Supermarkets and hypermarkets is driving the Australia confectionery market.

As per the Australia confectionery market analysis, these channels offer a wide range of products to cater to the diverse needs of consumers. They offer products from various brands while offering competitive prices. Such channels provide a one-stop-shopping destination for snacks and confectionery items. Confectionery items such as cookies, chocolates, gums, jellies, and others are widely available in these markets with different varieties. Convenience stores are retail channels in residential neighbourhoods that provide quick and convenient snack options.

The growing focus of individuals on healthy alternatives such as plant-based and vegan confectionery options has driven the Australia confectionery market growth. Companies and manufacturers produce candies, chocolates, and sweets to cater to the needs of health-conscious consumers.

The changing consumers preferences is resulting in the development of innovative flavours and combinations such as salted caramel, chilli-infused chocolate, and exotic fruit pairings. Further, unique packaging designs and new formats such as bite-sized candies, resealable pouches, and portion-controlled servings to attract consumers while offering on-the-go snacking is driving the Australia confectionery market.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- Ice Cream

- Gums and Jellies

- Chocolate

- Sugar confectionery

- Others

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channels

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Confectionery Market Share

Online channels offer consumers convenience and a wider selection of products, e-commerce platforms and brand websites enable easy access to international and niche confectionery items. Additionally, online channels facilitate targeted marketing, personalised recommendations, and subscription services, enhancing customer engagement and satisfaction.Leading Companies in the Australia Confectionery Market

The growth of the confectionery market is fuelled by the development of products by manufacturers made with plant-based alternatives to cater for the evolving needs of consumers.- Nestlé Australia Ltd.

- Ferrero International

- Mars, Incorporated

- Mondelez Global LLC

- Australian Sweet Co.

- Others

Table of Contents

Companies Mentioned

- Nestlé Australia Ltd.

- Ferrero International

- Mars, Incorporated

- Mondelez Global LLC

- Australian Sweet Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | October 2025 |

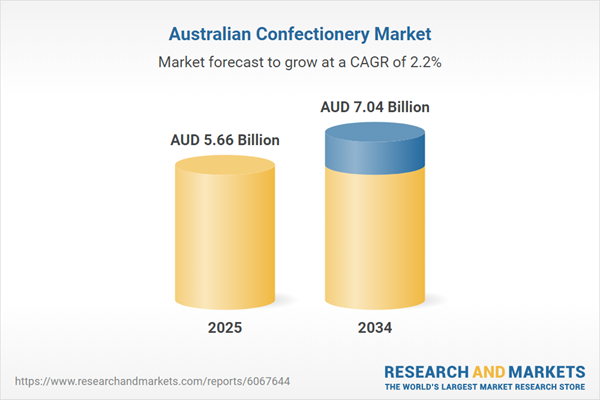

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 5.66 Billion |

| Forecasted Market Value ( AUD | $ 7.04 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 5 |