Global Payment Instruments Market - Key Trends & Drivers Summarized

Are We Moving Towards a Cashless Future? The Evolution of Payment Instruments

The global financial landscape is undergoing a dramatic transformation, with payment instruments evolving beyond traditional cash transactions to digital, contactless, and blockchain-based alternatives. The rapid rise of e-commerce, digital banking, and fintech innovation has accelerated the adoption of various payment instruments, including credit and debit cards, mobile wallets, cryptocurrencies, and real-time payment systems. Consumers are shifting away from physical cash in favor of seamless, instant, and secure digital payment methods that enhance convenience and efficiency. Governments and financial institutions are actively promoting cashless transactions to enhance transparency, reduce fraud, and improve financial inclusion. Emerging economies, where a significant portion of the population remains unbanked, are witnessing rapid adoption of mobile money services as an alternative to conventional banking. The COVID-19 pandemic further propelled the shift towards digital payments, as contactless transactions became the preferred method for hygiene-conscious consumers. With continuous advancements in payment technology, the landscape of payment instruments is evolving, creating a future where physical money may become obsolete.How Is Technology Revolutionizing Payment Instruments? AI, Blockchain & Contactless Innovation

Technological advancements are redefining how transactions are processed, making payment instruments faster, more secure, and increasingly automated. Artificial intelligence (AI) and machine learning are enhancing fraud detection and risk assessment in digital transactions, enabling real-time monitoring and anomaly detection. Blockchain technology is disrupting the traditional payment ecosystem by offering decentralized and tamper-proof transactions, reducing reliance on intermediaries. Cryptocurrencies and stablecoins are gaining traction as alternative payment instruments, allowing for borderless and low-cost transactions. Contactless payment innovations, such as Near Field Communication (NFC) and QR codes, are driving mass adoption of tap-and-go transactions, particularly in retail and public transportation sectors. Biometric authentication, including facial recognition and fingerprint scanning, is replacing traditional PIN-based transactions, enhancing both security and user experience. The rise of digital wallets and super apps is consolidating multiple payment instruments into a single platform, offering users seamless integration of bank accounts, cards, cryptocurrencies, and rewards programs. With real-time payment systems such as India's UPI (Unified Payments Interface), Europe's SEPA Instant, and FedNow in the U.S., instant money transfers are becoming the norm, reducing settlement times and enhancing global financial connectivity.Who Are the Key Players Driving the Payment Instruments Market? A Look at Industry Expansion

The payment instruments market is being shaped by a dynamic mix of traditional financial institutions, fintech startups, regulatory bodies, and tech giants. Banks and financial service providers continue to dominate the credit and debit card ecosystem, but fintech disruptors are redefining the industry with innovative payment solutions. Mobile wallet providers such as PayPal, Apple Pay, Google Pay, and Alipay are capturing a significant share of digital transactions, offering consumers a seamless and integrated payment experience. Central banks are exploring the implementation of Central Bank Digital Currencies (CBDCs) as an alternative to traditional fiat money, ensuring regulatory oversight while enhancing digital payment adoption. The growing influence of non-banking financial companies (NBFCs) and embedded finance solutions is further diversifying the payment landscape, enabling businesses to integrate payment services directly into their platforms. Retailers and e-commerce giants are integrating proprietary payment instruments, such as store-branded credit cards and Buy Now, Pay Later (BNPL) services, to drive customer loyalty and boost sales. As cross-border e-commerce continues to expand, international remittance service providers are leveraging blockchain and digital currencies to facilitate low-cost, real-time transactions. With increased regulatory scrutiny on payment security and data privacy, collaboration between financial institutions, regulators, and technology providers is shaping the future of payment instruments worldwide.The Growth in the Payment Instruments Market Is Driven by Several Factors…

The increasing digitization of financial transactions is a primary driver accelerating the adoption of diverse payment instruments. The rise of e-commerce, digital banking, and on-demand services is fueling demand for seamless and frictionless payment solutions. The widespread penetration of smartphones and internet connectivity is expanding access to mobile payment platforms, particularly in developing markets. The growing preference for contactless and cashless transactions, driven by hygiene concerns and consumer convenience, is transforming retail and in-store payment methods. Regulatory frameworks promoting financial inclusion and digital payments are driving the adoption of mobile money services and real-time payment networks. The emergence of blockchain-based payment instruments, including cryptocurrencies and CBDCs, is reshaping cross-border transactions and decentralized finance (DeFi). AI-driven fraud prevention and authentication technologies are improving security in digital payments, enhancing consumer confidence. The proliferation of embedded finance and BNPL services is expanding the scope of payment instruments beyond traditional banking channels. Strategic collaborations between fintech companies, financial institutions, and regulatory authorities are fostering innovation in the payment ecosystem. As digital transformation accelerates across industries, the future of payment instruments will continue to evolve, redefining how transactions are conducted globally.Report Scope

The report analyzes the Payment Instruments market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Desktop, Handheld, Mobile); End-Use (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-Commerce, Transportation, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Desktop Instruments segment, which is expected to reach US$248.6 Billion by 2030 with a CAGR of a 15.9%. The Handheld Instruments segment is also set to grow at 10.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $44.2 Billion in 2024, and China, forecasted to grow at an impressive 19.3% CAGR to reach $78.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Payment Instruments Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Payment Instruments Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Payment Instruments Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adyen, Alipay (Ant Group), Amazon Pay, American Express, Apple Pay and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Payment Instruments market report include:

- Adyen

- Alipay (Ant Group)

- Amazon Pay

- American Express

- Apple Pay

- Discover Financial

- Google Pay

- Klarna

- Mastercard Inc.

- Neteller

- Payoneer

- PayPal Holdings Inc.

- Revolut

- Samsung Pay

- Skrill

- Square Inc. (Block)

- Stripe

- Visa Inc.

- WeChat Pay (Tencent)

- Worldpay

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adyen

- Alipay (Ant Group)

- Amazon Pay

- American Express

- Apple Pay

- Discover Financial

- Google Pay

- Klarna

- Mastercard Inc.

- Neteller

- Payoneer

- PayPal Holdings Inc.

- Revolut

- Samsung Pay

- Skrill

- Square Inc. (Block)

- Stripe

- Visa Inc.

- WeChat Pay (Tencent)

- Worldpay

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

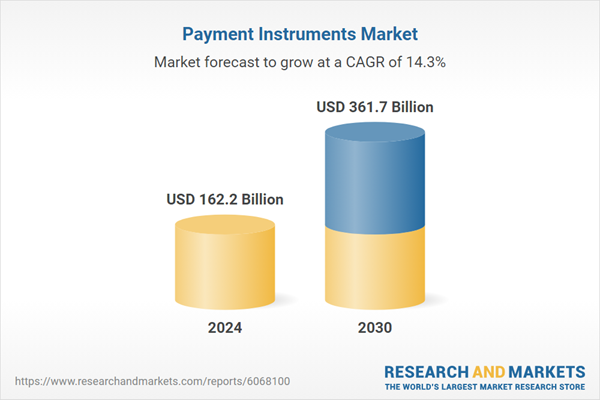

| Estimated Market Value ( USD | $ 162.2 Billion |

| Forecasted Market Value ( USD | $ 361.7 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |