Eau de Parfum (EDP) dominates the Australia fragrance and perfume market.

In the Australia fragrance and perfume market, Eau de Parfum (EDP) holds a leading position because of its longer-lasting fragrance, attributed to its higher concentration of fragrance oils. EDP is often associated with luxury due to its sophisticated packaging and intensified fragrance content. Furthermore, innovations in packaging design and the introduction of unique scent blends contribute to the growing demand for Eau de Parfum. Eau de Cologne are highly affordable and light fragrance composition.

The Australia fragrance and perfume market is driven by several factors. Brands are increasingly offering customized fragrance options to cater to diverse consumer preferences. Additionally, there is a rising trend towards incorporating sustainable botanical extracts and environmentally friendly packaging in perfumes, aiming to eliminate synthetic chemicals from formulations.

Furthermore, technological innovations in perfumery, such as long-lasting encapsulated fragrances and scenting solutions for home use, are enhancing the fragrance experience. The online purchasing of fragrances is being bolstered by virtual reality technologies that enable virtual fragrance consultations and other interactive experiences for consumers, thereby propelling the growth of Australia fragrance and perfume market revenue.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Parfum or De Parfum

- Eau De Parfum (EDP)

- Eau De Toilette (EDT)

- Eau De Cologne (EDC)

Market Breakup by Consumer Group

- Men

- Women

- Unisex

Market Breakup by Distribution Channel

- Online

- Offline

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Fragrance and Perfume Market Share

Online distribution channels hold a significant share in the Australia fragrance and perfume market due to several key factors including convenience, competitive pricing, accessibility, and virtual try-on and consultation.Leading Companies in the Australia Fragrance and Perfume Market

The expansion of the fragrance and perfume market is driven by increasing numbers of health-conscious consumers, demand for clean-label ingredients, advancements in technology, and the rising popularity of plant-based and functional sweeteners.- Parfumis

- Arise Aromatics Pty Ltd

- MetaScent Australia

- Fragrance Innovation Australia

- Others

Table of Contents

Companies Mentioned

- Parfumis

- Arise Aromatics Pty Ltd

- MetaScent Australia

- Fragrance Innovation Australia

Table Information

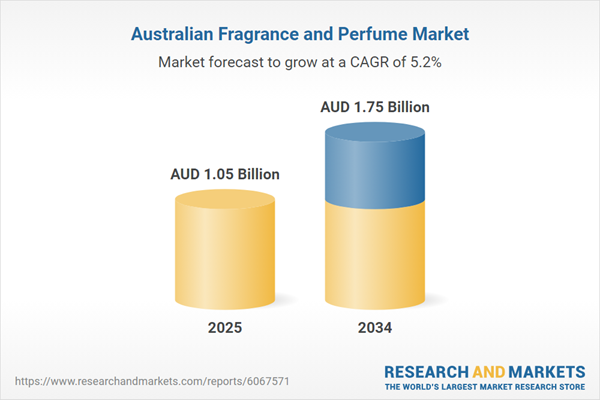

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.05 Billion |

| Forecasted Market Value ( AUD | $ 1.75 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 4 |