Global Blood and Blood Components Market - Key Trends & Drivers Summarized

Why Is the Demand for Blood and Blood Components Increasing Across Healthcare Systems?

Blood and blood components play a critical role in modern medicine, serving as life-saving therapeutic products in surgeries, trauma care, cancer treatments, and chronic disease management. With the increasing prevalence of conditions such as anemia, hemophilia, leukemia, and other hematologic disorders, the global demand for blood products - including red blood cells (RBCs), platelets, plasma, and clotting factors - continues to rise. Additionally, advancements in medical procedures, including organ transplants, complex surgeries, and aggressive chemotherapy treatments, have further elevated the need for a stable and efficient blood supply.Blood transfusion remains a fundamental component of emergency medicine, particularly in response to accidents, battlefield injuries, and maternal hemorrhage during childbirth. Moreover, the growing geriatric population, which is more susceptible to blood-related disorders, has contributed to an increasing reliance on blood components. Despite the rising demand, challenges such as blood shortages, donor recruitment, and concerns over transfusion-transmitted infections (TTIs) persist. To address these issues, healthcare organizations, blood banks, and biotech firms are exploring innovative solutions, including artificial blood substitutes, pathogen reduction technologies, and advanced blood storage techniques.

How Are Technological Advancements Enhancing Blood Collection, Processing, and Storage?

Innovations in blood processing and transfusion medicine are significantly improving the safety, efficiency, and availability of blood and blood components. One of the most impactful advancements is the development of pathogen reduction technologies (PRTs), which help eliminate viruses, bacteria, and parasites from blood products, reducing the risk of transfusion-transmitted infections. These technologies, including UV light-based pathogen inactivation and solvent-detergent plasma treatment, are enhancing the safety profile of blood transfusions worldwide.Another breakthrough in the blood industry is the introduction of automated apheresis systems, which allow for the selective collection of specific blood components such as plasma, platelets, or red blood cells while returning the remaining blood to the donor. Apheresis not only improves donor retention but also increases the efficiency of blood collection by reducing the need for whole blood donations. Additionally, advancements in cryopreservation and extended blood storage techniques are addressing supply chain challenges, ensuring that blood components remain viable for longer durations, especially in remote or disaster-stricken regions. The ongoing development of synthetic blood substitutes, including hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based (PFC) blood substitutes, holds promise for emergency transfusions and military applications, potentially reducing dependency on donor blood supplies.

Which Market Trends Are Driving Growth in the Blood and Blood Components Industry?

The global blood and blood components market is expanding due to a combination of rising disease prevalence, increasing surgical procedures, and improvements in healthcare infrastructure. One of the most prominent trends shaping the industry is the growing emphasis on plasma-derived therapies. Plasma fractionation has become a key area of investment, as plasma-derived products are essential in treating immunodeficiency disorders, hemophilia, and neurological conditions. With rising demand for immunoglobulins, albumin, and clotting factors, biopharmaceutical companies are expanding plasma collection networks and investing in large-scale fractionation facilities.Another key trend influencing the market is the shift toward voluntary and non-remunerated blood donation policies. Many countries are implementing initiatives to improve donor recruitment and retention through awareness campaigns, incentives, and digital engagement strategies. Additionally, the integration of blockchain and digital tracking systems in blood supply chains is enhancing transparency, reducing wastage, and improving traceability in blood banking. The expansion of personalized medicine and regenerative therapies is also driving interest in autologous blood transfusions, where a patient’ s own blood is collected and reinfused during surgeries or cancer treatments. As healthcare systems prioritize efficiency and safety, the adoption of digital blood management solutions and advanced donor screening techniques is expected to further streamline blood collection and distribution.

What Are the Key Growth Drivers Shaping the Future of the Blood and Blood Components Market?

The growth in the blood and blood components market is driven by several critical factors, including the increasing burden of chronic diseases, advancements in transfusion medicine, and rising investments in blood safety and supply chain optimization. One of the primary growth drivers is the expanding number of surgical procedures and trauma cases, necessitating a reliable blood supply. With an increasing number of elective and emergency surgeries being performed worldwide, hospitals and healthcare providers are investing in blood banking and transfusion services to ensure availability during critical interventions.Another crucial driver shaping the market is the growing demand for plasma-derived therapeutics. The biopharmaceutical industry’ s focus on immunodeficiency treatments, hemophilia care, and novel plasma-based therapies has led to increased plasma collection efforts and research into recombinant alternatives. Additionally, the adoption of advanced donor screening technologies, including nucleic acid testing (NAT) and AI-driven risk assessment models, is improving blood safety and reducing the incidence of transfusion-related complications. As governments and healthcare organizations strengthen regulatory frameworks for blood donation, processing, and transfusion practices, the market is poised for continued expansion. With ongoing innovations in synthetic blood substitutes, pathogen reduction strategies, and digital health integration, the future of the blood and blood components industry will be defined by enhanced safety, efficiency, and accessibility, ensuring better patient outcomes worldwide.

Report Scope

The report analyzes the Blood and Blood Components market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Blood Components, Whole Blood Type); Application (Anemia Application, Trauma and Surgery Application, Cancer Treatment Application, Bleeding Disorders Application, Other Applications); End-Use (Hospitals End-Use, Ambulatory Surgical Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blood Components segment, which is expected to reach US$8.6 Billion by 2030 with a CAGR of a 2.8%. The Whole Blood Type segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blood and Blood Components Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blood and Blood Components Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blood and Blood Components Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Blood and Blood Components market report include:

- American Association of Blood Banks (AABB)?

- American Red Cross?

- Australian Red Cross?

- Baxter International Inc.?

- Beckman Coulter, Inc.?

- Bio Products Laboratory (BPL)?

- bioMérieux SA?

- Cerus Corporation?

- CSL Limited?

- European Blood Alliance?

- Fresenius SE & Co. KGaA?

- Grifols, S.A.?

- Haemonetics Corporation?

- Hualan Biological Engineering Inc.?

- Immucor, Inc.?

- Indian Red Cross Society?

- Kedrion Biopharma?

- Maco Pharma International GmbH?

- Mitsubishi Tanabe Pharma Corporation?

- Octapharma AG?

- South African National Blood Service?

- Takeda Pharmaceutical Company Limited?

- Teleflex Incorporated?

- Terumo Corporation?

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Association of Blood Banks (AABB)?

- American Red Cross?

- Australian Red Cross?

- Baxter International Inc.?

- Beckman Coulter, Inc.?

- Bio Products Laboratory (BPL)?

- bioMérieux SA?

- Cerus Corporation?

- CSL Limited?

- European Blood Alliance?

- Fresenius SE & Co. KGaA?

- Grifols, S.A.?

- Haemonetics Corporation?

- Hualan Biological Engineering Inc.?

- Immucor, Inc.?

- Indian Red Cross Society?

- Kedrion Biopharma?

- Maco Pharma International GmbH?

- Mitsubishi Tanabe Pharma Corporation?

- Octapharma AG?

- South African National Blood Service?

- Takeda Pharmaceutical Company Limited?

- Teleflex Incorporated?

- Terumo Corporation?

Table Information

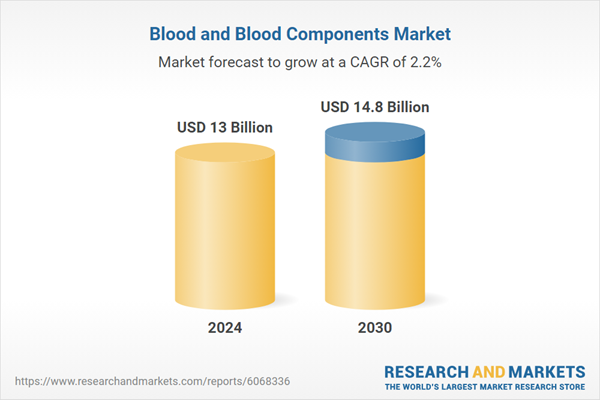

| Report Attribute | Details |

|---|---|

| No. of Pages | 370 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13 Billion |

| Forecasted Market Value ( USD | $ 14.8 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |