Based on type, the Australia footwear market share is led by athletic footwear

The Australia footwear market is experiencing growth due to athletic footwear, which offers the support necessary to prevent injuries like sprains and blisters., they provide flexibility and comfort when available in the correct size, thus improving the performance of the athletes. Non-athletic footwear is available in different styles based on individual preference for specific occasions. They are designed to provide support and protection from various environmental changes such as rain and heat.Various trends and advancements in the Australia footwear market growth including features like lightweight materials and enhanced traction for better performance are being added by the brands. Moreover, to reduce the carbon footprint and minimize waste, the brands are using sustainable production materials and processes. To enhance the performance and health of users, smart features, such as fitness tracking sensors and wearable technology are being integrated into the footwear. To cater the individual preferences and needs, technological advancements such as 3D printing and custom fit options are being integrated into the footwear.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Athletic Footwear

- Sports Shoes

- Trekking/Hiking Shoes

- Running Shoes

- Others

- Non-athletic Footwear

- Flip-Flops/Slippers

- Boots

- Sneakers

- Others

Market Breakup by Material

- Leather

- Fabric

- Rubber

- Plastic

- Others

Market Breakup by Pricing

- Mass

- Premium

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Sales

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australia Capital Territory

- Western Australia

- Others

Table of Contents

Companies Mentioned

- Nike, Inc.

- Adidas Australia Pty Limited

- Lester Shoes Pty. Ltd.

- Victor Footwear Pty Ltd

- Brand Collective Pty Ltd.

Table Information

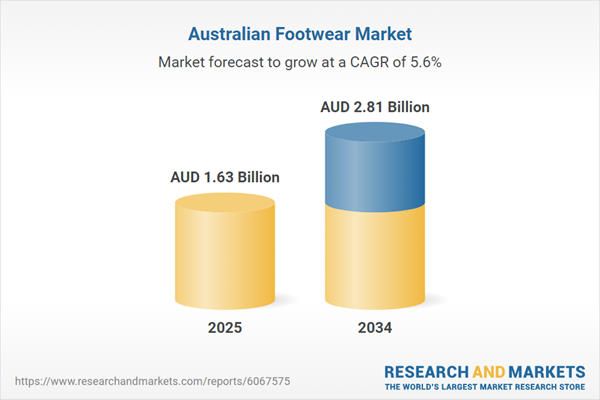

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.63 Billion |

| Forecasted Market Value ( AUD | $ 2.81 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 5 |