Global Membrane Electrode Assembly Market - Key Trends & Drivers Summarized

Why Is Membrane Electrode Assembly (MEA) Critical for Fuel Cells and Electrolyzers?

Membrane Electrode Assembly (MEA) is the core component of proton exchange membrane fuel cells (PEMFCs) and water electrolyzers, playing a pivotal role in electrochemical energy conversion. It consists of a proton-conducting membrane, catalyst layers (anode and cathode), and gas diffusion layers (GDLs) that facilitate the movement of protons and electrons, generating electricity or hydrogen. MEAs are widely used in hydrogen fuel cells, water electrolysis for green hydrogen production, and energy storage applications. The demand for clean energy solutions, hydrogen fuel cell vehicles (FCEVs), and sustainable power generation has significantly boosted the adoption of high-performance MEAs. With industries transitioning toward zero-emission energy sources, advancements in MEA technology are crucial for improving efficiency, durability, and cost-effectiveness in hydrogen-based energy systems.How Are Technological Innovations Enhancing Membrane Electrode Assembly Performance?

The Membrane Electrode Assembly market is experiencing rapid advancements in material science, manufacturing techniques, and efficiency optimization. One of the most significant innovations is the development of high-performance catalyst materials, including platinum-group metal (PGM) alloys, non-PGM catalysts, and nanostructured catalysts, which enhance reaction kinetics while reducing precious metal usage. The rise of ion-exchange membranes with improved proton conductivity and durability has also contributed to better energy efficiency and extended MEA lifespan.Another key advancement is the use of thin-film deposition techniques and advanced coating methods, allowing for precise catalyst layer structuring, leading to improved electrode performance and lower degradation rates. Additionally, the integration of reinforced and composite membranes has enhanced chemical and mechanical stability, reducing membrane thinning and failure under high-temperature and pressure conditions. The scaling up of MEA production with roll-to-roll manufacturing and automated assembly processes is also reducing costs, making fuel cell technology more commercially viable.

Furthermore, bipolar plate advancements and gas diffusion layer (GDL) improvements are enhancing overall system performance by improving reactant distribution, water management, and electrical conductivity. The ongoing development of next-generation MEAs, such as hydroxide exchange membranes (HEMs) and anion exchange membranes (AEMs), is paving the way for cheaper and more efficient hydrogen fuel cell systems. With AI-driven modeling and simulation tools, researchers are now optimizing MEA designs for higher power densities and longer operational lifespans.

Which Industries and Applications Are Driving Demand for Membrane Electrode Assemblies?

The transportation sector is the largest consumer of MEAs, as fuel cells are being increasingly adopted in hydrogen-powered electric vehicles (FCEVs), trucks, buses, trains, and even maritime vessels. The automotive industry, led by companies like Toyota, Hyundai, and Honda, is investing heavily in fuel cell vehicle development, increasing the demand for durable and efficient MEAs. The aviation and aerospace industries are also exploring hydrogen fuel cells as a potential alternative for zero-emission aircraft and drones.The renewable energy sector is another major driver, with MEAs playing a key role in hydrogen production through water electrolysis, supporting green hydrogen initiatives globally. With countries investing in hydrogen economy projects, the demand for high-efficiency electrolyzers using advanced MEAs is rising. Additionally, stationary power generation applications, including off-grid power, backup power systems, and distributed energy storage, are leveraging fuel cells to ensure clean and reliable energy.

Other industries adopting MEAs include consumer electronics, where portable fuel cells are being developed for laptops, drones, and military applications requiring longer-lasting and lightweight power solutions. The marine industry is also integrating fuel cell technology into ships and submarines to reduce reliance on fossil fuels. Furthermore, industrial applications, such as hydrogen-powered forklifts and mining vehicles, are benefiting from MEA-based fuel cell powertrains, offering a quiet, emission-free, and efficient energy source.

What Factors Are Fueling the Growth of the Membrane Electrode Assembly Market?

The growth in the Membrane Electrode Assembly market is driven by increasing investments in hydrogen fuel cell technology, government incentives for clean energy, and the rising need for energy efficiency. The push toward decarbonization and net-zero emissions has led to aggressive investments in hydrogen infrastructure, fueling stations, and large-scale electrolysis projects, directly increasing MEA demand.Additionally, advancements in fuel cell vehicle technology, supported by government policies, subsidies, and incentives, have accelerated the commercial adoption of MEAs in the transportation sector. Countries like Japan, Germany, South Korea, and the U.S. are investing heavily in hydrogen-powered public transport fleets and fuel cell infrastructure, boosting MEA production. The expansion of renewable energy integration and hydrogen storage has also created significant opportunities for MEA manufacturers.

The declining cost of fuel cell technology due to mass production, material advancements, and process optimization has further encouraged adoption. However, challenges such as high production costs, catalyst degradation, and durability concerns continue to be areas of focus for ongoing research and development. Emerging markets in Asia-Pacific, the Middle East, and Latin America are witnessing rapid industrialization and clean energy initiatives, creating strong demand for cost-effective and high-performance MEAs.

With continued innovations in catalyst design, membrane durability, and scalable manufacturing, the MEA market is poised for exponential growth, reinforcing its role in the future of hydrogen fuel cells, water electrolysis, and next-generation clean energy solutions.

Report Scope

The report analyzes the Membrane Electrode Assembly market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Membranes, Gas Diffusion Layers, Gaskets, Others); Product Type (3-layer, 5-layer, 7-layer); Application (Fuel Cell, Electrolyzer).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Membranes Component segment, which is expected to reach US$8.7 Billion by 2030 with a CAGR of a 7.3%. The Gas Diffusion Layers Component segment is also set to grow at 9.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 12% CAGR to reach $4.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Membrane Electrode Assembly Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Membrane Electrode Assembly Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Membrane Electrode Assembly Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accepta Ltd, Alfa Laval, American Water Chemicals, Inc., Aquatech International LLC, Asahi Kasei Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Membrane Electrode Assembly market report include:

- 3M Company

- Advent Technologies Holdings, Inc.

- Ballard Power Systems

- BASF SE

- Danish Power Systems

- DuPont de Nemours, Inc.

- FuelCellsEtc

- Giner Inc.

- Greenerity GmbH

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- IRD Fuel Cells A/S

- ITM Power plc

- Johnson Matthey

- NEL Hydrogen

- Plug Power Inc.

- PowerCell Sweden AB

- SFC Energy AG

- The Chemours Company

- Toyota Motor Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Advent Technologies Holdings, Inc.

- Ballard Power Systems

- BASF SE

- Danish Power Systems

- DuPont de Nemours, Inc.

- FuelCellsEtc

- Giner Inc.

- Greenerity GmbH

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- IRD Fuel Cells A/S

- ITM Power plc

- Johnson Matthey

- NEL Hydrogen

- Plug Power Inc.

- PowerCell Sweden AB

- SFC Energy AG

- The Chemours Company

- Toyota Motor Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

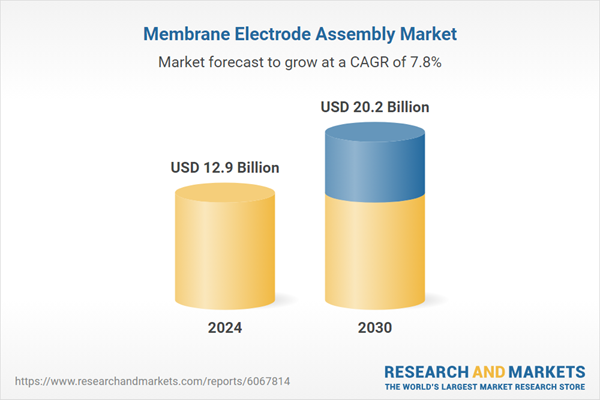

| Estimated Market Value ( USD | $ 12.9 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |