Based on material, the Australia flooring market share is led by resilient flooring materials as they are less affected by scratches, and stains thus showing high durability

They are comparatively more cushioning and comfortable in use for longer periods as compared to the non-resilient flooring material. Moreover, they possess water-resistant properties and thus can be used as applications in bathroom flooring. They offer easy-to-clean benefits to the users and they are better affordable as compared to the non-resilient flooring materials.Various trends driving the Australia flooring material market development include the increase in the development of luxury vinyl tiles which are easy to clean, affordable and highly durable. Moreover, the use of waterproof flooring is also rising as they are water-resistant and can be used in moisture-prone areas. The trend of large format tiles provides users with tiles that are aesthetic, convenient to clean, affordable and easy to install. The integration of smart technologies in flooring such as LED lighting and sensors has resulted in increasing comfort and safety. The use of modular flooring systems is also increasing as they are equipped with interlocking.

According to Jobs and Skills Australia, individuals working as full-time floor finishers hold around 92% share of the total floor-finishers employment in the country.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

- Resilient

- Breakup By Type

- Vinyl

- Linoleum

- Rubber

- Others

- Non-Resilient

- Breakup By Type

- Ceramic Tiles

- Laminated

- Stone

- Wood

- Others

Market Breakup by Application

- Residential

- Commercial

- Industrial

Market Breakup by Region

- South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Table of Contents

Companies Mentioned

- SIKA Australia Pty Ltd.

- Mapei Australia Pty. Ltd.

- Gerflor Australasia Pty Ltd.

- Interface Australia Pty Ltd.

- Antiskid Industries Pty Ltd.

- MB Solutions Australia Pty Ltd.

- Multiblast Flooring Pty Ltd.

- Hychem Pty Ltd.

- Roxset Australia

- Kajaria Tiles Australia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | October 2025 |

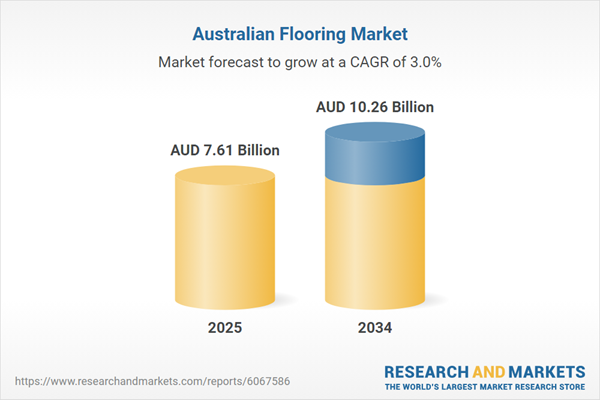

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 7.61 Billion |

| Forecasted Market Value ( AUD | $ 10.26 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |