Global Low Voltage Electric Boiler Market - Key Trends & Drivers Summarized

What Is Triggering the Resurgence of Low Voltage Electric Boilers in Industrial Settings?

A notable trend sweeping through the global energy and heating sectors is the resurgence of low voltage electric boilers, particularly in industrial environments. Traditionally overshadowed by fossil fuel-based heating systems and high-voltage alternatives, these boilers are now enjoying renewed attention due to the evolving energy infrastructure and stringent decarbonization mandates. One of the most significant shifts is the adoption of decentralized energy systems and electrified heating solutions that align with low-emission targets across Europe, North America, and parts of Asia. As industries move away from carbon-intensive energy sources, low voltage electric boilers are emerging as a viable alternative, especially in applications requiring moderate thermal energy. Their ability to seamlessly integrate with renewable power sources like solar and wind energy makes them ideal for industries looking to transition toward carbon neutrality. Additionally, their compatibility with smart grid infrastructure supports real-time energy optimization and demand-side management - an attractive feature for industries balancing production efficiency and energy costs.From a regulatory standpoint, governments and international bodies are imposing increasingly aggressive limits on emissions from industrial heat generation. The EU’ s “ Fit for 55” package and similar initiatives in North America are compelling businesses to seek clean alternatives, thereby enhancing the appeal of low voltage electric boilers. These units, unlike high voltage variants, require less infrastructural reinforcement, making retrofitting in existing plants more economically feasible. The low complexity of installation, minimal maintenance, and lower upfront costs compared to high voltage systems contribute to their attractiveness. Moreover, industrial players from sectors such as food processing, pharmaceuticals, and chemical manufacturing - all of which require precise, controlled heat - are now investing in electric boilers to future-proof their energy systems. With rising grid reliability and increasing renewable energy penetration, these boilers are increasingly viewed not as secondary solutions but as primary heating systems in evolving industrial ecosystems.

How Are Commercial and Residential Segments Adapting to This Silent Energy Revolution?

While industrial adoption is significant, the uptake of low voltage electric boilers is also quietly transforming commercial and residential heating landscapes. Urbanization and the shift toward electric-only energy usage in new building developments - especially in Europe and parts of Asia - have paved the way for a broader acceptance of low voltage systems. Large commercial complexes, schools, hospitals, and apartment blocks are beginning to incorporate these boilers into their energy strategies, often paired with smart thermostats and building management systems. Their ability to provide consistent, low-emission heating at relatively low operational costs is particularly appealing to facilities managers and property developers aiming for green building certifications like LEED or BREEAM. In many cases, these systems are also being used in district heating networks, especially in Scandinavian and Baltic countries, where electrified heating is being scaled up as a replacement for outdated, fossil fuel-reliant infrastructure.The residential segment, although traditionally slower to shift from gas or oil-based heating, is gradually warming up to electric boilers as technological advancements improve performance and affordability. Rising fuel prices, combined with growing awareness about carbon footprints, are pushing homeowners to consider electric alternatives - especially those in multi-family units or regions with supportive subsidies and incentives. In addition, the increase in smart home adoption plays a critical role, as low voltage electric boilers can be effectively integrated into centralized control systems. Consumers are also responding positively to the silent operation, compact design, and zoned heating capabilities these boilers offer. Real estate developers, in particular, are embracing them in new builds, where electric heating infrastructure is easier to plan and implement from the outset. As governments continue to phase out fossil-fueled boilers, especially in new residential constructions, the residential market is poised to become a major contributor to overall demand.

Is Technology Redefining the Performance Expectations of Low Voltage Electric Boilers?

The evolution of the low voltage electric boiler market is deeply intertwined with technological innovation, particularly in the realm of energy efficiency, automation, and materials science. Advances in microprocessor-based control systems now allow for real-time modulation and adaptive heating responses based on building occupancy, external weather patterns, or process load. This results in significantly reduced energy waste and optimized energy consumption - a crucial advantage in commercial and industrial environments where operational margins are tight. Additionally, IoT integration and remote monitoring capabilities enable predictive maintenance and system diagnostics, reducing downtime and ensuring consistent performance. These features are particularly valuable in mission-critical environments such as hospitals and research labs, where uninterrupted heating is essential.Another breakthrough has been in the design of heating elements and insulation materials. Manufacturers are increasingly leveraging ceramic-based components and high-grade stainless steels, which not only enhance heat transfer efficiency but also extend the operational life of the units. The use of modular designs has further enabled customization of heating output, allowing systems to be scaled according to specific application needs without unnecessary energy overuse. The emergence of hybrid systems - combining low voltage electric boilers with heat pumps or thermal storage units - is also shaping market dynamics by improving system responsiveness and reducing peak electricity demand.

Why Is the Market for Low Voltage Electric Boilers Poised for Sustained Expansion?

The growth in the low voltage electric boiler market is driven by several factors specific to the technological landscape, evolving end-user demands, and changing consumption patterns. A key driver is the ongoing electrification of heat - part of a broader trend toward decarbonized energy systems that prioritize low-emission technologies in place of traditional combustion-based heating. Rapid urban development, especially in emerging markets, is fueling demand for compact, efficient heating solutions that can be easily integrated into modern infrastructure. Another pivotal influence is the increasing cost competitiveness of electricity generated from renewable sources. As clean energy becomes more accessible and affordable, it is making electric-based heating systems more economically attractive than fossil-fueled alternatives in many regions.End-users are also displaying a marked shift in behavior, with a growing preference for automated, low-maintenance, and digitally connected heating solutions. This aligns with the rise in smart infrastructure projects and green building codes, which are being adopted at an unprecedented scale worldwide. Furthermore, utility companies and energy service providers are actively promoting demand-side electrification strategies to stabilize grid loads, often providing incentives or rebates for electric boiler installations. Technological miniaturization, modular manufacturing, and improved efficiency metrics have made low voltage systems more scalable and flexible, catering to a broader range of applications - from small-scale commercial buildings to large industrial facilities. Finally, the tightening of emissions standards, especially around NOx and particulate emissions in urban zones, is pushing even the most resistant sectors toward electric heating adoption. These converging forces position the market for sustained, long-term expansion as electrified heating becomes a cornerstone of future-ready energy ecosystems.

Report Scope

The report analyzes the Low Voltage Electric Boilers market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Capacity (Below 10 MMBtu / hr, 10 - 50 MMBtu / hr, 50 - 100 MMBtu / hr, 100 - 250 MMBtu / hr); Application (Residential, Commercial, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 10 MMBtu / hr Boilers segment, which is expected to reach US$16.8 Billion by 2030 with a CAGR of a 12.9%. The 10 - 50 MMBtu / hr Boilers segment is also set to grow at 8.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 15% CAGR to reach $6.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Low Voltage Electric Boilers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Low Voltage Electric Boilers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Low Voltage Electric Boilers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Benshaw Inc., Danfoss A/S, Eaton Corporation plc, Emerson Electric Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Low Voltage Electric Boilers market report include:

- Acme Engineering Products Ltd.

- Alfa Laval

- Ariston Thermo

- Babcock Wanson

- Baxi

- Bosch Industriekessel GmbH

- Cleaver-Brooks

- Danstoker A/S

- Ecotherm Austria GmbH

- Ferroli S.p.A

- Flexiheat UK Ltd.

- Hi-Therm Boilers Pvt. Ltd.

- Kospel

- LAARS Heating Systems Co.

- Lochinvar

- PARAT Halvorsen AS

- Precision Boilers

- Slant/Fin Corporation

- The Fulton Companies

- Viessmann

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme Engineering Products Ltd.

- Alfa Laval

- Ariston Thermo

- Babcock Wanson

- Baxi

- Bosch Industriekessel GmbH

- Cleaver-Brooks

- Danstoker A/S

- Ecotherm Austria GmbH

- Ferroli S.p.A

- Flexiheat UK Ltd.

- Hi-Therm Boilers Pvt. Ltd.

- Kospel

- LAARS Heating Systems Co.

- Lochinvar

- PARAT Halvorsen AS

- Precision Boilers

- Slant/Fin Corporation

- The Fulton Companies

- Viessmann

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

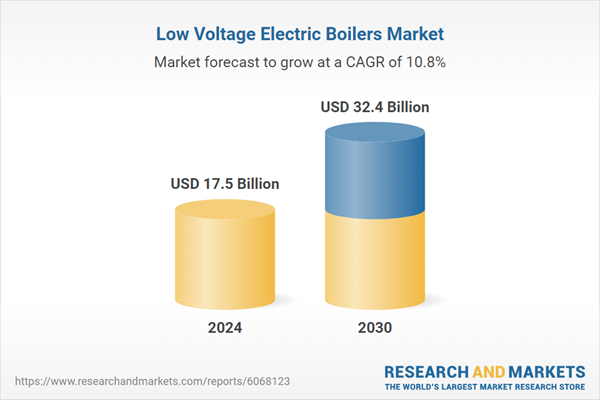

| Estimated Market Value ( USD | $ 17.5 Billion |

| Forecasted Market Value ( USD | $ 32.4 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |