Global Ocular Adhesives and Sealants Market - Key Trends & Drivers Summarized

Why Are Ocular Adhesives and Sealants Gaining Traction as a Surgical Alternative to Sutures?

Ocular adhesives and sealants are rapidly transforming ophthalmic surgery by offering a safer, faster, and less invasive alternative to traditional suturing methods. These specialized biomaterials are designed to promote tissue adhesion, close incisions, seal corneal perforations, and prevent post-operative fluid leakage in various ophthalmic procedures. What sets ocular adhesives apart is their ability to reduce surgical time, minimize tissue trauma, and enhance patient comfort - especially crucial in delicate eye surgeries where precision is paramount. The increasing complexity of ophthalmic interventions, including cataract extraction, corneal transplants, LASIK, and glaucoma drainage procedures, has intensified demand for sealants that provide strong adhesion under wet conditions. Fibrin-based adhesives, polyethylene glycol (PEG) hydrogels, cyanoacrylate glues, and newer bioengineered polymers are among the most widely adopted solutions, each suited for specific clinical needs. For example, fibrin sealants are preferred for their biocompatibility and biodegradability, while cyanoacrylates are favored in emergency scenarios due to their rapid polymerization. The growing use of minimally invasive surgeries has further bolstered the need for these adhesives, particularly as microincisions and sutureless procedures become more commonplace. Additionally, these sealants play a critical role in reducing the risk of endophthalmitis, astigmatism, and other complications associated with traditional suturing. As surgical outcomes and patient experience become key performance metrics in modern ophthalmology, ocular adhesives and sealants are emerging as indispensable tools in achieving superior clinical results with fewer complications and quicker recovery times.How Are Global Demographics and Eye Disorder Trends Influencing Market Demand?

The global surge in age-related eye disorders and the increasing volume of ophthalmic procedures are driving significant demand for ocular adhesives and sealants. As populations age, conditions such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy are becoming increasingly prevalent, particularly in North America, Europe, and Asia-Pacific. The World Health Organization estimates that over 2 billion people globally have a vision impairment, much of which could be addressed through surgical intervention - underscoring the growing need for supportive surgical materials like adhesives and sealants. Furthermore, increased access to healthcare in emerging economies is expanding the number of people undergoing elective and corrective eye surgeries, from refractive surgeries to pterygium removal. Pediatric ophthalmology is also seeing a rise in the adoption of adhesives to manage congenital anomalies and trauma-related injuries, where sutures can be impractical or cause long-term discomfort. In addition to clinical volume, heightened patient expectations for quick recovery and improved cosmetic outcomes are accelerating the shift toward sutureless solutions. Regions like Asia-Pacific are experiencing a particularly sharp growth curve due to a combination of high surgical volume, increasing per capita health expenditure, and government investments in ophthalmic infrastructure. Simultaneously, global health initiatives focused on preventing blindness are pushing for the adoption of advanced surgical tools in low-resource settings, further catalyzing demand. As the epidemiological burden of ocular diseases rises and surgical access expands, the global market for adhesives and sealants is poised to play a vital role in modernizing eye care delivery.Is Innovation in Biomaterials Revolutionizing the Landscape of Ocular Sealants?

Indeed, technological advancements in biomaterials and formulation science are significantly reshaping the ocular adhesives and sealants market. Innovations are primarily focused on improving biocompatibility, transparency, adhesion strength, and biodegradation profiles, ensuring that sealants can safely integrate into sensitive ocular tissues without eliciting inflammation or toxicity. Next-generation PEG-based hydrogels are gaining momentum for their ability to form flexible, transparent seals that maintain ocular clarity - a critical requirement in vision-centric applications. Researchers are also exploring novel cross-linking chemistries that enable faster curing under light activation or body temperature, which simplifies intraoperative use. Meanwhile, bioengineered adhesives inspired by natural compounds - such as gelatin, silk fibroin, and mussel-derived proteins - are being developed to combine strong adhesion with enhanced healing properties. Another exciting area is the integration of drug delivery capabilities into ocular sealants, allowing for post-surgical release of anti-inflammatory or antibiotic agents, thereby reducing the need for separate topical medications. Additionally, nanotechnology is playing a role in designing adhesives with enhanced mechanical strength and antimicrobial properties. On the manufacturing side, innovations in sterile packaging, single-use applicators, and dual-syringe delivery systems are streamlining surgical workflows and minimizing contamination risk. Regulatory agencies are increasingly supporting these innovations by fast-tracking approvals for products that demonstrate significant clinical benefit. As the boundaries between therapeutic materials and surgical aids continue to blur, ocular adhesives and sealants are evolving into multifunctional platforms that enhance both surgical efficiency and patient safety.What Factors Are Fueling the Accelerated Growth of the Ocular Adhesives and Sealants Market?

The growth in the ocular adhesives and sealants market is driven by several factors centered on clinical innovation, rising surgical volumes, and evolving patient care standards. One of the primary drivers is the increasing global frequency of ophthalmic surgeries, fueled by the rising incidence of age-related eye diseases and greater patient access to vision care services. Technological progress in minimally invasive and micro-incisional techniques has further increased the demand for non-suturing solutions that maintain ocular integrity without compromising healing. From a materials standpoint, the development of fast-acting, biocompatible, and transparent adhesives is opening new applications in corneal, conjunctival, and scleral repairs. In the outpatient surgical setting, the use of adhesives can significantly reduce operating room time and follow-up care, making them a cost-effective solution for high-volume centers. Patient preference also plays a key role - today’ s patients are more informed and more likely to seek procedures with shorter recovery periods and fewer complications, increasing demand for products that improve post-operative comfort and healing. On the commercial side, increasing investments from both established players and med-tech startups are driving rapid product innovation and expanding global distribution networks. Regulatory approvals in major markets like the U.S., EU, and Japan are accelerating market entry for new products, while rising R&D collaboration between academic institutions and private companies is pushing the frontiers of biomaterial science. Additionally, supportive reimbursement frameworks in developed regions and growing surgical capacity in developing countries are creating fertile ground for market expansion. Collectively, these dynamics are propelling the ocular adhesives and sealants market into a phase of sustained and transformative growth.Report Scope

The report analyzes the Ocular Adhesives and Sealants market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Natural Ocular Adhesives & Sealants, Synthetic Ocular Adhesives & Sealants); Application (Tissue Engineering Application, Conjunctival Surgery Application, Refractive Surgery Application, Vitreo-Retinal Surgery Application, Corneal Surgery Application); End-Use (Ophthalmic Clinics End-Use, Hospitals End-Use, Ambulatory Surgery Centers End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Ocular Adhesives & Sealants segment, which is expected to reach US$150.1 Million by 2030 with a CAGR of a 5.1%. The Synthetic Ocular Adhesives & Sealants segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $45.9 Million in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $49.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ocular Adhesives and Sealants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ocular Adhesives and Sealants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ocular Adhesives and Sealants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arkema Group, Axxence Aromatic GmbH, BASF SE, Bharat Petroleum Corporation Limited, Dow Chemical Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Ocular Adhesives and Sealants market report include:

- 3M Company

- AccuPS

- Advanced Medical Solutions Group plc

- Aesculap (a division of B. Braun)

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- BIOFLEX

- Cohera Medical, Inc.

- CryoLife, Inc.

- Everett Surgical

- GluStitch Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Medtronic plc

- Ocular Therapeutix, Inc.

- Reliance Life Sciences

- Smith & Nephew plc

- Stryker Corporation

- Sutures India Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- AccuPS

- Advanced Medical Solutions Group plc

- Aesculap (a division of B. Braun)

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- BIOFLEX

- Cohera Medical, Inc.

- CryoLife, Inc.

- Everett Surgical

- GluStitch Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Medtronic plc

- Ocular Therapeutix, Inc.

- Reliance Life Sciences

- Smith & Nephew plc

- Stryker Corporation

- Sutures India Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

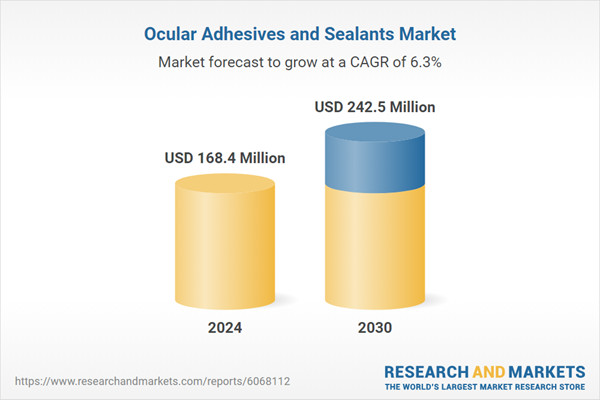

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 168.4 Million |

| Forecasted Market Value ( USD | $ 242.5 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |