and the growing awareness of health and sustainability. Over recent years, consumers have become more discerning about the ingredients in the products they purchase, opting for those made with fewer additives, preservatives, and artificial ingredients.

This change in consumer behaviour is pushing manufacturers to innovate, with many companies focusing on developing products that cater to the demand for more natural and organic offerings. As a result, the market has witnessed an increased production of jams, jellies, and preserves made from organic fruits and sweeteners such as honey or stevia. This trend is not only reflective of the broader shift toward healthier food choices but also aligns with the growing interest in environmentally friendly production processes.

One of the key factors driving the Australia jam jelly and preserves market expansion is the rising preference for natural and organic food products. Consumers are becoming more conscious of the ingredients in their food, with a particular focus on avoiding artificial sweeteners, colorants, and preservatives. In response, many brands have shifted their focus toward using fresh, organic fruits and natural sweeteners in their products. This has led to an increase in the availability of organic jams, jellies, and preserves that appeal to health-conscious consumers. These products not only offer a more authentic and wholesome taste but also cater to the growing demand for foods that are perceived to be better for overall well-being.

Additionally, there has been an increasing shift toward premium and artisanal products within the Australia jam jelly and preserves market. Australian consumers are showing a growing preference for small-batch, locally produced, and handcrafted products, which are perceived as more authentic and of higher quality. Artisanal jams and preserves, often made from locally sourced fruits and traditional recipes, have found a niche in the market, especially among those seeking unique and authentic flavours. This segment of the market is expected to continue to expand as consumers become more willing to pay a premium for products that are made with high-quality ingredients and in small, sustainable quantities.

The convenience factor is also playing a significant role in shaping the Australia jam jelly and preserves market dynamics. As lifestyles become increasingly fast-paced, many Australian consumers are looking for quick and easy meal solutions that do not compromise on taste or nutrition. Jams, jellies, and preserves are easy to store, long-lasting, and can be used in a variety of ways, making them a popular choice for busy households. Whether spread on toast, added to smoothies, or used in baking, these products offer versatility and convenience, factors that have contributed to their sustained demand in the market.

Sustainability is another critical Australia jam jelly and preserves market trend. As consumers grow concerned with the environmental impact of their purchasing decisions, manufacturers are being pushed to adopt more sustainable practices. This has led to innovations in both sourcing and packaging. Many producers are focusing on reducing their carbon footprint by sourcing fruits from local farmers and using eco-friendly packaging materials. Moreover, some manufacturers are investing in biodegradable or recyclable packaging options, which not only appeal to environmentally conscious consumers but also reflect the broader industry trend towards sustainability.

Another significant factor aiding the Australia jam jelly and preserves market development is the rise of sugar-free or low-sugar alternatives. With the increasing awareness of the health risks associated with excessive sugar consumption, more consumers are turning to sugar-free jams and preserves, which are sweetened with natural alternatives like stevia, monk fruit, or erythritol. This growing demand for healthier products is pushing manufacturers to develop new recipes that meet the needs of consumers seeking lower sugar intake while still offering the familiar sweetness and texture that they expect from traditional jams and jellies.

Despite the positive outlook, there are several challenges that the Australia jam jelly and preserves market must address. One of the primary concerns is the rising cost of raw materials, particularly fruits. The market for fresh fruits, which is a key ingredient in jam and jelly production, can be volatile due to factors such as climate change, crop yields, and supply chain disruptions. These fluctuations in raw material prices can lead to higher production costs, which may be passed on to consumers in the form of higher retail prices. As such, manufacturers must navigate these cost pressures while maintaining competitive pricing.

The future outlook for the Australia jam jelly and preserves market remains positive, with growth expected to continue over the next few years. As consumer preferences continue to evolve, the demand for natural, organic, and sustainably produced products will drive innovation and shape the market's future direction. With the rise of health-conscious consumers and the growing desire for premium, artisanal products, the market for jams, jellies, and preserves will likely continue to expand.

In conclusion, the Australia jam jelly and preserves market is poised for continued growth in the coming years, driven by changing consumer tastes, a preference for healthier options, and the increasing demand for convenience and sustainability. While challenges such as raw material costs and competition remain, opportunities for innovation and premium product offerings are abundant. As consumers continue to seek higher-quality, more sustainable food products, the market for jams, jellies, and preserves will evolve to meet these demands, ensuring a prosperous future for the industry.

Market Segmentation

The market can be divided based on product type, distribution channel, and region.Market Breakup by Product Type

- Jams and Jellies

- Preserves

- Marmalade

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Australia jam jelly and preserves market. Some of the major players explored in the report are as follows:- Andros Barker’s Australia Pty Ltd.

- Fiaje

- Beerenberg Pty Ltd.

- Quincey Jones Jelly Preserves Co. Pty Ltd.

- The Sticky Pot

- Others

Table of Contents

Companies Mentioned

- Andros Barker’s Australia Pty Ltd.

- Fiaje

- Beerenberg Pty Ltd.

- Quincey Jones Jelly Preserves Co. Pty Ltd.

- The Sticky Pot

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | March 2025 |

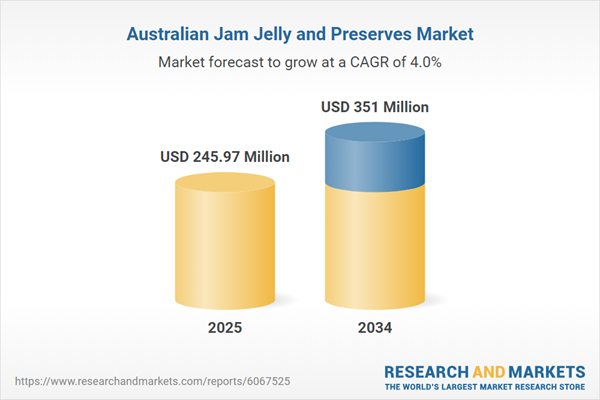

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 245.97 Million |

| Forecasted Market Value ( USD | $ 351 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 5 |