Global Lead Acid Industrial Traction Battery Market - Key Trends & Drivers Summarized

Why Are Lead Acid Industrial Traction Batteries Essential for Material Handling and Heavy-Duty Applications?

Lead acid industrial traction batteries are a crucial energy source for heavy-duty electric vehicles and machinery, particularly in warehouses, manufacturing plants, and mining operations. These batteries are widely used in forklifts, automated guided vehicles (AGVs), electric industrial trucks, and railway locomotives due to their high reliability, cost-effectiveness, and ability to deliver sustained power over extended operational hours. Unlike lithium-ion batteries, lead acid traction batteries offer a more affordable and established energy storage solution, making them a preferred choice for industrial applications requiring robust performance.The demand for lead acid traction batteries is growing in tandem with the expansion of the logistics and e-commerce sectors, where efficient warehouse operations are critical. Forklift fleets powered by lead acid batteries enable seamless material handling, optimizing inventory management and supply chain operations. Additionally, the mining industry continues to rely on these batteries for underground electric equipment, where safety and consistent power supply are paramount. The increasing transition toward electric material handling vehicles, driven by environmental regulations and fuel cost considerations, further bolsters the adoption of lead acid industrial traction batteries.

What Technological Advancements Are Improving Lead Acid Traction Battery Performance?

Advancements in lead acid battery technology have significantly enhanced their efficiency, lifespan, and sustainability. One of the key innovations is the development of tubular plate technology, which improves battery durability and performance in demanding industrial environments. Unlike flat plate batteries, tubular plate designs enhance energy retention and cycling capabilities, reducing the frequency of battery replacements and minimizing operational downtime. This makes them particularly valuable in applications requiring frequent charge-discharge cycles, such as warehouse forklifts and AGVs.Another notable development is the integration of advanced battery management systems (BMS) into lead acid traction batteries. These systems provide real-time monitoring of battery health, temperature, and charge levels, optimizing energy efficiency and preventing premature battery failures. Additionally, improved lead acid battery formulations with reduced maintenance requirements, such as gel-based and absorbent glass mat (AGM) designs, have made traction batteries more attractive for industries looking to lower maintenance costs. These technological enhancements are enabling lead acid traction batteries to remain competitive in the face of rising lithium-ion adoption.

Which Industries Are Driving the Demand for Lead Acid Traction Batteries?

The industrial and material handling sectors are the primary consumers of lead acid traction batteries, with demand particularly high in warehousing, logistics, and manufacturing. As e-commerce continues to expand globally, companies are investing in efficient warehouse automation, where electric forklifts and AGVs play a pivotal role. Lead acid batteries provide an affordable and reliable power source for these machines, ensuring seamless operations in distribution centers and fulfillment hubs. Additionally, the construction industry relies on traction batteries to power electric machinery and off-road vehicles, where durability and deep-cycle performance are crucial.The mining sector remains another significant driver of lead acid traction battery adoption, as underground mining equipment requires safe and explosion-proof battery technologies. Rail transportation, particularly electric locomotives and subway systems, also relies on traction batteries to support auxiliary power and emergency backup functions. Furthermore, as governments and industries prioritize sustainable energy storage solutions, lead acid traction batteries are being adapted for hybrid applications where they complement lithium-ion and fuel cell technologies. The ability to recycle lead acid batteries efficiently also strengthens their position in environmentally conscious industries.

What Are the Key Growth Drivers of the Lead Acid Industrial Traction Battery Market?

The growth in the lead acid industrial traction battery market is driven by several factors, including increasing demand for electric material handling equipment, expansion of logistics and e-commerce, and cost advantages over alternative battery chemistries. The affordability and well-established recycling infrastructure for lead acid batteries make them an attractive option for industrial applications, particularly in cost-sensitive markets. Additionally, the rise in automation and electrification of warehouse operations is fueling demand for high-performance traction batteries capable of supporting round-the-clock material handling tasks.Government regulations promoting cleaner energy and electrification of industrial vehicles are also contributing to market growth. While lithium-ion batteries are gaining traction, lead acid batteries continue to dominate in applications requiring proven durability, lower upfront costs, and reliable deep-cycle performance. Advances in battery management systems and maintenance-free designs further enhance their appeal, reducing total ownership costs for industrial operators. As the industrial sector continues to evolve toward automation and electrification, the demand for lead acid traction batteries is expected to remain strong, ensuring sustained market expansion.

Report Scope

The report analyzes the Lead Acid Industrial Traction Battery market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Forklift Application, Railroads Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Forklift Application segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 7.9%. The Railroads Application segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $304.9 Million in 2024, and China, forecasted to grow at an impressive 11.8% CAGR to reach $367.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Lead Acid Industrial Traction Battery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Lead Acid Industrial Traction Battery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Lead Acid Industrial Traction Battery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

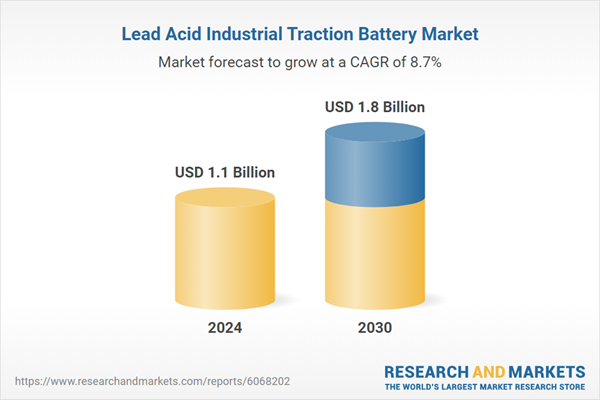

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AdooQ BioScience, AmeriPharm, Inc., BioKyowa Inc., BulkSupplements.com, Fenchem and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Lead Acid Industrial Traction Battery market report include:

- Amara Raja Batteries Ltd.

- C&D Technologies, Inc.

- Camel Group Co., Ltd.

- Clarios International Inc.

- Coslight Technology International Group

- East Penn Manufacturing Co.

- EnerSys

- Exide Industries Limited

- FIAMM Energy Technology S.p.A.

- GS Yuasa Corporation

- Harris Battery Company, Inc.

- HBL Power Systems Limited

- Hoppecke Batterien GmbH & Co. KG

- Leoch International Technology Limited

- Narada Power Source Co., Ltd.

- NorthStar Battery Company

- Shandong Sacred Sun Power Sources Co., Ltd.

- Sunlight Group Energy Storage Systems

- Tianneng Battery Group

- Trojan Battery Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amara Raja Batteries Ltd.

- C&D Technologies, Inc.

- Camel Group Co., Ltd.

- Clarios International Inc.

- Coslight Technology International Group

- East Penn Manufacturing Co.

- EnerSys

- Exide Industries Limited

- FIAMM Energy Technology S.p.A.

- GS Yuasa Corporation

- Harris Battery Company, Inc.

- HBL Power Systems Limited

- Hoppecke Batterien GmbH & Co. KG

- Leoch International Technology Limited

- Narada Power Source Co., Ltd.

- NorthStar Battery Company

- Shandong Sacred Sun Power Sources Co., Ltd.

- Sunlight Group Energy Storage Systems

- Tianneng Battery Group

- Trojan Battery Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |