Global Industrial Drones Market - Key Trends & Drivers Summarized

Industrial Drones: Transforming Industrial Operations with Aerial Intelligence

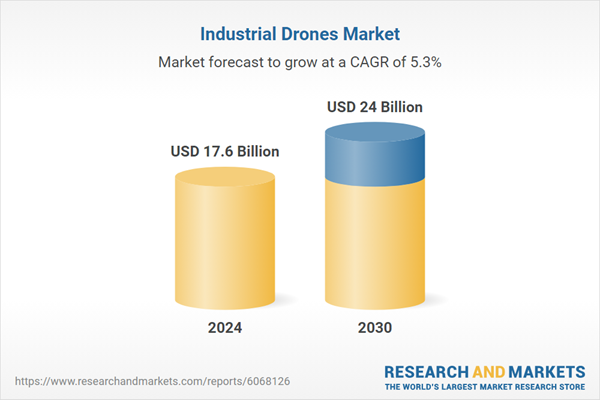

The industrial drone market is experiencing exponential growth as industries increasingly adopt unmanned aerial vehicles (UAVs) for inspection, surveillance, mapping, and logistics. Industrial drones are revolutionizing sectors such as oil & gas, agriculture, construction, mining, and logistics by providing real-time data collection, improved safety, and operational efficiency. These UAVs reduce the need for manual labor in hazardous environments, optimize industrial workflows, and lower operational costs while increasing productivity.A major trend shaping the market is the rise of AI-powered autonomous drones capable of real-time obstacle detection, automated flight planning, and predictive analytics. Additionally, the integration of LiDAR, thermal imaging, multispectral cameras, and GPS tracking is enhancing drone capabilities for infrastructure monitoring, pipeline inspection, and aerial mapping. With 5G connectivity and cloud-based drone analytics, industries can now process high-resolution aerial data instantly, enabling faster and more informed decision-making.

Why Are Industrial Drones Critical for Modern Industries?

Industrial drones are playing a transformative role in various sectors by enhancing efficiency, safety, and data accuracy. In the oil & gas and energy industries, drones are used for pipeline inspections, flare stack monitoring, and offshore platform surveillance, reducing the need for costly and hazardous manual inspections. Drones equipped with thermal imaging and gas detection sensors can identify leaks and structural weaknesses before they lead to failures, preventing environmental hazards and production disruptions.In the construction and infrastructure sector, industrial drones are used for site surveying, project progress tracking, and 3D modeling. They provide high-precision topographic data, helping engineers optimize resource allocation and reduce project delays. In agriculture, drones equipped with multispectral sensors enable precision farming, allowing farmers to monitor crop health, irrigation efficiency, and pest infestations with unprecedented accuracy.

How Is Technology Advancing Industrial Drone Capabilities?

Technological advancements are making industrial drones more autonomous, efficient, and versatile. The development of AI and machine learning-based navigation systems is enabling drones to fly autonomously, detect obstacles in real time, and make dynamic route adjustments. Additionally, edge computing and onboard AI processing allow drones to analyze data in-flight, reducing the need for post-flight processing and accelerating decision-making.The integration of LiDAR technology and high-resolution imaging systems is enhancing drone capabilities in precision mapping, terrain analysis, and infrastructure inspections. The deployment of drone swarms, where multiple UAVs operate collaboratively, is improving efficiency in large-scale industrial applications such as disaster response, security surveillance, and smart city planning. Additionally, advancements in battery technology and hydrogen-powered drones are extending flight durations, enabling drones to cover larger areas without frequent recharging.

What’ s Driving the Growth of the Industrial Drones Market?

The growth in the industrial drones market is driven by technological advancements, regulatory approvals for commercial UAV operations, and increasing demand for cost-effective industrial inspections. Governments and private organizations are investing in drone-based infrastructure monitoring, security surveillance, and logistics automation, accelerating adoption across industries.Another significant factor driving growth is the rising need for automation and digitalization in industrial processes. Companies are leveraging drone technology to reduce labor-intensive tasks, enhance safety compliance, and improve real-time decision-making. Additionally, the integration of AI-driven drone analytics and cloud-based data management platforms is transforming industrial drones into powerful business intelligence tools. As industries continue to embrace automation, aerial intelligence, and real-time data processing, demand for high-performance industrial drones is expected to surge, shaping the future of industrial operations.

Report Scope

The report analyzes the Industrial Drones market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Fixed Wing Drones Type, Rotary Wing Drones Type, Hybrid Wing Drones Type); Payload Capacity (Lightweight Drones Payload Capacity, Medium Payload Drones Payload Capacity, Heavy Duty Drones Payload Capacity); Propulsion (Gasoline Propulsion, Electric Propulsion, Hybrid Propulsion); Distribution Channel (Direct Distribution Channel, Indirect Distribution Channel); End-Use (Agriculture End-Use, Construction End-Use, Mining End-Use, Oil & Gas End-Use, Energy End-Use, Logistics & Transportation End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fixed Wing Drones segment, which is expected to reach US$14.2 Billion by 2030 with a CAGR of a 5.7%. The Rotary Wing Drones segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.6 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Drones Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Drones Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Drones Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, Applied Industrial Technologies, Inc., CG Power and Industrial Solutions Limited, China XD Group, Eaton Corporation plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Industrial Drones market report include:

- AeroVironment Inc.

- AgEagle Aerial Systems Inc.

- Anduril Industries

- Asteria Aerospace

- Auterion Ltd.

- Delair

- DJI

- Draganfly Inc.

- EHang Holdings Limited

- Flyability SA

- Insitu Inc.

- Intel Corporation

- Kespry Inc.

- Parrot SA

- PrecisionHawk Inc.

- Quantum-Systems GmbH

- senseFly SA

- Skydio Inc.

- Volansi Inc.

- Yuneec International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroVironment Inc.

- AgEagle Aerial Systems Inc.

- Anduril Industries

- Asteria Aerospace

- Auterion Ltd.

- Delair

- DJI

- Draganfly Inc.

- EHang Holdings Limited

- Flyability SA

- Insitu Inc.

- Intel Corporation

- Kespry Inc.

- Parrot SA

- PrecisionHawk Inc.

- Quantum-Systems GmbH

- senseFly SA

- Skydio Inc.

- Volansi Inc.

- Yuneec International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.6 Billion |

| Forecasted Market Value ( USD | $ 24 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |