Global Autonomous Harvesters Market - Key Trends & Drivers Summarized

How Are Autonomous Harvesters Transforming Modern Agriculture?

Autonomous harvesters are revolutionizing agriculture by integrating cutting-edge automation, AI-driven analytics, and machine learning to enhance harvesting efficiency and productivity. These intelligent machines are designed to operate with minimal human intervention, utilizing advanced sensors, GPS navigation, and real-time data processing to optimize harvesting. The adoption of autonomous harvesters is rapidly increasing due to labor shortages and the rising demand for precision farming techniques. With global food production requirements escalating, automated harvesting solutions help improve yield consistency, reduce operational costs, and maximize resource utilization. As farmers embrace digital transformation, autonomous harvesters are expected to become an essential component of future farming operations, redefining agricultural efficiency and sustainability.What Technological Innovations Are Driving Market Growth?

The market for autonomous harvesters is being propelled by rapid advancements in robotics, artificial intelligence, and sensor technology. These machines are equipped with machine vision systems that enable real-time crop recognition, allowing for selective and precise harvesting. Integration of IoT and cloud computing allows farmers to monitor harvester performance remotely, ensuring predictive maintenance and optimizing operational efficiency. Additionally, improvements in lithium-ion battery technology and hybrid propulsion systems are enhancing the energy efficiency and runtime of autonomous harvesters, making them more viable for large-scale agricultural applications. As smart farming ecosystems evolve, the convergence of automation, AI, and robotics will continue to drive the adoption of autonomous harvesters globally.Which Agricultural Sectors Are Leading the Adoption of Autonomous Harvesters?

Autonomous harvesters are being widely adopted across various agricultural sectors, including grains, fruits, vegetables, and specialty crops. In large-scale grain farming, autonomous combines are being deployed to streamline harvesting processes, improving efficiency and reducing grain losses. Fruit and vegetable producers are increasingly using robotic harvesters to address labor shortages and maintain harvesting precision. The viticulture industry is also leveraging autonomous harvesting technology to optimize grape collection and enhance wine production quality. Moreover, emerging economies in Asia-Pacific and Latin America are witnessing a surge in demand for autonomous harvesting equipment as governments push for modernization and food security initiatives. With increasing mechanization in global agriculture, autonomous harvesters are set to play a vital role in optimizing yield and reducing post-harvest losses.What Factors Are Fueling Market Expansion?

The growth in the autonomous harvesters market is driven by several factors, including advancements in AI-powered automation, the increasing need for labor-efficient solutions, and the push for precision agriculture. The rising global demand for food production, coupled with shrinking agricultural workforces, is accelerating the adoption of robotic harvesting solutions. Governments and agricultural organizations are investing in smart farming technologies, incentivizing farmers to adopt automation-driven solutions. Additionally, climate change and unpredictable weather conditions are necessitating efficient harvesting solutions to minimize crop losses. The expanding role of agri-tech firms in developing AI-driven harvesting technologies, along with collaborations between farming equipment manufacturers and tech companies, is further fostering innovation in this sector. As the agricultural industry continues its transition toward digitalization, autonomous harvesters will become indispensable in ensuring food security and farm profitability.Report Scope

The report analyzes the Autonomous Harvesters market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Level of Autonomy (Semi-Autonomous Harvesting, Remote-Controlled Harvesting, Fully-Autonomous Harvesting); Crop Type (Grains and Cereals, Fruits and Vegetables, Cotton, Sugarcane, Other Crop Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Semi-Autonomous Harvesting segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 14.4%. The Remote-Controlled Harvesting segment is also set to grow at 11.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $476.8 Million in 2024, and China, forecasted to grow at an impressive 12.1% CAGR to reach $583.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Harvesters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Harvesters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Harvesters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aptitude Software Limited, Auditoria.AI, Emagia Corporation, Fennech Financial Ltd., Gaviti and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Autonomous Harvesters market report include:

- Beri Udyog Pvt. Ltd. (Fieldking)

- CLAAS KGaA mbH

- CNH Industrial America LLC

- Deere & Company

- Deutz-Fahr (SDF Group)

- Fieldwork Robotics

- Harvest CROO Robotics LLC

- HuizingHarvest

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Raven Industries, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Beri Udyog Pvt. Ltd. (Fieldking)

- CLAAS KGaA mbH

- CNH Industrial America LLC

- Deere & Company

- Deutz-Fahr (SDF Group)

- Fieldwork Robotics

- Harvest CROO Robotics LLC

- HuizingHarvest

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Raven Industries, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

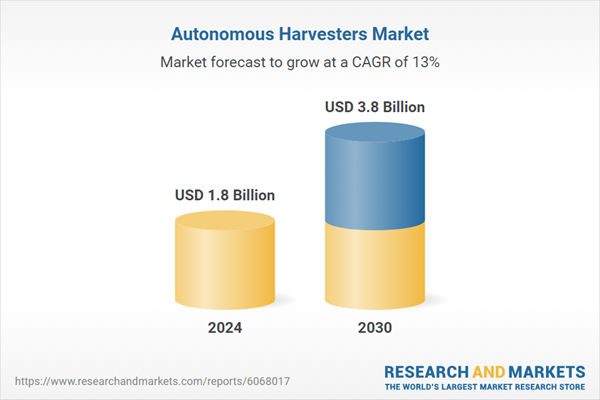

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |