Global Boat & Yacht Insurance Market - Key Trends & Drivers Summarized

How Is Technology Transforming the Boat & Yacht Insurance Industry?

The boat and yacht insurance industry is experiencing a technological transformation, driven by the integration of advanced data analytics, telematics, and digital platforms. The adoption of telematics devices enables real-time monitoring of vessel performance, navigation patterns, and safety metrics, providing insurers with valuable data to assess risk more accurately. Predictive analytics and artificial intelligence (AI) are being leveraged to enhance underwriting processes, enabling more precise risk assessments and customized policy offerings. Blockchain technology is emerging as a tool for improving transparency and efficiency in claims processing, reducing fraud, and streamlining documentation. Additionally, digital platforms and mobile applications are revolutionizing customer engagement, allowing policyholders to manage their insurance portfolios, file claims, and receive instant support through user-friendly interfaces. The integration of satellite tracking and geospatial technologies is enhancing loss prevention strategies by providing real-time weather updates and route optimization for safer voyages.What Market Trends Are Influencing the Demand for Boat & Yacht Insurance?

The demand for boat and yacht insurance is being shaped by several emerging market trends, reflecting changes in ownership patterns, recreational activities, and regulatory environments. The growing popularity of recreational boating and luxury yachting, driven by rising disposable incomes and lifestyle changes, has expanded the customer base for marine insurance products. The increasing trend of yacht charters and shared ownership models is creating new insurance requirements, as these arrangements introduce unique risks related to liability and usage patterns. Climate change and the associated rise in extreme weather events are influencing insurers to reassess risk models and pricing structures, particularly for vessels operating in hurricane-prone regions. Additionally, stricter maritime regulations and safety compliance requirements are driving demand for comprehensive insurance coverage that addresses legal liabilities and environmental risks. The global expansion of maritime tourism and long-distance cruising has increased the need for international insurance policies that provide cross-border coverage and support. These trends are reshaping the landscape of boat and yacht insurance, prompting insurers to innovate and adapt to the changing dynamics of marine risk management.How Are Consumer Expectations and Regulatory Changes Impacting the Boat & Yacht Insurance Market?

Consumer expectations in the boat and yacht insurance market are evolving, with policyholders seeking greater flexibility, transparency, and personalized coverage options. Modern boat owners expect seamless digital experiences, from policy purchasing to claims processing, leading insurers to invest in mobile apps and online platforms that offer convenience and real-time support. There is also a growing demand for usage-based insurance models, where premiums are calculated based on actual vessel usage and risk exposure, providing cost savings for seasonal or infrequent boaters. On the regulatory front, maritime authorities are implementing stricter compliance requirements related to safety equipment, crew certifications, and environmental protection, influencing the terms and conditions of insurance policies. International maritime conventions and local laws governing liability, salvage, and pollution are also impacting insurance coverage, requiring specialized policies for commercial operators and luxury yacht owners. Additionally, increasing awareness of cybersecurity threats in connected marine systems is prompting the inclusion of cyber risk coverage in comprehensive insurance plans. These shifts in consumer behavior and regulatory landscapes are driving insurers to develop innovative, customer-centric products that align with the evolving needs and expectations of the modern boating community.The Growth in the Boat & Yacht Insurance Market Is Driven by Several Factors…

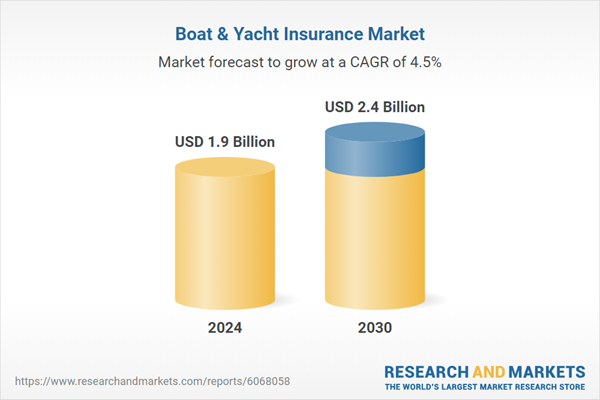

The growth in the boat and yacht insurance market is driven by several factors, including the rising popularity of recreational boating, advancements in marine technology, and evolving regulatory frameworks. The expansion of global maritime tourism and luxury yachting has created a larger, more diverse customer base with varying insurance needs. Technological innovations, such as telematics, predictive analytics, and digital platforms, are enhancing risk assessment and claims management, making insurance products more accessible and tailored to individual preferences. Regulatory changes at both international and local levels are driving demand for comprehensive insurance coverage that addresses new compliance requirements, including environmental liability and crew safety. Additionally, the increasing frequency of extreme weather events and natural disasters is raising awareness about the importance of robust insurance protection, leading to higher penetration rates in both recreational and commercial boating segments. Consumer demand for flexible, usage-based insurance models and seamless digital experiences is pushing insurers to innovate and diversify their offerings. These factors, combined with ongoing investments in technology and customer engagement, are propelling the boat and yacht insurance market towards sustained growth and increased global adoption.Report Scope

The report analyzes the Boat & Yacht Insurance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Insurance Type (Boat Insurance, Yacht Insurance); Policy (Agreed Value Policy, Actual Cash Value Policy).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Boat Insurance segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 5.3%. The Yacht Insurance segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $504.5 Million in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $501.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Boat & Yacht Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Boat & Yacht Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Boat & Yacht Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Interconnections Corp., AirBorn, Inc., Amphenol Communications Solutions, CSCONN Corporation, HARTING Deutschland GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Boat & Yacht Insurance market report include:

- American International Group, Inc. (AIG)

- Allstate Insurance Company

- AXA XL

- Chubb

- Foremost Insurance Group

- GEICO Marine Insurance Company

- Kemper Corporation

- Markel Group Inc.

- Nationwide Mutual Insurance Company

- PIB Insurance Brokers

- Progressive Casualty Insurance Company

- Safeco Insurance Company

- State Farm Mutual Automobile Insurance Company

- USAA (United Services Automobile Association)

- Zurich Insurance Group Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American International Group, Inc. (AIG)

- Allstate Insurance Company

- AXA XL

- Chubb

- Foremost Insurance Group

- GEICO Marine Insurance Company

- Kemper Corporation

- Markel Group Inc.

- Nationwide Mutual Insurance Company

- PIB Insurance Brokers

- Progressive Casualty Insurance Company

- Safeco Insurance Company

- State Farm Mutual Automobile Insurance Company

- USAA (United Services Automobile Association)

- Zurich Insurance Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |