Luxury Packaging: What’ s Making High-End Packaging the New Battleground for Prestige Brands?

Global Luxury Packaging Market - Key Trends & Drivers Summarized

The global luxury packaging market has evolved beyond its traditional role as a protective container to become a powerful tool for storytelling, brand elevation, and consumer engagement. Spanning industries such as fashion, cosmetics, jewelry, fine wine & spirits, gourmet food, and tech accessories, luxury packaging is increasingly being used to convey exclusivity, quality, and sustainability. High-end brands are leveraging packaging as an integral part of the product experience - often equating the unboxing moment with brand identity itself. From embossed rigid boxes and magnetic closures to artisanal wrapping papers and custom inserts, luxury packaging is now an orchestrated symphony of materials, finishes, and functionality that speaks directly to consumer expectations of premium value. In sectors like beauty and fashion, packaging innovation has even become a market differentiator, influencing purchasing decisions and brand loyalty.The aesthetic and emotional impact of luxury packaging is being magnified by its growing role in digital-first brand strategies. With e-commerce continuing to rise in the premium segment, the tactile and visual appeal of packaging serves as a physical bridge between online and offline brand experiences. As social media and unboxing culture make packaging a visible and viral asset, brands are investing heavily in design-led packaging that resonates on camera and delivers a multisensory experience. Furthermore, luxury packaging is now inseparable from sustainability narratives - brands are under pressure to use eco-friendly materials, reduce waste, and ensure traceability without compromising on visual sophistication or structural integrity. These dynamics are collectively reshaping the global luxury packaging landscape, turning it into a central pillar of luxury brand positioning.

What Innovations Are Shaping the Next Generation of Luxury Packaging?

Innovation in materials science, digital printing, and structural engineering is driving a renaissance in luxury packaging design. One of the most prominent trends is the move toward sustainable luxury, with brands increasingly opting for biodegradable, recycled, or upcycled materials that maintain a premium feel. Innovations include plant-based laminates, FSC-certified paperboards, reusable packaging shells, and water-based coatings. Some brands are even experimenting with seed-infused papers or packaging embedded with scents and textures to enrich the sensory connection with the consumer. Luxury brands are also embracing mono-material designs to enhance recyclability, and using smart adhesives that can be easily separated during recycling processes without degrading the brand aesthetic.Digital and smart packaging technologies are also making inroads into the luxury sector. NFC chips, QR codes, and AR-enabled packaging are being integrated to provide authenticity verification, traceability, and immersive storytelling experiences. These interactive elements help brands establish digital connections with consumers and enhance trust, especially in markets plagued by counterfeiting - such as high-end spirits, watches, and cosmetics. Additionally, innovations in structural design are enabling complex, origami-inspired packaging solutions that combine minimalism with luxury, allowing for flat-packed delivery and reduced carbon footprints without compromising shelf appeal. Digital prototyping and rapid sampling are helping designers iterate faster and align packaging innovation with shifting consumer preferences, especially in the personalization segment where customization is becoming standard in luxury gifting and limited-edition runs.

Which Markets and Consumers Are Fueling the Demand for Luxury Packaging - And Why?

Regionally, Western Europe remains a cornerstone of luxury packaging innovation, particularly in countries like France, Italy, and the UK, which are home to legacy fashion, fragrance, and wine brands. European manufacturers lead in craftsmanship, sustainable packaging standards, and artisan collaborations. However, Asia-Pacific - especially China, South Korea, and Japan - is now the fastest-growing market for luxury packaging, fueled by booming luxury consumption, brand localization strategies, and heightened consumer interest in premium presentation. In China, packaging often holds ceremonial and gifting value, driving demand for elaborate, meticulously crafted designs with personalized, culturally relevant elements.Affluent millennials and Gen Z are emerging as the most influential consumer groups in luxury packaging. These demographics prioritize authenticity, visual storytelling, and sustainability - expecting packaging to reflect their values and enhance their social media experiences. As a result, there is growing demand for limited-edition packaging, co-branded collectibles, and packaging-as-art collaborations. E-commerce growth is also altering packaging needs, with a sharp rise in demand for durable yet aesthetically pleasing shipping solutions that preserve the luxury image through delivery. Meanwhile, the hospitality, jewelry, and fine dining sectors are elevating their packaging standards to match customer expectations for immersive, high-touch experiences - creating new B2B opportunities in the luxury packaging ecosystem.

The Growth in the Luxury Packaging Market Is Driven by Several Factors…

The growth in the luxury packaging market is driven by several factors spanning material innovation, sustainability demands, e-commerce transformation, and evolving end-user preferences. One of the strongest growth drivers is the premiumization of consumer goods across diverse industries - from cosmetics and personal care to gourmet food and electronics. As brands vie for attention in saturated luxury segments, distinctive and expressive packaging becomes a vital brand differentiator. The rising adoption of eco-conscious materials - such as recycled paperboard, biodegradable plastics, and refillable formats - is also contributing to growth, allowing brands to align environmental responsibility with aesthetic excellence.The acceleration of luxury e-commerce is another major factor, with brands investing in secondary packaging that offers both protection and a high-end tactile experience. This includes drawer-style rigid boxes, magnetic closures, and layered opening mechanisms that replicate in-store experiences. In end-use markets, luxury packaging is expanding into previously untapped verticals such as wellness products, artisanal spirits, tech accessories, and high-end CBD offerings - each demanding bespoke, visually sophisticated solutions. Furthermore, the growing emphasis on personalization - enabled by digital printing and modular designs - is allowing brands to offer monogrammed, numbered, or occasion-specific packaging that enhances perceived value. Lastly, anti-counterfeiting technology embedded in packaging (e.g., RFID tags, holographic seals) is becoming a critical tool in protecting brand equity, particularly in markets like luxury fashion and spirits. Together, these drivers are ensuring that the luxury packaging market continues to evolve as both a strategic brand asset and a growth catalyst across the global premium product ecosystem.

Report Scope

The report analyzes the Luxury Packaging market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Luxury Packaging Bags, Luxury Packaging Bottles, Luxury Packaging Pouches, Luxury Packaging Boxes, Other Luxury Packaging Products); Material (Paperboard Material, Plastic Material, Glass Material, Metal Material, Other Materials); Application (Cosmetics & Personal Care Application, Home Decor & Furnishings Application, Fashion Accessories & Apparels Application, Premium Alcohol Application, Chocolates & Confectioneries Application, Nutraceuticals Application, Other Applications); End-Use (Consumer Goods End-Use, Food & Beverages End-Use, Pharmaceuticals End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Packaging Bags segment, which is expected to reach US$9.8 Billion by 2030 with a CAGR of a 3.3%. The Packaging Bottles segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $4.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Luxury Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Luxury Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Luxury Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alterna Haircare, Aveda Corporation, Balmain Hair Couture, Bumble and bumble, Cécred and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Luxury Packaging market report include:

- Amcor Limited

- Cosfibel Group

- Crown Holdings, Inc.

- DS Smith Plc

- Ekol Ofset

- Fedrigoni

- GPA Global

- Groupe Pochet

- HH Deluxe Packaging

- Hunter Luxury

- IPL Packaging

- Mosaiq Group

- MW Creative Ltd

- Pendragon Presentation Packaging Ltd

- Premier Packaging, LLC

- Prestige Packaging Industries

- Pusterla 1880

- Tinshine

- WestRock Company

- Winter and Company AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor Limited

- Cosfibel Group

- Crown Holdings, Inc.

- DS Smith Plc

- Ekol Ofset

- Fedrigoni

- GPA Global

- Groupe Pochet

- HH Deluxe Packaging

- Hunter Luxury

- IPL Packaging

- Mosaiq Group

- MW Creative Ltd

- Pendragon Presentation Packaging Ltd

- Premier Packaging, LLC

- Prestige Packaging Industries

- Pusterla 1880

- Tinshine

- WestRock Company

- Winter and Company AG

Table Information

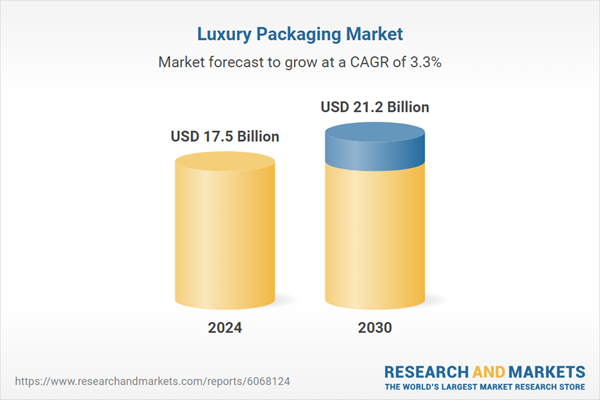

| Report Attribute | Details |

|---|---|

| No. of Pages | 498 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.5 Billion |

| Forecasted Market Value ( USD | $ 21.2 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |