The Australia ICT market encompasses a wide range of technologies, including telecommunications, cloud computing, data centres, software, hardware, and services. As industries such as banking, retail, healthcare, and manufacturing undergo digital transformations, the demand for ICT solutions that enable operational efficiencies, enhance customer experiences, and drive innovation is on the rise. This ongoing transformation is fuelled by the growing need for businesses to modernise their operations, enhance cybersecurity measures, and keep pace with the ever-evolving digital landscape.

A key driver aiding the Australia ICT market growth is the rapid increase in internet penetration and the growing reliance on mobile connectivity. As mobile devices and broadband networks become ubiquitous, businesses and consumers alike are increasingly dependent on seamless digital communication. This has led to significant investments in the expansion and upgrading of telecommunication infrastructure across the country.

The rollout of 5G technology in Australia, for instance, is expected to further boost the ICT market by offering faster internet speeds, lower latency, and greater connectivity options, particularly in remote and underserved areas. The widespread adoption of 5G is poised to open new opportunities for industries such as autonomous vehicles, smart cities, and Internet of things (IoT) applications, all of which require robust connectivity to function effectively.

Another significant Australia ICT market trend is the increasing adoption of cloud computing. Cloud solutions enable businesses to scale their operations efficiently, reduce infrastructure costs, and enhance data accessibility. The shift toward cloud-based services has been accelerated by the ongoing digitalisation of businesses, as companies seek flexible and cost-effective solutions that can meet their evolving needs. Public, private, and hybrid cloud models are gaining traction, allowing organizations to store data securely, access computing power on-demand, and leverage advanced analytics tools without the need for expensive on-premise infrastructure.

Cybersecurity remains a crucial concern in the Australia ICT market, particularly as businesses face growing risks associated with cyberattacks, data breaches, and online fraud. As organisations increase their reliance on digital systems, the need for robust cybersecurity measures has become paramount. Australia’s commitment to strengthening its cybersecurity infrastructure is reflected in ongoing investments in advanced security technologies and services, as well as the development of frameworks designed to protect sensitive data and ensure business continuity. This emphasis on cybersecurity is expected to continue driving the demand for ICT services in Australia as businesses seek to safeguard their operations from ever-evolving cyber threats.

The Australian government has also played an essential role in fostering the Australia ICT market development through policy initiatives and investments in digital infrastructure. Programmes such as the National Broadband Network (NBN) and initiatives to promote smart cities, digital government services, and innovation hubs have contributed to the overall development of the market. These initiatives are helping to bridge the digital divide, improve internet accessibility, and create an environment conducive to technological innovation. The government’s focus on fostering innovation, particularly in emerging technologies such as AI, blockchain, and IoT, has further accelerated the growth of the ICT market.

In addition to government support, the Australia ICT market expansion benefits from a highly skilled workforce, with the country’s tech sector attracting talent from both domestic and international markets. The increasing demand for professionals with expertise in areas such as software development, cybersecurity, data science, and AI is helping to fuel the market’s expansion. Educational institutions in Australia are increasingly offering specialized programmes in ICT-related fields, ensuring that the country has a pool of talent to meet the demands of a growing tech-driven economy.

One of the most notable developments influencing the Australia ICT market dynamics is the continued growth of the IoT ecosystem. IoT refers to the network of interconnected devices that communicate and exchange data, enabling smarter operations and decision-making processes. In Australia, the IoT market is expanding across various industries, including agriculture, manufacturing, transportation, and healthcare. For example, IoT-enabled devices in the agricultural sector help farmers optimise water usage, monitor crop health, and track livestock, while in the manufacturing industry, IoT technologies are being used to improve supply chain management, predictive maintenance, and operational efficiency.

The evolution of the Australia ICT market is also being driven by the increasing adoption of big data and advanced analytics. Organisations across industries are leveraging large volumes of data to derive actionable insights and improve business performance. The ability to analyse and interpret data in real-time is enabling Australian businesses to make better decisions, anticipate customer needs, and optimise their operations. The growing importance of data analytics is expected to continue fuelling demand for advanced ICT solutions, particularly in industries such as finance, retail, and healthcare.

In conclusion, the Australia ICT market is set for continued growth in the forecast period, driven by factors such as the expansion of 5G networks, the adoption of cloud computing, the rise of AI and IoT, and the increasing focus on cybersecurity. The ongoing government investments, coupled with a skilled workforce and the growing demand for advanced software solutions, will further propel the market forward. As businesses and industries continue to embrace technological advancements, the market is well-positioned for sustained success and development in the years ahead.

Market Segmentation

The market can be divided based on type, enterprise size, end use, and region.Market Breakup by Type

- Hardware

- Software

- IT Services

- Telecommunication Services

- Others

Market Breakup by Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Market Breakup by End Use

- Public Sector

- Telecom

- Transportation

- BFSI

- Manufacturing

- Energy

- Retail

- Healthcare

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Australia ICT market. Some of the major players explored in the report are as follows:- Samsung Electronics Australia Pty Limited

- Apple, Inc.

- Microsoft Corporation

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Infosys Limited

- Wipro Limited

- Others

Table of Contents

Companies Mentioned

- Samsung Electronics Australia Pty Limited

- Apple, Inc.

- Microsoft Corporation

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Infosys Limited

- Wipro Limited

Table Information

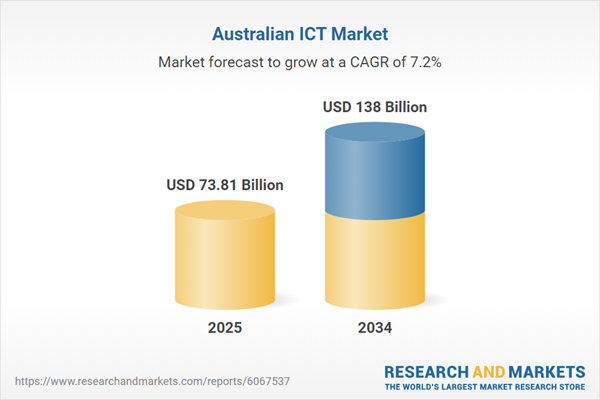

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | March 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 73.81 Billion |

| Forecasted Market Value ( USD | $ 138 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 8 |